Inflationary pressures are only likely to intensify from here and bolster the case for tighter monetary policy, but Wise Funds’ Philip Matthews says investors can still find assets that will make money in this environment.

The Bank of England last week raised the base rate from 0.1% to 0.25% owing to inflationary pressure; the latest official UK inflation print surprised at 5.1% for the 12 months to November, taking CPI to a 10-year high. In the US, inflation stands at 6.8% - its highest since 1982.

The need for central banks to tighten policy in order to curb inflation has become one of the main worries of the market, even in the midst of the Omicron coronavirus variant. The US Federal Reserve is now forecasting three interest rate rises and a doubling of the pace of tapering its quantitative easing programme in 2022.

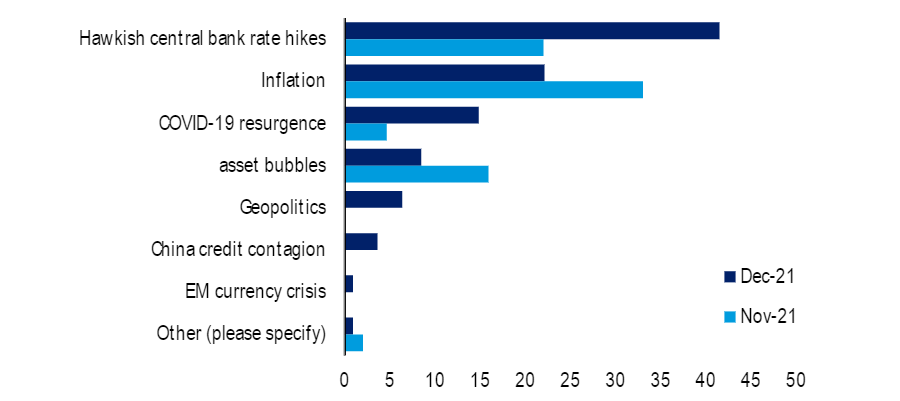

The latest Bank of America Global Fund Manager Survey found 42% of investors think hawkish central bank hikes is the biggest ‘tail risk’ today followed by inflation (22%); only 15% cited a Covid-19 resurgence and this was after the Omicron variant had been identified.

Fund managers’ biggest task risks – December 2021

Source: BofA Global Fund Manager Survey

Matthews, a co-manager on Wise Funds’ multi-asset portfolios, said: “While each successive wave of the virus has had a more limited negative impact on economic growth, inflationary forces are proving more persistent than initially expected and action was needed to stop inflation expectations feeding through to higher wages as well as to curb speculative behaviour in markets.”

He highlighted a number of holdings across the TB Wise Multi-Asset Growth and TB Wise Multi-Asset Income funds that illustrate how investors can add inflation protection into their portfolios.

Firstly, he noted that equities tend to hold up better than fixed income in times of higher inflation and interest rates; TB Wise Multi-Asset Growth has 63.7% of its portfolio in stocks while the income fund has 54.8%.

Matthews added that exposure to financials is a good way to protect against inflation as banks are direct beneficiaries of rising rates.

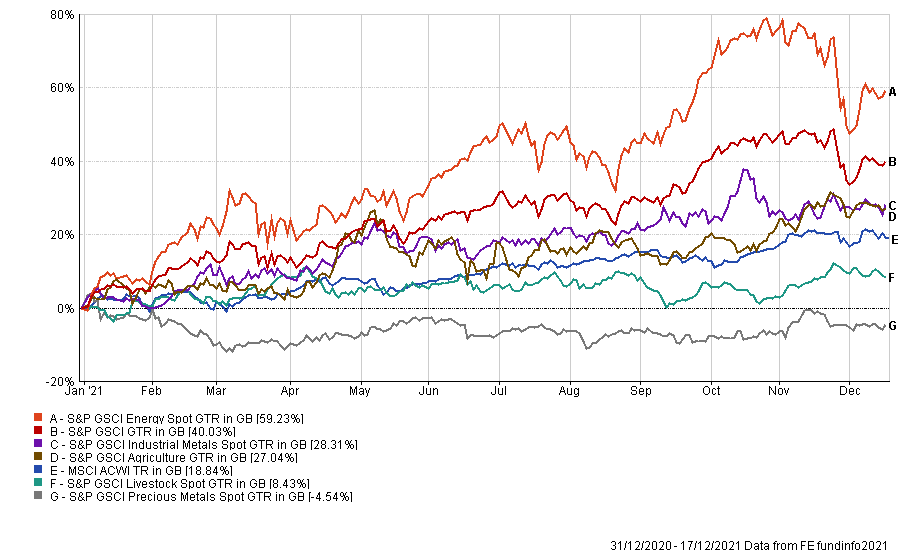

In addition, commodity stocks benefit from rising commodity prices – which has been the case throughout much of the year. The chart below shows how the main commodity groups have performed relative to global equities over the course of 2021, although the strongest rises have come from the likes of tin (up 130%), coffee (75%) and unleaded gasoline (up 71%).

Performance of commodity groups over 2021

Source: FE Analytics

One of the ways that the Wise Funds' portfolios have exposure to this theme is through the BlackRock World Mining investment trust. Managed by Evy Hambro and Olivia Markham, the trust has a strong long-term track record – making a total return of 60% over the past decade, when its average peer fell close to 30%.

Matthews also pointed to infrastructure as an asset class that can offer a degree of inflation protection. This is because the revenues of most infrastructure assets have an explicit link to inflation through regulation, contract agreements or concession, which allows them to increase prices as inflation grows.

He highlighted Ecofin Global Utilities & Infrastructure as a holding that fits into this theme. This trust has repositioned its traditional regulatory utility holdings towards countries where the regulatory framework incorporates inflation, such as the UK and Italy.

“Our fixed income allocations are relatively low given the low yields on offer and the risk of higher persistent inflation,” the multi-asset manager continued.

“However, we do hold the TwentyFour Income fund where the underlying asset-backed security holdings are floating rate in nature and thus see their coupons move in tandem with rising rates. Our other fixed income holdings, such as GCP Infrastructure and Starwood European Real Estate, also have an element of floating rate exposure.”

Finally, TB Wise Multi-Asset Growth and TB Wise Multi-Asset Income hold some property assets that Matthews thinks can mitigate the impact of higher inflation.

Some, such as Impact Healthcare REIT, benefit from rents that increase in line with inflation while others, like Urban Logistics REIT, could have the ability to lift their rents due to the inflationary pressures on land and build costs.