UK inflation dropped slightly during September, the latest official figures show, although market experts have said this is a temporary pause and warned of more to come in the months ahead.

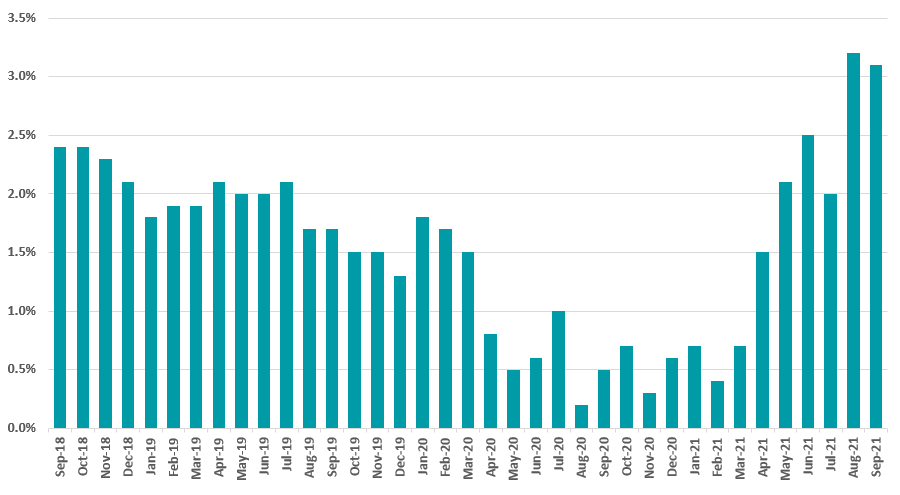

The consumer prices index (CPI) fell to 3.1% in the 12 months to September, according to the Office for National Statistics (ONS), down from 3.2% in the previous month. Inflation remains much higher than the Bank of England’s 2% target.

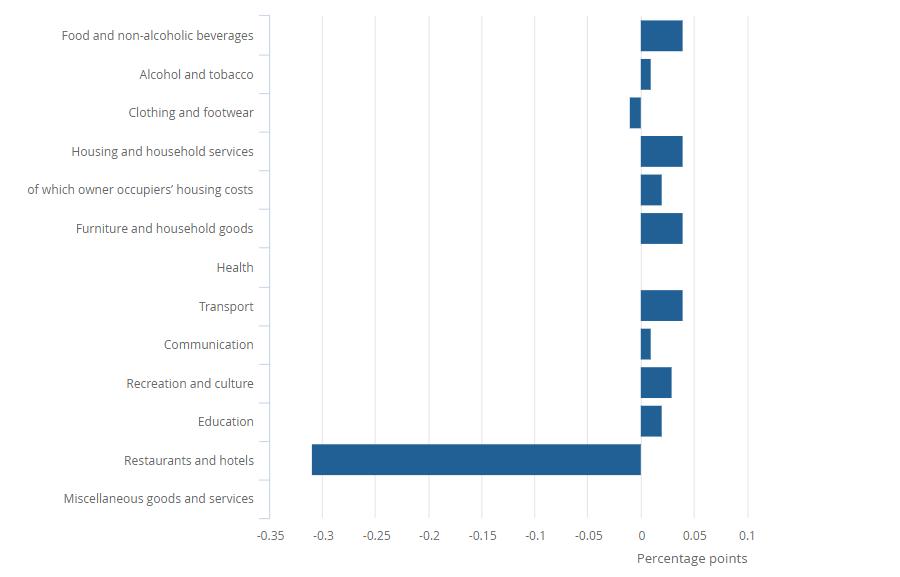

Higher prices for transport were the biggest contributor to September’s CPI. However, the dip from August is attributed to last year’s Eat Out to Help Out scheme – prices rose when the scheme ended in September 2020, meaning the new figures are slightly lower due to a temporary ‘base effect’.

Change in CPI over 12 months

Source: ONS

Melanie Baker, senior economist at Royal London Asset Management, said: “UK inflation remains elevated and although we may not have seen another big jump in the CPI measure of inflation in September, there is more to come. Energy bills are among factors set to help push consumer price inflation further above the Bank of England’s target in the near term.”

Silvia Dall’Angelo, senior economist at the International business of Federated Hermes, noted that price gains tend to remain concentrated in the sectors mostly affected by supply constraints and high commodity prices, such as core goods, energy and food.

This suggests that inflation is still subject to “Covid-related distortions”, which would support the prevailing narrative that the recent spike in inflation is transitory.

Contributions to change in the CPIH 12-month inflation rate between Aug and Sep 2021

Source: ONS

“That said, the inflation picture is set to get worse in the short term before it starts improving. The current gas crisis and recent increases in energy commodity prices more generally imply that inflation will continue to climb in the winter months, likely peaking at north of 4% between February and April of next year,” Dall’Angelo added.

However, base effects, moderation in commodity prices and a gradual easing of supply constraints should drive inflation down starting in the spring of next year, he noted.

“In general, cost-push inflationary pressures tend to be self-defeating and temporary, if they are not matched by demand-pull drivers, i.e. wage gains that are not justified by productivity improvements,” said Dall’Angelo.

“Developments in inflation expectations and the labour market – still hard to interpret due to Covid-related distortions – will ultimately determine the inflation picture.”

Rachel Winter, associate investment director at Killik & Co, agreed that September’s dip in inflation is likely to be “a blip”.

She pointed out that a number of contributory factors will likely cause inflation to climb higher again in October, especially the global increase in the price of fuel. Indeed, she argued that high fuel prices, pandemic-related supply chain issues, an ongoing skilled labour shortage and rising food prices have created “a perfect storm” for inflation.

“With so many economic obstacles in play, all eyes will be on the Bank of England to intervene,” Winter finished.

“While getting the Bank to agree to raise interest rates may feel like pulling blood from a stone, progress appears to be on the way, with [governor] Andrew Bailey suggesting that the central bank may soon be forced to act to curb inflation, though it is unclear when this will be.”