When deciding how much equity exposure to have within their portfolio, an investor ultimately must determine how much risk they are willing and able to take.

Appetite for risk can depend on many factors, including time horizon and wealth. For example, if an investor has a long-term horizon, they can generally afford to weather short-term volatility in pursuit of higher long-term returns, meaning they will likely have a higher equity rating.

On the flip side, if market peaks and troughs bring out the cold sweats, keeping an overweight to cash or fixed income would help them sleep at night.

Of course, for many investors the reality is somewhere in the middle.

According to Darius McDermott, managing director at FundCalibre, a 50% equity allocation “strikes a healthy balance, providing enough growth potential to keep pace with inflation, but with meaningful downside protection”.

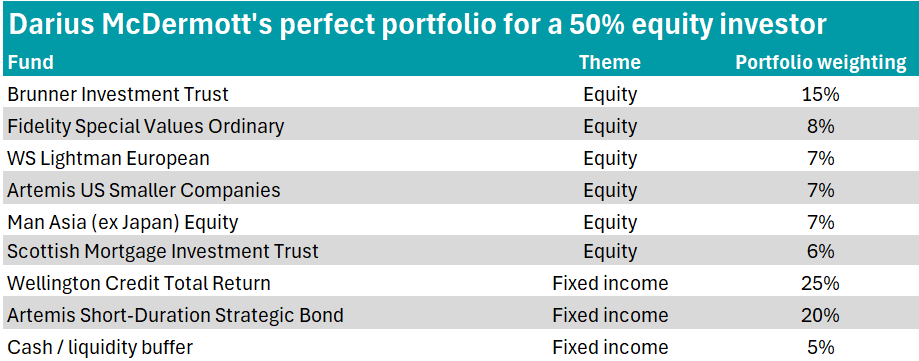

Below, he has outlined his perfect portfolio for a 50% equity investor.

Source: FE Analytics

On the stock market side, McDermott suggested an array of funds to ensure multi-cap and global diversification across multiple investment styles such as value and growth.

He first allocated 15% to the £606.3m AIC Dividend Hero Brunner Investment Trust, describing it as a “global, all-weather equity portfolio with a unique balance across quality, growth and value”.

The trust has been managed by Christian Schneider since 2022, alongside deputy managers Marcus Morris-Eyton and Simon Gergel, and is currently trading on a 10.2% discount to net asset value (NAV).

It captures the growth of US tech giants through Magnificent Seven names Microsoft and Alphabet, paired with more defensive and value-driven holdings like the Bank of Ireland.

Performance of the trust vs sector and benchmarks over 5yrs

Source: FE Analytics

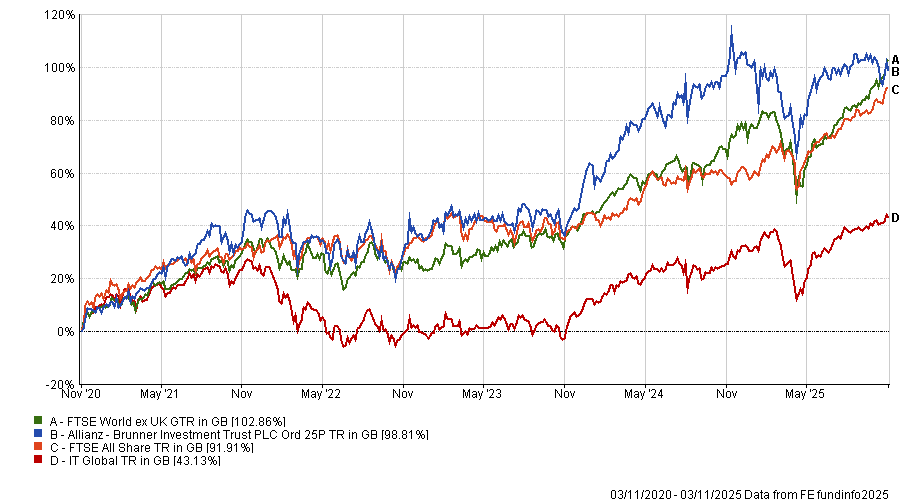

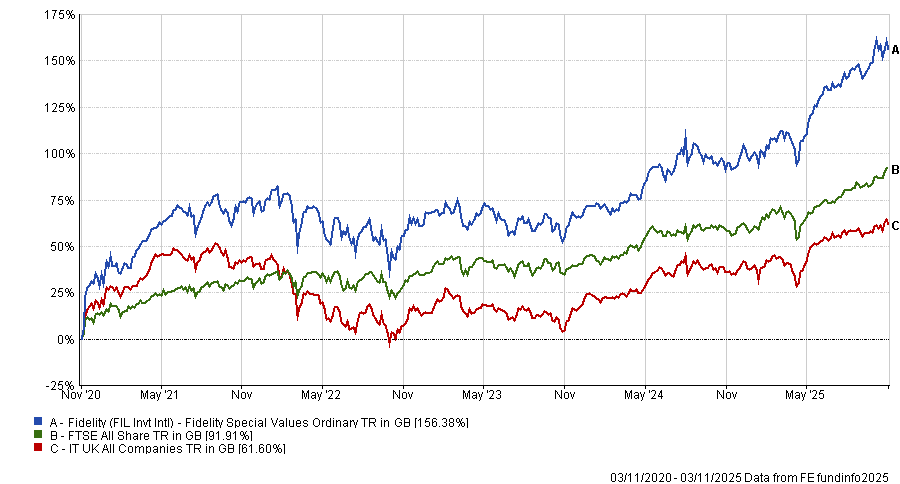

“From there, investors can add regional and style diversification,” said McDermott, who suggested Fidelity Special Values Ordinary to provide “contrarian UK value exposure” and WS Lightman European to ensure investors have access to value and recovery names “in a region that remains attractively valued versus the US”. McDermott allocated each of the funds 8% and 7% in the portfolio respectively.

Fidelity’s £1.3bn investment trust has an FE fundinfo Crowning Rating of five out of five and shares trade on a narrow discount of 3.1% to its NAV.

It targets UK companies which FE fundinfo Alpha Manager Alex Wright and Jonathan Winton believe to be undervalued, with FTSE 100 stocks dominating its top holdings, including British American Tobacco and NatWest Group.

The trust has an ‘AA’ rating from Titan Square Mile, with analysts stating it is “a compelling proposition run by a highly motivated and passionate investor”.

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

Meanwhile, WS Lightman European – also with £1.3bn in assets under management – is a concentrated portfolio of between 40 and 50 European holdings which managers Rob Burnett and George Boyd-Bowman believe are undervalued with positive operational momentum.

RSMR analysts added: “The focus on operational momentum and balance sheet strength in addition to traditional value factors has proven to be very beneficial and means the fund does not have a ‘special situations’ or ‘recovery’ feel to it, but more of a traditional value bias.”

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

In addition, McDermott allocated 7% to the £1.3bn Artemis US Smaller Companies fund to ensure mid- and small-cap exposure “in the world’s most innovative market”.

Managers Cormac Weldon and Olivia Micklem take a long-only view to small- and mid-cap companies they expect can grow in all market conditions. The fund is dynamic with an average annual turnover of 50%.

It has delivered first-quartile returns in the IA North American Smaller Companies sector over one, three and 10 years, gaining 280.4% over the decade. However, it dropped to the third quartile in the sector over five years.

Elsewhere, the largest fund in the portfolio, the £12.9bn Scottish Mortgage Investment Trust, has been allocated a slightly smaller position of 6%. It invests in fast-growing public and private companies in every market and shares are trading on a 10.8% discount to NAV.

RSMR analysts cited the performance of FE fundinfo Alpha Manager Tom Slater and Lawrence Burns as key to its “exceptionally strong” performance.

“The trust’s ability to exercise patience, its long-term approach and engagement with the companies in which it invests have all come together and its performance reflects all these aspects,” they added.

It has delivered first-quartile returns in the IT Global sector over one, three and 10 years, but dropped to the fourth quartile over five years with a gain of 16.8% versus the 40.8% sector average, as the portfolio struggled during 2021 and 2022 when interest rates rose.

From big funds to small, McDermott suggested allocating 7% of the portfolio to the £150.7m Man Asia (ex Japan) Equity to capture Asia’s long-term growth potential.

“The region looks more attractive right now than it has in years and the fund’s disciplined process has a strong track record through different market cycles,” he said.

The fund offers a long-only, style agnostic strategy, with manager Andrew Swan looking to capture the turning points in earnings revisions where there has historically been significant potential to generate alpha.

It invests in emerging market giants, including China’s Tencent and Alibaba, which have helped to push the fund into the top quartile of the IA Asia Pacific Excluding Japan sector over one, three and five years.

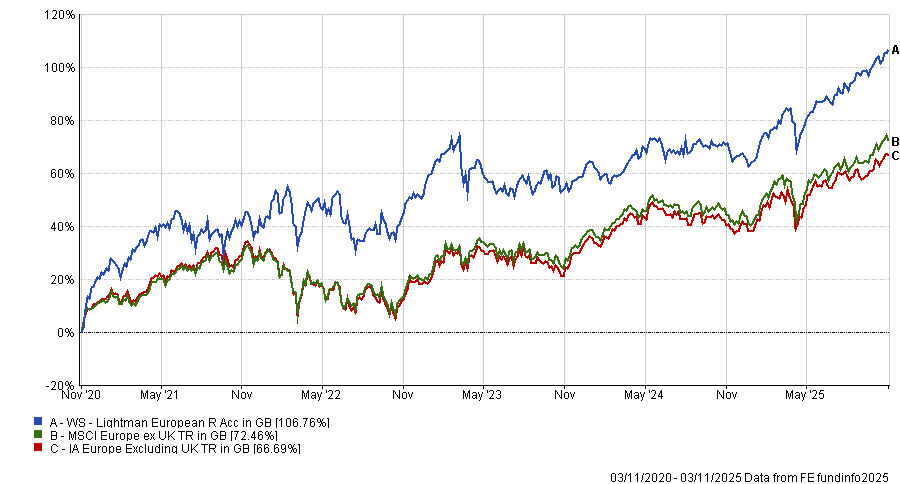

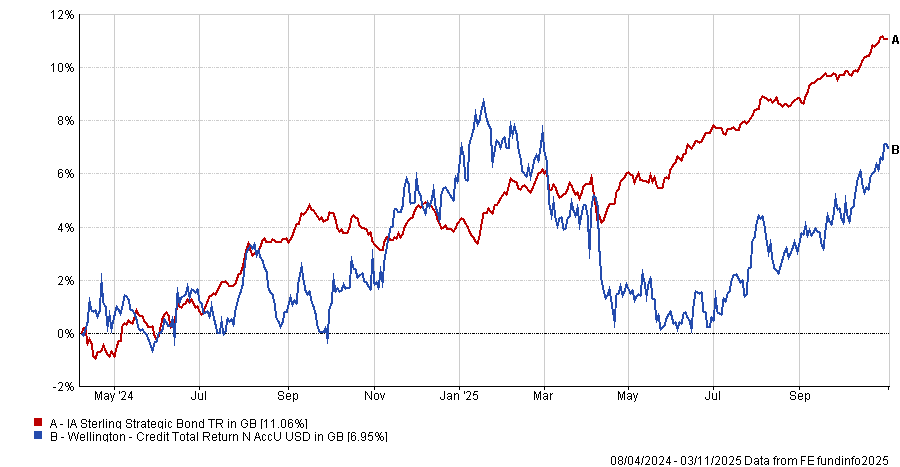

Finally, on the defensive side, McDermott allocated 25% to Wellington Credit Total Return and 20% to Artemis Short-Duration Strategic Bond, with the remainder held as a liquidity buffer in cash.

“Together, they form a strong ballast against equity volatility,” McDermott said.

The $1.4bn Wellington Credit Total Return, is an unconstrained global credit fund, that “has the flexibility to adapt as markets evolve”, he added.

Managed by Conner Fitzgerald and Schuyler Reece, it seeks long-term total returns by investing primarily in a global portfolio of US dollar-denominated treasury, corporate, high yield and emerging market fixed income instruments.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

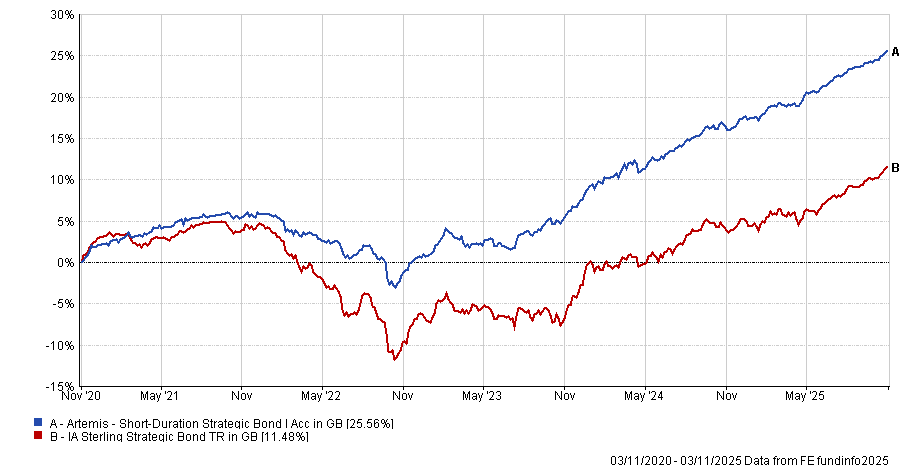

Meanwhile, McDermott said Artemis Short-Duration Strategic Bond “provides income and stability without taking on excessive duration risk”.

With £639.5m in assets under management and a Crown Rating of five, the portfolio of global debt and debt-related securities maintains an aggregate duration of below four years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics