Nick Train said he is serious about “winning the investment battle” as his investment firm experienced its worst period of performance in 20 years.

All of the investment trusts and funds managed by Nick Train’s firm have fallen to the bottom quartile of their sector over the past year.

This has hit the Lindsell Train Investment Trust particularly hard because almost half of its portfolio is made up of his investment firm Lindsell Train Limited.

Since June of this year, the Lindsell Train Global Equity fund has gone from £9.1 billion in assets to £7.9bn in December. The less money under management, the less money the investment firm is able to recoup in management fees.

The trust has fallen from a 39.4% premium to net asset value (NAV) in August of this year to an 11% premium as of early December.

Amidst the poor performance, Train said he is battling to protect the long-term value of their savings and will not trade in and out of the high-quality businesses that he invests in.

Although some risk is unavoidable, he said he will not take “frivolous risks” or indulge in “long-term losing behaviour”.

“I will not make flippant or complacent predictions about prospects for Lindsell Train Limited, as we experience arguably the worst period of relative investment performance in our 20-year history,” he said.

“We assure you, we remain disciplined and serious in our efforts to invest in assets with the potential of protecting or enhancing the real, after-tax purchasing power of your savings.”

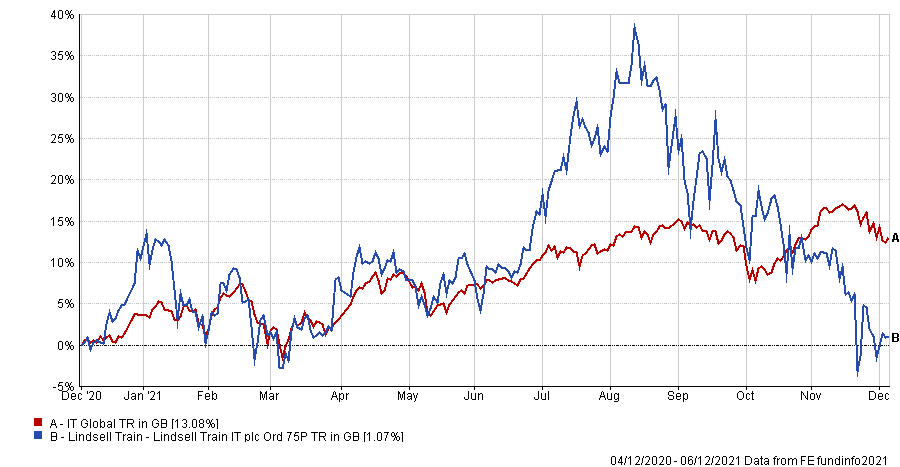

The Lindsell Train investment trust has delivered a bottom-quartile 1.1% total return over the past year, compared to 13.1% from the IT Global sector average.

Performance of trust over 1yr

Source: FE Analytics

Although not owning certain software and technology businesses has hurt the relative performance of many of Nick Train’s funds, he did point to a category of companies that he thinks are “blessed with intellectual property (IP)”.

These include companies such as the London Stock Exchange, Nintendo, PayPal and RELX.

“The digital age has made such IP even more valuable than it was in the 20th century because access to it has become easier and its utility enhanced, while the profitability of such “capital-lite” data services tends toward the infinite,” he said.

Train had hoped Pearson would have been included in this category of companies, but there is some scepticism around the education company’s ability to leverage its intellectual property. Shares are down some 30% from its year-highs.

Julian Cazalet, chairman of the Lindsell Train Investment Trust said: “As we see it, the trust’s current underperformance is predominantly because of two factors: not enough exposure to software/platform technology; and no exposure to capital intensive manufacturing, whether that be hardware technology, materials, energy or infrastructure.”

Although the trust’s chairman does not expect Train to invest in manufacturing, he said he expects to see more investments in software and platform technology “if opportunities for establishing an investment at a favourable entry point present themselves”.

Train alluded to this in his update to investors of his Lindsell Train Global Equity fund: “We absolutely know that if we are to meet our clients’ expectations in coming years, we will need to participate in more tech winners – existing and new holdings.

“However, we also know that some tech stocks will never justify their current market capitalisations and investments in businesses that can compound steadily, like Heineken or Mondelez, remain valid and valuable portfolio constituents.”

Both Heineken and Mondelez form large positions in many of Nick Train’s funds.