For the next two years European companies are going to provide the best equity income growth, according to JP Morgan manager Sam Witherow, who has made it a main focus for his global income fund.

Witherow runs the JPM Global Equity Income fund, which has been the third best performing portfolio in the IA Global Equity Income sector over three and five years. It returned 81.2% over the past half-decade.

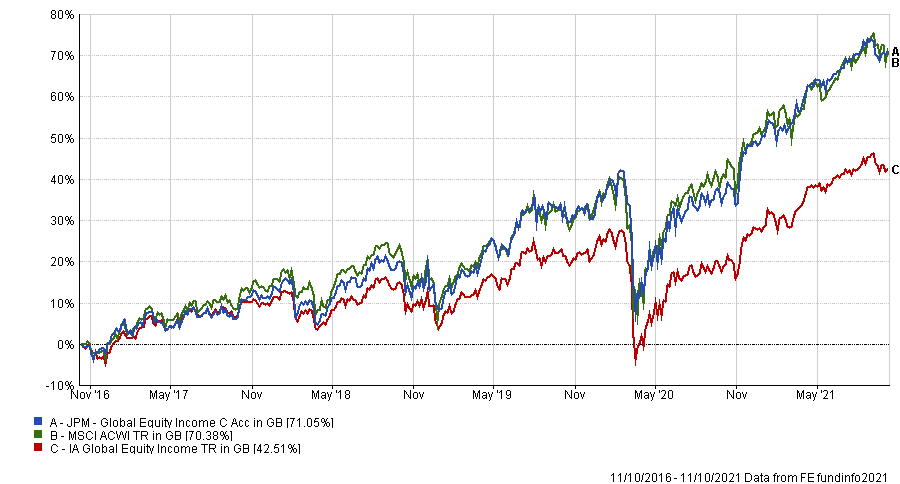

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Over the next five years Witherow said he expects strong, compound dividend growth globally coming out of the Covid-19 pandemic, led by Europe, as it experienced some of the biggest falls in dividends and is only now getting back to pre-pandemic levels.

“It’s a case of the harder they fall the higher they bounce,” Witherow said.

He added: “We’re trying to take advantage of that rebound back to normal levels of payout.”

At the start of the pandemic last year, companies were forced to cut dividends and shore up balance sheets to deal with the financial impact of Covid-19 and the lockdowns. This caused dividends to fall to record lows globally.

Coming out of lockdown businesses have been able to operate more normally and some have restarted their payouts. Comparing the second quarter of 2020, when the majority of the cuts took place, and the second quarter of this year, dividends globally have jumped by 26.3% on a headline basis, the latest Janus Henderson Global Dividend Index found.

Dividends in Europe fell by around 40% in 2020’s second quarter but in the second quarter of 2021 quarter pay-outs increased by 66.4%, according to the index.

“We think certainly in the next two years the dividend rebound picture in Europe is exceptional relative to other regions,” Witherow said.

At the moment Europe’s recovery from Covid is “OK”. Many of the regulatory and fiscal rules put in place to suppress dividends in 2020 have now been alleviated. For example, the European Central Bank (ECB) allowed banks to restart dividend payments during the summer.

ING was one bank that resumed dividends and Witherow said he is expecting a mid-teen return on the stock over the next 12 months.

“It’s numbers like that that really do sing the European dividend picture,” he said.

The manager added that the reason he is forecasting a bigger recovery in European dividends is not because the European economy is strong, or fast growing – in fact Witherow thinks it’s the opposite – but how much growth companies have ahead of them to get back to pre-Covid levels.

As such, his JPM Global Equity Income is holding an overweight to Europe compared to the sector, with almost 25% of the fund invested in names from the Continent. This a shift from when the pandemic started, when Witherow had the fund on a neutral Europe allocation.

One of the most exciting stocks in the fund, according to Witherow, is Schneider Electric, a French company which provides energy and automation solutions for efficiency and sustainability.

A large part of the business is helping add renewable energy sources to the main power grid, a theme that has received significant attention in Europe especially with the rollout of the European Green Deal, focusing on widespread renewable infrastructure.

“Schneider is the world leader without a doubt in this area,” Witherow said.

Although the JPMorgan manager was especially bullish on European stocks he maintained an interest in the US. The fund currently has a neutral weighting on the US, making up 60% of the total portfolio allocation.

Europe may be the immediate future for dividend growth, but the US is still a long-term source of income for the fund. In 2020 US dividends grew by around 2.5%, according to the Janus Henderson Global Dividend Index.

A “negligible amount,” Witherow said, but in comparison with other regions, which were all negative, “it was still pretty incredible.”

He said he expects US dividend growth to “power along happily” at a 7% growth rate over the next five years.

US tech giant Microsoft is currently the fund’s biggest holding at 4.9%. Witherow said that it had been a significant contributor to the fund’s outperformance in the past three and five years.

Last year the company was the largest dividend payer in 2020 globally, according to interactive investor.

“We do have some selective positions in the UK, but it’s definitely not a bet on the domestic economy. I’d rather not be overweight on a material basis because history shows us that that hasn’t been a smart move over the past decade,” he said.