Investors should keep a close eye on global energy supply, geopolitical tensions between China and the US, and vendor-financed deals for signs that the AI boom is at risk, strategists suggest.

The market impact of the AI revolution has been massive, with Daniel Casali, chief investment strategist at Evelyn Partners, saying “some of the numbers are staggering”.

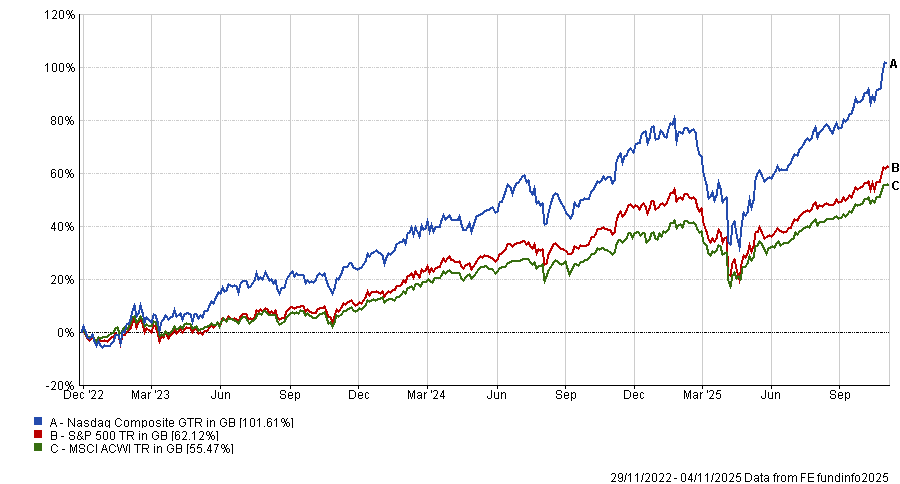

The US tech heavy Nasdaq composite – which includes major AI players such as Alphabet, Meta Platforms, Amazon, Oracle, Microsoft and Nvidia – has doubled to add $18trn in market value since the launch of ChatGPT in November 2022.

Performance of Nasdaq, S&P 500 and MSCI AC World since ChatGPT launch

Source: FE Analytics. Total return in sterling between 30 Nov 2022 and 4 Nov 2025

But investors are growing increasingly concerned that AI stocks are in a bubble, given the scale of their gains so far. For example, the October 2025 edition of the Bank of America Global Fund Manager Survey found 54% of institutional investors think AI stocks are in a bubble while the Bank of England’s Financial Policy Committee warned that “equity market valuations appear stretched, particularly for technology companies focused on artificial intelligence”.

These concerns over AI stock valuations are playing out in the real time. Yesterday, the S&P 500 dropped 1.2% and the Nasdaq fell 1.8% after Morgan Stanley and Goldman Sachs suggested that AI was in bubble territory.

Emma Wall, chief investment strategist at Hargreaves Lansdown, said: “The concerns are valid. While a number of AI firms have benefited from strong revenue and profit growth, this has been a narrow and extreme rally.

“Earlier this year, following both the DeepSeek disruption in January and the tariff tantrum in April, returns seemed to be more broad-based, with the equal-weighted S&P 500 outperforming the market cap for periods. But this did not last, and once again high-growth, tech-biased, AI-focused businesses have delivered much of the aggregate S&P 500 returns over the past six months.”

What to watch from here

Evelyn Partners’ Casali argued it is “reasonable to expect the AI investment boom to continue”.

He pointed to the potential for rising profit margins driven by AI-driven productivity gains, with firms using data to automate decisions, personalise services and cut costs as a tailwind. He also noted that corporate balance sheets remain strong and AI-related valuations, while elevated, are still far from the speculative highs of the early 2000s.

However, the chief investment strategist said there are three key risks that investors should be monitoring: energy supply, geopolitics and circular vendor financing.

AI development demands large amounts of electricity, particularly for model training and inference. The International Energy Agency (IEA) reported that data centres consumed about 1.5% of global electricity in 2024, with projections rising to 4.4% by 2030 under a high-growth scenario.

“Without a significant ramp-up in grid capacity and generation, especially in regions hosting hyperscaler data centres, the pace of AI adoption could slow,” Casali said. “Investors are increasingly recognising that the AI boom is linked to the ability of the energy sector to keep up with its power-hungry needs. However, for now it seems that the AI adoption rate in the US economy continues to creep up.”

Geopolitical tensions between the US and China also present a key risk to the AI investment landscape. Recent export controls and retaliatory measures have turned technology supply chains into tools of economic diplomacy, with advanced chips and rare earths caught at the centre.

China’s DeepSeek has introduced further disruption by showing that high-performing AI can be developed more efficiently and cost-effectively. As an open-source platform with global reach, its rise could reduce demand for energy-intensive hyperscaler infrastructure and shift the direction of future AI investment.

On circular vendor financing, Casali said: “The AI boom is being supported by vendor-financed deals, where major suppliers like Nvidia and AMD help fund their customers’ purchases – creating a circular flow of capital.

“For instance, Nvidia has invested $100bn in OpenAI, which in turn committed to buying its high-end designed chips. Effectively, Nvidia is using its own capital to fuel demand for its products. AMD has structured similar deals, offering OpenAI equity-linked incentives to purchase its chips.”

Similar structures from AMD and cloud providers like Oracle (which agreed to provide $300bn in cloud infrastructure to OpenAI, much of which is powered by Nvidia and AMD chips), highlight a growing trend of blurred supplier-customer relationships. These circular financing models raise questions about the sustainability of demand and whether current growth reflects genuine market needs.

What investors think

Evelyn Partners is not the only investment house to think the AI trade has further to run.

Dom Rizzo, portfolio manager of T. Rowe Price’s Global Technology Equity strategy, recently argued that the AI surge is “being driven by real fundamentals, not hype”.

“This is not a bubble. It is a broad-based buildout with room for multiple winners. The AI opportunity is large, the fundamentals are strong and the sector still has plenty of runway,” he said.

A report by Albemarle Street Partners conceded that the rise in AI stocks “looks exactly like a bubble” but ultimately argued that this is not the case currently as their lofty valuations are being underpinned by higher profits and earnings growth.

But the firm continued: “The current situation does not reassure us that a bubble cannot be in the stages of forming. It remains entirely possible that these companies cannot sustain their extraordinary profit growth, that other disruptive businesses emerge to break their dominance or that the huge debt-fuelled investments they are making to buy data centre capacity, often in circular loops with one another, could come unstuck.”

One investor who has publicly gone against the AI trade is Michael Burry, who is known for predicting the 2008 US housing market crash. His profitable bet against the US housing bubble featured in The Big Short book and movie.

Burry’s Scion Asset Management hedge fund has put options (which rise when share prices fall) against 1 million Nvidia shares and 5 million Palantir shares with respective notional values of $187m and $912m, a regulatory filing released Monday for the third quarter shows.

Russ Mould, investment director at AJ Bell, said: “Burry’s decision to buy put options and field against Nvidia and Palantir, albeit in a structure to carefully manage the potential downside as well as the upside, further raises the temperature of the debate over whether AI-related stocks are in the midst of a bubble to match those that inflated and then punctured the valuations of the Go-Go technology stocks of the late 1960s, the Nifty Fifty of the early 1970s and technology, media and telecoms firms in the late 1990s.

“No one can deny that Nvidia is currently demonstrating phenomenal growth, as its chipsets help to power the data centres and servers that underpin the development of large language models and provide the computing power that drives AI.

“But what no one knows, yet, is whether the current capex boom will hit a speed bump to match that of networking equipment in the early 2000s, but it cannot be entirely ruled out as only really Nvidia currently seems able to turn the AI development boom into profits and cashflow (though Alphabet may be doing the best of the rest).”