Europe has long been viewed as a ‘value’ market, much in the same way as the UK, but it is the vibrant, exciting growth stocks at the lower end of the market that investors would have been better off holding over the past decade, according to data from Trustnet.

In this series, we look at investment style, market capitalisation and active vs passive funds to work out what has been the best way to play each major market over the past decade.

Previously we have looked at the UK market, where smaller companies funds were the clear winners, while in the global sector, large-cap passive funds came out on top, and there were similar results in the US study.

In Europe, we have reverted back to smaller companies. As the chart below shows, when comparing the wider MSCI indices, the MSCI Europe ex UK Small Cap index has returned 327.9% while the wider MSCI Europe ex UK index has made 193%.

Performance of indices over 10yrs

Source: FE Analytics

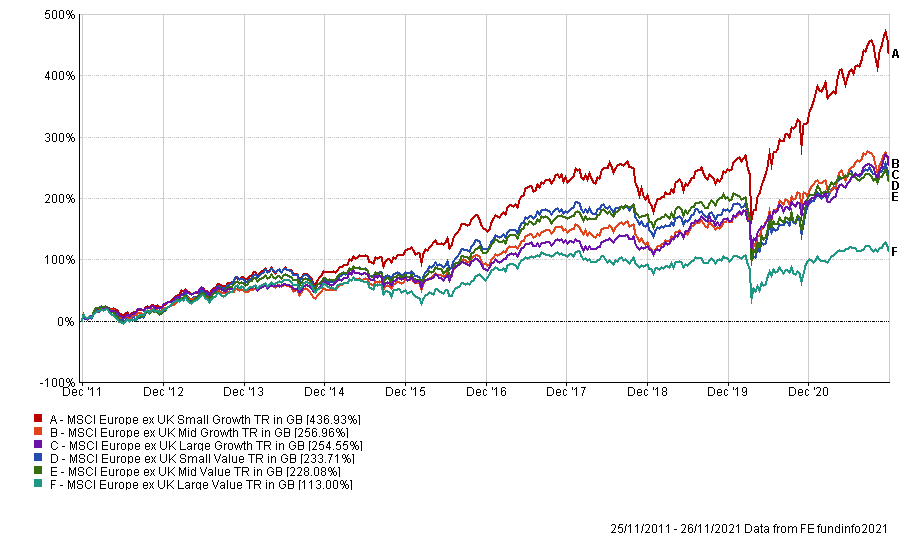

Breaking this down further, when splitting up the large, mid and small indices by growth and value, European small caps with a ‘growth’ tilt have made by far and away the highest returns.

The MSCI Europe ex UK Small Growth index has made investors 436.9% over 10 years, almost four times more than the MSCI Europe ex UK Large Value index, which has made just 113%. The growth index has beaten the value index across the market capitalisation spectrum.

Performance of indices over 10yrs

Source: FE Analytics

In terms of active versus passive, the average IA European Smaller Companies fund underperformed the small-cap index by 40 percentage points over the past decade, while all-market funds fared better. Although more smaller companies funds beat the index over the past decade, the study includes those funds that have been closed or wound down in the interim.

The average fund in the IA Europe excluding UK sector beat the MSCI Europe ex UK index by 21.7 percentage points, although still lagged its average small-cap peer.

For anyone that wants to invest in this way, the €789.4m (£667.8m) iShares MSCI EMU Small Cap UCITS ETF has a five FE fundinfo P-Crown Rating and charges 0.58%.

The €242.8m Lyxor MSCI EMU Small Cap UCITS ETF and €129.8m UBS MSCI EMU Small Cap UCITS ETF are smaller but cheaper alternatives, costing 0.4% and 0.33% respectively.

Smaller companies indices are harder to track than their larger counterparts as the underlying stocks can be much more volatile. The Lyxor exchange-traded fund (ETF) has the lowest tracking error – and is therefore the one that most closely resembles the benchmark – of 0.12 while the UBS ETF has a score of 0.46 and the iShares tracker 0.74.

The iShares and UBS funds have made more than the index over the past decade, returning 300.5% and 301.6% respectively, versus the benchmark’s 295.9%, while the Lyxor tracker has made 293.2%.

Although the average fund has failed to beat the index, a number of actively managed portfolios have made significantly higher returns.

The £62m ASI Europe ex UK Smaller Companies fund is up 468.5% over the past decade. The portfolio uses abrdn’s matrix system, designed by FE fundinfo Alpha Manager Harry Nimmo, which looks for companies that can upgrade earnings and therefore re-rate. The €1.7bn European version of the fund is second, returning 457.3% to investors.

Janus Henderson European Smaller Companies is the only other active fund to cross the five-fold threshold, returning 416.8% over the past decade.

It too uses a quantitative screen to filter down the number of available stocks into four categories: high growth, quality growth, cash generators and turnaround candidates.

| Fund | Sector | Fund size | Manager name(s) | OCF |

| Aberdeen Standard European Smaller Companies | IA European Smaller Companies | €1,497.7m | Andrew Paisley | 0.97% |

| ASI Europe ex UK Smaller Companies | IA European Smaller Companies | £62.1m | Andrew Paisley | 0.96% |

| iShares MSCI EMU Small Cap UCITS ETF | IA European Smaller Companies | €667.5m | Credit Suisse AG, Index Solutions Team, BlackRock Advisors (UK) Limited | 0.58% |

| Janus Henderson European Smaller Companies | IA European Smaller Companies | €482.8m | Ollie Beckett, Rory Stokes | 0.86% |

| Lyxor MSCI EMU Small Cap (DR) UCITS ETF | IA Europe Excluding UK | €205.3m | N/A | 0.40% |

| UBS MSCI EMU Small Cap UCITS ETF | Gbl ETF Equity - Small Cap Europe | €109.8m | Marcel Fischli, Mike Kaiser | 0.33% |