Investors are paying more than double the stated ongoing charges figure (OCF) in some funds because of their ‘hidden’ transaction fees, research by FE Trustnet has found.

In this study Trustnet looked at the additional transaction costs (referred to as ex-ante costs) of the IA Global sector so far this year. The Markets in Financial Instruments Directive (MiFID II) regulations requires investment houses to disclose additional transaction costs, which are charged on top of published OCFs.

These regulations came into force in 2018 and at the time Rob Gleeson, chief investments officer at FE Investments, said that many of the fees were “necessary and unavoidable, because you can’t invest without trading”.

However, while these fees are part of investing, some will be surprised to learn that they can add up to so much. Indeed, in this study, 12 IA Global funds charged transaction fees of more than double the OCF.

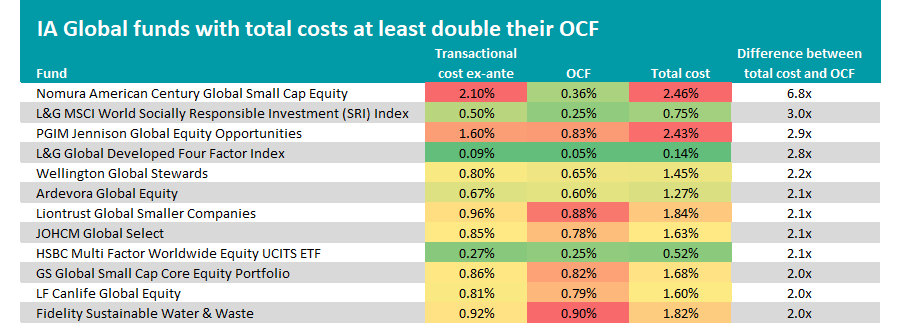

This is shown in the table below, which shows the transaction costs, original OCF and the overall total, as well as how many times more an investor is paying versus the states fee.

It is also conditionally formatted against the sector. The colours represent how expensive a fund’s cost is relative to the entire sector. Those in the green are the cheapest among their peers, while red indicates the most expensive. Yellow and orange are somewhere in the middle.

Source: FE Analytics

Please note that the OCF figures were based off the main driver share class in FE Analytics and charges may vary depending on the share class available.

Nomura American Century Global Small Cap Equity fund had the biggest increase between OCF and total overall cost in the entire IA Global sector.

Its published OCF of 0.36% is on the lower end of the spectrum for the IA Global sector, but it has 2.1% in transaction costs fees, bringing the total cost of the fund up to 2.46%.

This means investors are paying almost seven times more than the stated OCF to hold the fund. Within the IA Global sector this was the highest transaction cost overall.

Mike Barrett, consulting director at the Lang Cat, said that the “relatively high transaction costs are a result of how frequently these funds might be trading/rebalancing their underlying assets”.

The past 18 months has been one of the busiest periods in markets on records with managers carrying out a higher rate of transactions in reaction to the pandemic, which could contribute to higher extra fees.

Barrett said that these costs cannot be fully predicted but they can be anticipated.

“The trick will be to review the ex-post statements to see what the actual costs have been over the previous year,” he said.

The Nomura American Century Global Small Cap Equity fund is domiciled in Ireland and run by Federico Laffan and Trevor Gurwich. It has performed well since it launched in 2019, making two times the return of the average IA Global fund in that time, 85.3% overall, arguably justifying the higher fees.

There were several other small-cap funds on the list, including Liontrust Global Smaller Companies and GS Global Small Cap Core Equity Portfolio.

The Liontrust Global Smaller Companies fund had a mid-level OCF of 0.88% but its additional costs meant the total fees were two times higher than the OCF.

The fund is run by Robin Geffen and holds an FE fundinfo Crown rating of five, has been the 13th best performer in the sector over five years, up 157%.

GS Global Small Cap Core Equity Portfolio on the other hand has had a much more volatile performance record, fluctuating between top and bottom quartile returns in the past five years. Its total charges were 1.68% but the OCF was just 0.82%.

PGIM Jennison Global Equity Opportunities fund had the second-highest total cost from the list, at 2.43%. It has a middling OCF, 0.83%, versus the rest of the sector, but additional charges of 1.6% pushed it up the scale, making the total charges three times more than the OCF.

Holding a five Crown rating it has been one of the best performers through various time frames in the sector, making the fourth-highest returns over five years of 209.8%.

The outperformance of these funds could justify the higher fees overall, but if investors are not aware of what they are actually paying for those returns it could be more of an issue for them.

There were several index tracker funds on the list, an interesting result given that passive funds are seen as a cheaper way to invest in the broader market than active funds.

This does not mean that the trackers are expensive, however. For example the L&G Global Developed Four Factor Index fund has one of the lowest OCFs in the sector at 0.05% and the added transaction costs of 0.09%, gave it a total of 0.14%, still the 14th cheapest in the sector. However, investors are still paying three times more to hold the tracker than they might realise.

The data also revealed that in some cases it can push a passive fund into active-fee territory. The L&G MSCI World Socially Responsible Investment (SRI) Index, for example, had a total cost of 0.75%, triple the stated 0.25% OCF. T

This is more than it costs to hold the £8.5bn Lindsell Train Global Equity fund, which charges an OCF of 0.65% and has transaction costs of 0.06%, giving a total of 0.71%.