HG Capital, Ruffer and Capital Gearing are some of the top alternative options available to investors that do not require income from their portfolio, according to Anthony Leatham and Markuz Jaffe, research analysts at Peel Hunt.

Alternative investments – defined by Peel Hunt as trusts that do not buy traditional equities – have become popular in recent years and now account for around £111bn in assets under management.

Half of this money (£56bn) is allocated to trusts with a yield of more than 3%, while the rest is in investment companies that yield less than 3%.

Below, the analysts looked at those with a lower yield that can make strong risk-adjusted returns, either by investing in unlisted companies or across a range of asset classes to limit risk and volatility.

Private equity

Many investors have turned to private equity, whether through the use of a dedicated fund or indirectly by investing in trusts such as Scottish Mortgage and Monks.

For those that want dedicated exposure to the asset class, Hg Capital* has been the most-consistent performer over three, five and 10 years, making a top-quartile return over each period.

Leatham and Jaffe said: “We have confidence in Hg’s domain expertise and we think its position in the market makes it a trusted partner for successful unquoted software businesses.”

The trust is split into “clusters” such as tax and accounting (31% of net asset value), payroll (23%), legal (10%), tech services (8%) and healthcare (9%), among others.

Leatham and Jaffe said there were concerns that private equity valuations could come under pressure if inflation continued to rise – as has happened to listed technology companies in recent months.

However, they noted that the “healthy pipeline of realisations and refinancings” planned for the next 12 months should make any short-term discount volatility “a buying opportunity”.

Total return of funds over three years

Source: FE Analytics

Next up is HarbourVest Global Private Equity, which provides investors with access to a highly diversified global private equity portfolio. It does so by investing in more than 50 HarbourVest managed funds, which in turn make investments into leading private equity funds – the rare fund-of-fund-of-funds.

“The end result is a portfolio that is well diversified by geography, sector and strategy. The portfolio has exposure to more than 10,000 underlying companies, with the top 10 representing less than 10% of the total assets and the top 1,000 representing 83%,” the analysts said.

Another differentiator to its peers is that the trust invests in venture and growth-stage businesses, which have been a key source of value creation over time.

“We see HarbourVest Global Private Equity as an attractive way to allocate to private equity, which helps to minimise manager selection and company-specific risks,” Leatham and Jaffe said.

Third on the list was NB Private Equity Partners, which is in a “sweet spot” currently, according to the analysts. On average, the trust has held its underlying positions for 3.5 years – the highest in its recent history – which should lead to exits and realisations in the near future. Last year, the firm made 14 transactions, partial sales or full exits, netting an average profit of 83%.

“Given the mix of investments, the maturity profile of the portfolio, and the dividend, we see both NAV appreciation and discount narrowing from here,” the analysts said.

Fourth is Augmentum Fintech, which invests in unlisted companies in the financial technology sector, including digital banking, asset managers and infrastructure. The key thing in common is disruptive technology and the prospects for higher growth, which all of its underlying companies must have.

The trust’s largest holding is interactive investor (ii), which asset manager Abrdn is set to buy for £1.5bn. This is expected to net the investment company an 87% profit on its original stake.

Since its launch in 2018, the trust has grown from £94m in assets under management to £267m, but with more than £250m of active pipeline.

“We expect the trust to deploy the proceeds of the interactive investor exit into exciting, high-growth fintech companies (although we do not rule out the possibility of a one-time return of capital),” the analysts said.

“We also see multiple potential near-term net asset value drivers from portfolio-holding exits and realisations, setting up what should be a positive next 12 to 18 months for the trust.”

Flexible investments

Turning away from private equity, for the more cautious investor the analysts suggested three trusts that had the flexibility to make reasonable growth while protecting from market falls.

First up was Ruffer, the multi-asset portfolio that captured headlines in 2021 for investing in Bitcoin, although it has subsequently sold out.

“The focus is on avoiding capital loss and the core of the portfolio is formed of index-linked bonds, gold, and equities, which reflects the balance of defensive and growth assets,” Leatham and Jaffe said.

Recently, the management team has tilted the portfolio to hedge the risk of rising inflation and interest rates, with more than a third (38%) invested in inflation-linked bonds.

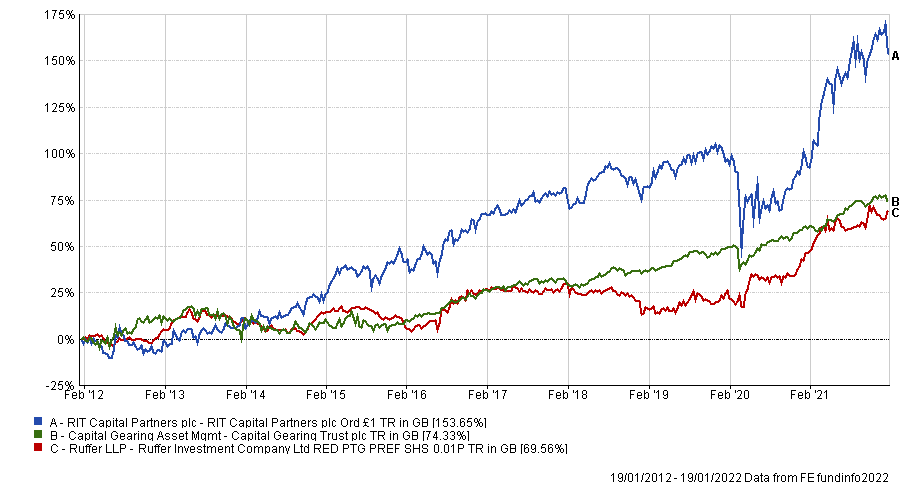

Total return of funds over 10 years

Source: FE Analytics

Next up is Capital Gearing, which aims to avoid losses over a 12-month period while making stock market-like returns over the course of an economic cycle.

It is currently defensively positioned and, like Ruffer, is focusing on inflation protection, with 34% of the portfolio invested in inflation-linked bonds, with 45% in risk assets.

Last up is RIT Capital Partners which, at a current 4% share price discount to its net asset value, is good value, according to the analysts. It has, historically, captured 38% of market downside, the analysts said, while participating in 70% of the market gains.

At present, the trust’s net equity exposure of 43% reflects its cautious view, with 30% in hedge or absolute return positions.

“We continue to place emphasis on the 35% in private investments, which benefits from the strength of the manager’s network and was boosted in 2021 by the IPO of Coupang,” said Leatham and Jaffe.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Gearing | Discount |

| Capital Gearing Trust | IT Flexible Investment | £993m | Peter Spiller, Alastair Laing, Chris Clothier | 0.89% | 0.58% | 0.0% | 2.3% |

| Augmentum Fintech | IT Technology & Media | £261m | Frostrow Capital LLP, Richard Matthews, Tim Levene | 0.00% | 1.90% | 0.0% | -2.5% |

| HarbourVest Global Private Equity | IT Private Equity | £2,203m | HarbourVest Advisers L.P. | 0.00% | 0.60% | 0.0% | -20.8% |

| HgCapital Trust | IT Private Equity | £1,912m | HgCapital | 1.19% | 1.80% | 1.2% | 12.5% |

| NB Private Equity Partners | IT Private Equity | £920m | NB Alternatives Advisers | 3.66% | 2.24% | 12.6% | -22.7% |

| RIT Capital Partners plc | IT Flexible Investment | £4,074m |

RIT Capital Partners |

1.36% | 0.66% | 4.3% | -3.7% |

| Ruffer Investment Company | IT Flexible Investment | £722m | Hamish Baillie, Duncan MacInnes | 1.06% | 1.08% | 0.0% | 2.6% |

*Hg Capital is the owner of FE Fundinfo.