Politics is one of the biggest risks that investors will face this year, both in the UK and abroad, according to Quilter Investors portfolio manager Stuart Clark, who warned that the Downing Street parties held during lockdown had merely “fired the starting gun”.

While the world is currently dealing with supply chain issues – which have led to rampant inflation – and the potential for central bank mismanagement, one potential pitfall not explored enough is political risk.

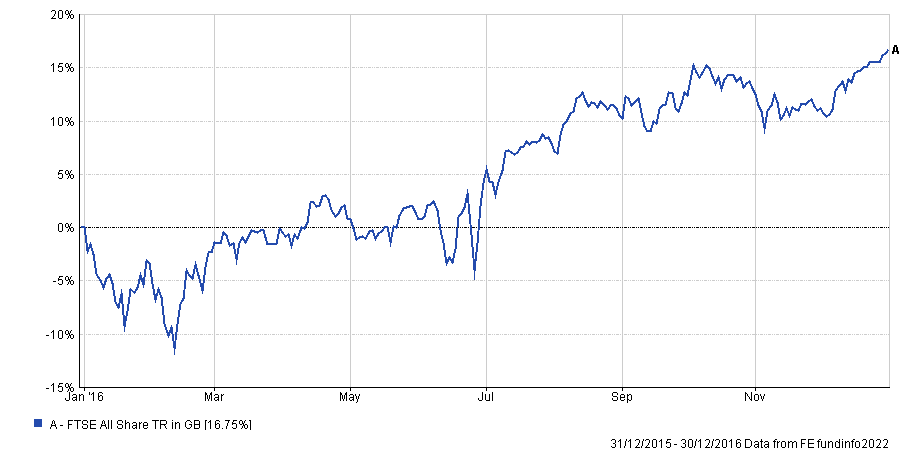

As we have seen in the past with events such as Brexit and the presidency of Donald Trump, these decisions can impact markets drastically. For example, immediately after the Brexit referendum in June 2016, the FTSE All Share index fell 7%.

“This year was already going to be an intriguing one from a political perspective given we are likely to see the return of Donald Trump ahead of the US midterms and the number of elections that are ongoing. With the UK now facing potential political upheaval, it is key investors don’t rest on their laurels,” Clark said.

However, the reaction to these events is often short-lived – the FTSE All Share index ended 2016 up 16.8% despite the shock fall – making it difficult to make know when and where to invest.

Total return of FTSE All Share index in 2016

Source: FE Analytics

“Around any political event there will be short-term noise, but it is important that you keep focused on the long term and instead look through at what could be implemented and how that may affect your portfolio,” Clark added.

Below, we look at the three major political risks investors will need to watch out for in 2022, both domestically and further afield.

The UK

Starting at home, prime minister Boris Johnson has come under increasing pressure from members of both his own and the opposition parties for hosting work events during the lockdowns in 2020 and 2021 – a time when this was against the government’s rules.

“It remains to be seen if he can survive this latest scandal. Politicians on both sides of the divide have called for him to resign and this has ratcheted up the political ambiguity the UK faces,” Clark said.

If there were a Conservative party leadership change this year, or even a general election, markets would likely react, although the impact should be minimal, he added, as there is no “extreme ideological move” between Johnson and Labour leader Keir Starmer.

The issue for investors, however, is that the UK market is cheap, but for good reason. Brexit has already hampered the market, causing foreign investors to stay away, and uncertainty in Westminster would do little to bring them back, keeping the domestic market undervalued versus its peers.

“We instead see Europe as a more attractive region, as it has the same undervalued qualities, relative to the rest of the world, without so much political uncertainty,” said Clark.

The US

Over in America, president Joe Biden will face his first big test since his election in 2021 with the midterm elections, which are expected to include a watered-down version of his ‘Build Back Better’ infrastructure plan and a pause on any potential tax increase, according to Clark.

“One point potentially being missed by investors, however, is the fact that the Federal Reserve will likely not make many, if any, moves to its signalled interest rate policy in the run up to the elections to preserve its impartiality,” he said.

Currently, markets are pricing in three or four rate hikes this year as well as a shift from tapering to quantitative tightening, yet it will have to move sooner rather than later if this is to be done in time before the midterms.

“With markets at such high valuations and a backdrop of swift monetary policy tightening, it is difficult to see US equities marching much higher. As such being diversified globally and across investment styles will help investors avoid the large repercussions of any taper tantrum that comes about from Fed tightening,” Clark noted.

Europe

The big red flag on the horizon in Europe is the French elections, although Clark said this was “unlikely to upset markets too much”.

President Emmanuel Macron is expected to stand again, but populist movements on the continent remain strong and although Macron should win, “it would be no surprise to see his share of vote reduce in the face of increased far-right challenges”, he said.

If this were to happen, it could cause European markets to wobble, although they should settle down shortly after, providing the status quo prevails.

“This is one instance where investors must look past the short-term noise and instead focus on what changes are likely down the line. If it is more of the same then there will be little to worry about,” Clark said.