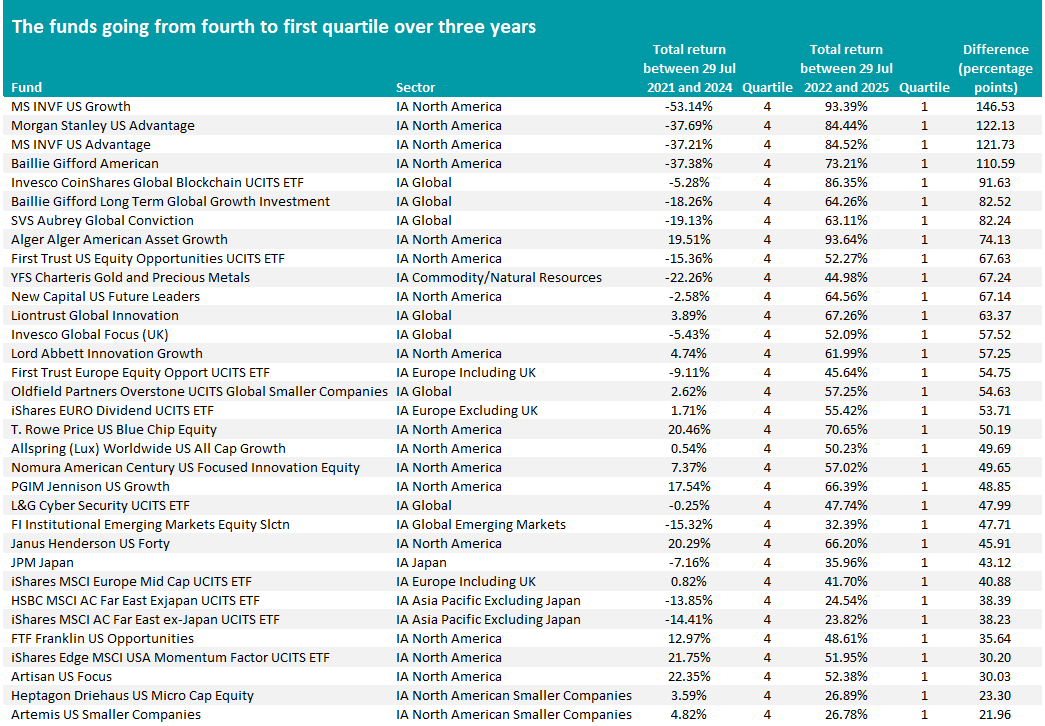

More than 30 equity funds have seen their three-year performance ranking jump from the bottom quartile of their sector to the top over the past 12 months, Trustnet research has found, after 2022’s heavy losses start to move into the distance.

Global equities entered 2022 under pressure from rising inflation, aggressive monetary tightening and geopolitical shocks, most notably the Russia‑Ukraine conflict. Major indices such as the S&P 500 and MSCI World recorded double‑digit declines, with technology and growth sectors hit hardest by higher interest rates.

Market conditions shifted again in 2023 and 2024 as inflation eased and central banks signalled a slower pace of rate hikes. Earnings growth stabilised and investors rotated back into technology and consumer discretionary sectors. By late 2024, optimism around artificial intelligence, a strong US labour market and falling energy prices supported new record highs in US equities, which lifted global benchmarks.

In 2025, volatility returned as political factors, including the Trump administration’s trade policy, introduced fresh uncertainty, yet equity valuations remained elevated relative to pre‑pandemic levels.

These fluctuating conditions caused funds to move up and down the rankings in the Investment Association’s equity sectors. Below are the 33 funds that were in the bottom quartile of their respective sectors over the three years to 29 July 2024 but had jumped into the first quartile over the most recent three years. They are ranked by the difference between the returns over the two periods.

Source: FE Analytics

The most obvious trend is US growth funds. Growth investing – or targeting companies expected to deliver above-average revenue or earnings growth compared with the wider market – has dominated the market for much of the recent past, thanks to low interest rates, lacklustre economic growth, technological innovation and the ‘US exceptionalism’ narrative.

Many of the funds listed above – such as Baillie Gifford American, Alger American Asset Growth, T. Rowe Price US Blue Chip Equity and Artemis US Smaller Companies – have strong long-term track record because of this.

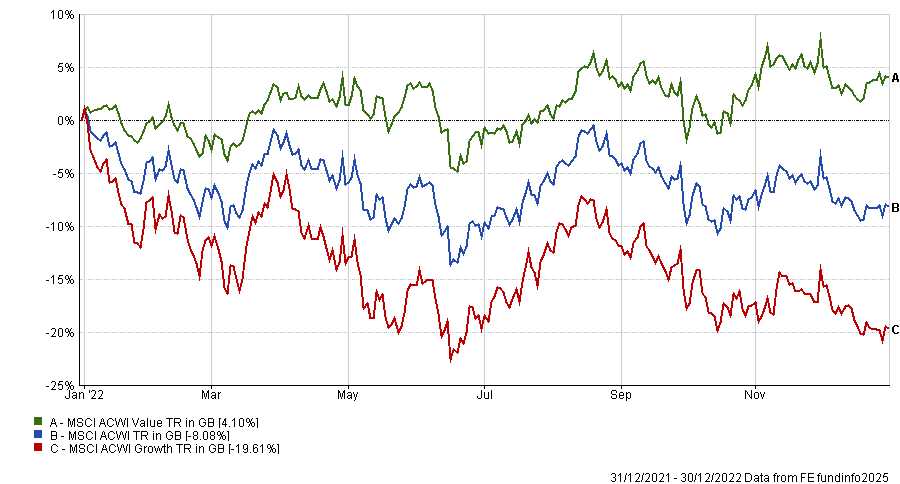

However, this trade broke down in 2022 when inflation spiked after the Covid lockdowns were lifted and central banks were forced to hike interest rates. While both equities and bonds plunged in 2022, growth stocks tanked while value stocks made a positive return.

Performance of growth and value stocks in 2022

Source: FE Analytics

This appears at the very start of the first three-year period and it pushed growth funds into the bottom quartile. In the 12 months spanning 29 July 2021 to 2022, the MSCI AC World Growth index fell 5.4% while the MSCI AC Value index gained 9.1%.

Translated into funds’ returns, MS INVF US Growth suffered a 59.1% drop over this 12-month period while Baillie Gifford American was down 51.1%. Of the 33 funds in the table above, only one made a positive total return in that period: Artisan US Focus, which made a third-quartile gain of 2.6%.

During the other three discrete 12-month periods, however, the growth index outperformed the value index by a significant margin. This means the funds identified in this research were able to rise from the bottom of their sector and their recent three-year rankings reflect the fact that 2022’s steep losses have been washed out of the performance period.

While the funds highlighted above invest in US stocks, the same trend is apparent in the IA Global and other equity peer groups.

Examples of funds that focus on growth stocks and have moved from the fourth to first quartile over the two three-year periods include Baillie Gifford Long Term Global Growth Investment, Invesco Global Focus, Liontrust Global Innovation, SVS Aubrey Global Conviction, L&G Cyber Security UCITS ETF and JPM Japan.

A few more specialist themes can be found in the list of funds above.

Invesco CoinShares Global Blockchain UCITS ETF has gone from the bottom to top of the IA Global sector, in line with the ups and downs of the cryptocurrency market.

The cryptocurrency market was turbulent in 2022. The collapse of Terra‑Luna in May and the bankruptcy of FTX in November triggered widespread losses and damaged investor confidence. Bitcoin fell from above $40,000 to below $18,000, ushering in a prolonged ‘crypto winter’ as regulatory scrutiny intensified, liquidity dried up and rising rates punished growth assets.

Recovery began in 2023, with the market roughly doubling in value as investor sentiment improved. The momentum accelerated in 2024 when spot‑Bitcoin ETFs launched in the US, drawing institutional inflows and pushing Bitcoin beyond previous highs, eventually exceeding $100,000 by year‑end.

In 2025, market direction shifted again with the Trump administration’s unexpectedly pro‑crypto stance: an executive order established a strategic Bitcoin reserve, SEC enforcement actions eased and a regulatory framework for stablecoins was created. These moves spurred institutional interest and drove Bitcoin briefly above $120,000.

Meanwhile, YFS Charteris Gold and Precious Metals reflects the yellow metal recently reaching record highs.

Gold prices proved resilient during the turbulence of 2022 as investors sought defensive assets amid high inflation and rising interest rates when equity and bond markets sold off. Gold prices moved between $1,700 and $2,000 per ounce for much of the year, briefly peaking in March 2022 during the early phase of the Russia‑Ukraine conflict.

However, other commodities rose higher, especially energy commodities, as global supply chains remained under pressure after the pandemic and sanctions on Russia affected the oil and gas supply. This meant gold-focused funds fell to the bottom of the IA Commodity/Natural Resources sector.

From 2023 through 2024, gold traded in a higher range as inflation pressures moderated but geopolitical and financial uncertainties persisted. By mid‑2023 it retested record highs near $2,070 per ounce and in 2024 it climbed further on expectations of rate cuts and continued central bank accumulation. In early 2025, gold reached fresh highs and is currently around $3,300.