Japan is a market that is often overlooked by investors. After almost two decades in which it struggled to recover from the crash of the early 1990s, it has been resurgent over the past 10 years on the back of economic policies from the government, which started with prime minister Shinzo Abe.

Corporate governance has improved, while the country remains one of the technology innovation capitals of the world, making it an appealing place to invest.

However, the best way to gain exposure to this market is not to buy the index, according to the latest Trustnet study, but to back active managers that specialise in the small-cap space.

In this series, we look at investment style (growth vs value) and market capitalisation, as well as whether active funds have beaten the benchmark, to work out what has been the best way to play each major market over the past decade.

Previously we have looked at the UK and Europe, where smaller companies funds were the clear winners, while in the global and US studies, large-cap passive funds came out on top.

In Japan it is less clear. The MSCI Japan Large Cap index has made 173.4% over the past decade, while the MSCI Japan Small Cap index has made 169.5%.

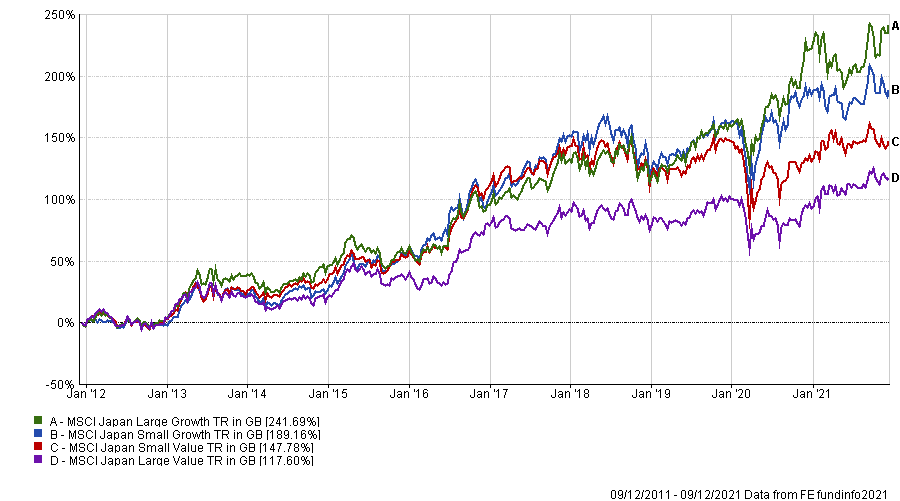

However, there is a clear divergence between styles. Large-cap growth stocks have been the best way to invest over the past decade, while small-cap growth stocks are in second, as the below chart shows. The value equivalents are significantly behind.

Total return of indices over 10yrs

Source: FE Analytics

When comparing the active funds versus passive, there are two types of winner. On a sector level, IA Japanese Smaller Companies has made 268.5% over the past decade, more than 80 percentage points above the average IA Japan fund and MSCI Small Cap index, making it the best choice.

However, looking at individual funds, there are two types of portfolio on top – small-cap specialists and large-cap growth funds.

When picking funds, FTF Martin Currie Japan Equity has been the top performer of the past decade. Although it sits in the IA Japan sector, the portfolio is an all-cap fund, with around half the portfolio in stocks with a market capitalisation of less than £5bn, while some of its large-cap holdings started in the fund as minnows.

The £1.3bn portfolio, managed by FE fundinfo Alpha Manager Hideo Shiozumi and formerly known as Legg Mason Japan Equity, is not for the faint-hearted, however, as it has had periods of significant volatility. This year, it has lost investors 7% – one of the worst returns in the sector.

Two smaller companies funds come next, with Baillie Gifford Japanese Smaller Companies and M&G Japan Smaller Companies returning 408% and 322.8%, respectively.

The £1bn Baillie Gifford fund invests in the same way as many others under the asset manager’s umbrella, picking high-growth stocks that can sustain their impressive earnings pace. The fund is managed by Praveen Kumar, who also helms the Baillie Gifford Shin Nippon trust.

Meanwhile, the £108m M&G fund is run by Carl Vine, who takes a bottom-up approach, seeking out growth companies trading on low valuations that can re-rate.

The £1.7bn JPM Japan and £3.8bn Baillie Gifford Japanese funds round out the top five, making 314% and 275.9%, respectively.

JPM Japan is a large-cap growth portfolio based in Tokyo. It picks high-quality companies that can benefit from long-term structural changes in Japan. As such, it has significant weightings to electric appliances, services and information and communication stocks. There is also an investment trust equivalent: JP Morgan Japanese.

The second Baillie Gifford name on the list, the £3.8bn Baillie Gifford Japanese fund, has been managed by Matthew Brett since 2008, but he took sole charge when longstanding manager Sarah Whitley stepped down in 2018.

Analysts at Square Mile Investment Consulting and Research said the fund’s longer-term time horizon was “different to that of many other Japanese equity investors”, but that performance can vary in the short term.

| Fund | Sector | Fund size | Manager name(s) | Yield | OCF |

| Baillie Gifford Japanese | IA Japan | £3,822m | Matthew Brett | 0.89% | 0.61% |

| Baillie Gifford Japanese Smaller Companies | IA Japanese Smaller Companies | £1,010m | Praveen Kumar | 0.22% | 0.61% |

| FTF Martin Currie Japan Equity | IA Japan | £1,256m | Hideo Shiozumi | 0.00% | 0.83% |

| JPM Japan | IA Japan | £1,665m | Shoichi Mizusawa, Nicholas Weindling, Miyako Urabe | 0.10% | 0.82% |

| M&G Japan Smaller Companies | IA Japanese Smaller Companies | £113m | Carl Vine, Dave Perrett | 0.79% | 0.90% |