The UK was left out in the cold again by closed-ended investors who turned towards North America and technology in November.

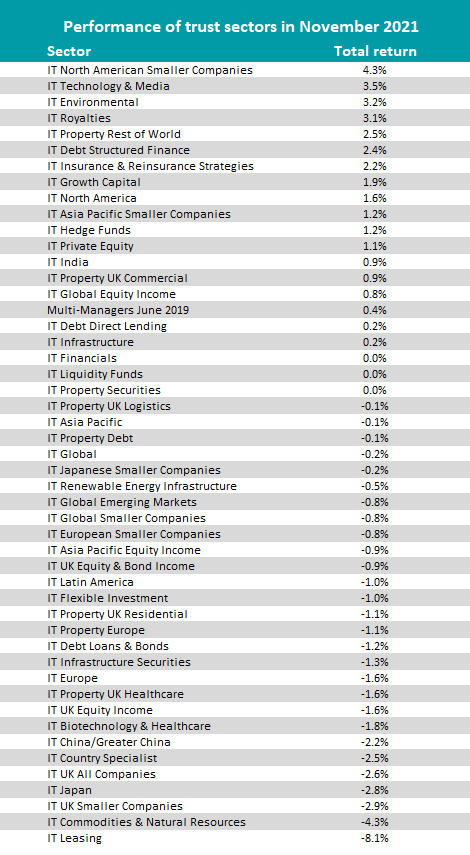

The major UK sectors found themselves at the bottom-end of November’s performance tables, with the IT UK Smaller Companies sector losing the most (2.9%), while the IT UK All Companies and IT UK Equity Income sectors lost 2.6% and 1.6%, respectively. The downturn was mainly caused by news of a new Covid variant, Omicron, which had a big impact on markets when announced last Thursday.

Global indices fell in reaction to the news but the UK even more so, with the FTSE 100 dropping 3.6% on Friday, its biggest decline in 18 months.

Omicron was the culprit for most of November’s rankings, despite occurring in the last days of the month. The new variant sparked fresh Covid concerns about whether existing vaccines were effective and if widescale lockdowns were likely.

At the moment it is unclear what impact Omicron could have from a health perspective but governments have increased some Covid measures until more is known.

In reaction to all this the oil price fell 20%, sending the price of a Brent crude oil barrel down to $69 (£52) after averaging $80 for most of the month.

Despite its safe haven reputation, gold did not have a particularly strong month either, with the Bloomberg Gold Sub index making just 3.1% during November. This was not enough to offset the oil price decline and consequently left the IT Commodities & Natural Resources sector languishing near the bottom of the rankings, losing 4.3% overall.

IT Leasing was the worst-performing sector overall with losses totalling 8.1%. Full of airline related stocks, the sector took a late hit from Omicron, which pushed most countries onto red travel lists, creating uncertainty around international travel.

At the top end of the table IT North American Smaller Companies and IT Technology and Media had the best month, making 4.3% and 3.5%, respectively.

IT Environmental also had a strong month, returning 3.2%. Despite macro and geopolitical uncertainties a global focus on climate change and other environmental problems has continued to gain momentum off the back of the COP26 conference in Glasgow in October, benefiting the sector.

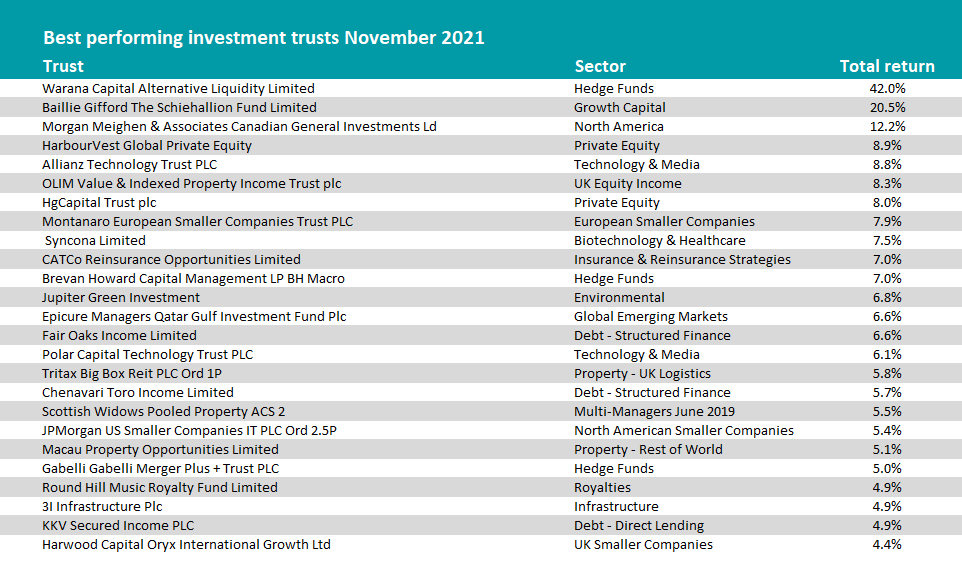

Turning to specific companies, Warana Capital Alternative Liquidity Limited was the best performing investment trust overall in November, making 42%.

The trust invests in illiquid assets, mainly hedge funds, private equity, real estate, infrastructure and private investment funds plus other alternative and absolute return funds.

The second-best trust was the Baillie Gifford The Schiehallion Fund Limited, with a total return of 20.3%. The trust buys into private companies which it plans to hold for long after they list publicly, looking for names with ‘transformational growth potential’.

Due to the nature of its assets, the trust is high risk but investors have still been bullish on the trust so far this year. Earlier this year, Trustnet found that out of the total raised by investment trusts in 2021 so far Schiehallion had taken the biggest portion, more than double the trust in second place.

The only other trusts to make more than 10% last month was Canadian General Investments (12.2%) The $917m trust sits in the IT North American sector but only invests in Canadian companies.

Other top-performing trusts were Syncona Limited, Jupiter Green Investment, Polar Capital Technology Trust and JPMorgan US Smaller Companies.

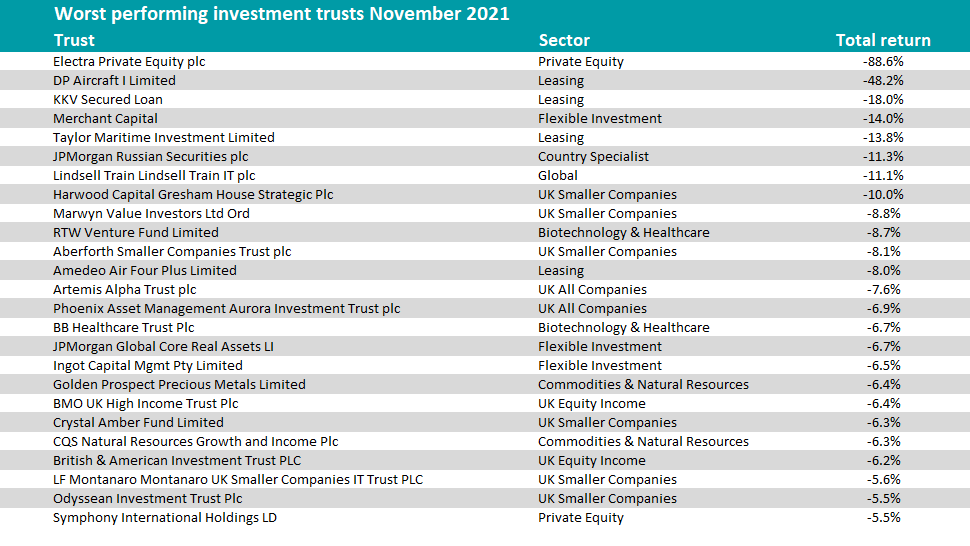

At the other end, the worst performer was Electra Private Equity which lost 88.6%. Electra Private Equity PLC announced at the start of November that it intends to stop being an investment trust and wants to focus on other areas of its business.

It plans to demerge from hospitality business Hostmore, after which is will cease to be an investment trust, rebranding to Unbound Group Plc.

Two IT Leasing trusts were also near the bottom: DP Aircraft I Limited and KKV Secured Loan lost 48.2% and 17.8% respectively, both affected by the potential for further lockdowns.

The downgrade in the oil price also played a big role in trusts underperforming for the month with several IT Commodities & Natural Resources ending the month on a loss.

Another poor performer was the highly rated Lindsell Train, run by veteran manager Nick Train. The fund has been one of the best performers in its sector over 10 years but has struggled to maintain this outperformance since the Covid vaccines were announced last year. Train addressed this underperformance earlier in the month and his own frustration with the trust's returns.