Japan’s story of corporate reform might be an ongoing one but it remains as relevant today as it has for the past five years, according to 2021’s top performing Japan managers.

The big investment story for Japan has been the reforms to corporate governance, according to several managers, which have been going on since prime minister Shinzo Abe began his ‘Abenomics’ programme in 2013. These changes were brought in to salvage the market and economy from its steep crash in the 1990s.

Although it has been a long-term aspect of Japanese investing, Jeff Atherton, manager of the £1.2bn Man GLG Japan CoreAlpha fund, said it has picked up with noticeable ferocity over the past couple of years.

“It's no exaggeration to say that there has been more change in Japan over the past two years than in the last 29 years of my career,” he said.

“Japanese markets always had a terrific treasure trove of assets investors have never been able to access. But now companies that have been sat on assets worth more than their entire market cap are selling them off and presenting investors with the kind of opportunities that remind me of the UK in the 1980s and 1990s, when there was a big improvement in corporate governance and financial returns.”

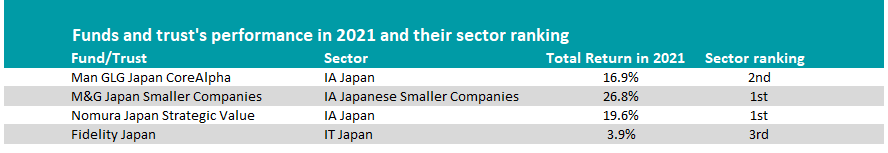

Source: FE Analytics

He said that Japan has historically been viewed as a cyclical market – its returns driven largely by interest rates and the global economy – but this “sea of change” among companies “has begun to present opportunities never seen before by foreign equity investors”.

Carl Vine, manager of M&G Japan Smaller Companies, the highest-returning Japan fund in 2021, seconded this, noting that while investors might be bored of hearing about Japan’s restructuring story, it was still a very important one.

“At the coalface, it’s incredibly exciting, especially for a stock picker,” he said, as more and more companies “are having the lightbulbs go off” in regard to corporate governance, which will only help build returns and share price.

This pace of change was unlikely to slow down in 2022, Vine added, as the market moved further on with its Covid recovery.

The continuation of this would enable Japan to challenge the “monster” US market in the coming years, Vine said, as companies rinse and repeat this cycle of raising returns on invested capital to then raise productivity, “which has just factually worked”.

The managers added that there has been no threat that new prime minister, Fumio Kishida, would seriously alter the course of this reform.

The market initially had mixed reactions when Kishisda took office last year, selling off as fears that Japan was restarting a bad habit of short, disruptive prime ministerial runs was restarting, but this quickly resolved itself when Kishisda’s optimistic and supportive monetary plans were revealed.

Yoshihiro Miyazaki, manager of the Nomura Japan Strategic Value fund, said that he fully expects the new administration to continue to announce policies to support the economy and build approval rating.

Outside of the government’s influence Nicholas Price, portfolio manager of Fidelity Japan trust, said that several headwinds had been removed, including supply chain constraints and higher raw material and freight rates.

“As these fall away and start to reverse, we could see a decent uplift to earnings in the first half of 2022,” Price said.

These issues have largely resolved because of the brighter Covid picture and global trading routes normalising after lockdowns, tackling the imbalance between supply and demand.

However, he advised staying away from directly consumer facing and manufacturers, which will face pricing pressures once the supply bottlenecks are resolved.

There were some lingering threats though, mainly a resurgence of Covid forcing another economic shut down.

The Tokyo governors were requested permission from the central government to implement tighter Covid measures this week, including shorter opening hours for bars and restaurants in an attempt to deal with the rising rate of infections, which are near record levels currently.

If another State of Emergency was announced, Miyazaki said it would rerate the economic recovery expectations downwards, “impacting companies that would benefit from the reopening”.

A resolution to Covid, or at least getting it under control, is one thing Atherton is hopeful for this year, not just in Japan but globally.

“We hope to see a period of economic stability in 2022 compared to the disruption of 2021,” he said.

This is the second in a series of articles asking the top-performing fund managers in their sectors over 2021 for their views on the coming year. Previously we have tackled the UK.

| Fund/trust | Sector | Fund Size(m) | Fund Manager | Yield | OCF | IT Net Gearing | IT Pub. NAV Discount |

| Man GLG Japan Core Alpha | IA Japan | £1,090.20 | Jeff Atherton, Adrian Edwards | 1.64% | 0.90% | ||

| Nomura Japan Strategic Value | IA Japan | £576.50 | Kentaro Takayangi | 1.28% | 0.88% | ||

| M&G Japan Smaller Companies | IA Japanese Smaller Companies | £114 | Carl Vine, Dave Perrett | 0.83% | 0.90% | ||

| Fidelity Japan Trust | IT Japan | £262.40 | Nicholas Price | 0.00% | 0.94% | 0.00% | -6.86% |