Funds with a strong performance history often increase in size at a rapid rate as investors gravitate towards their financial success, but some thriving portfolios can occasionally be overlooked.

Backing a fund early can be a useful strategy for investors, who have the potential to make larger gains when it in its infancy.

In this series, Trustnet looks at the funds that have consistently delivered high returns and are run by at least one FE fundinfo Alpha Manager, yet have not swelled to the size of some of their peers. First up is Asia.

Allianz Total Return Asian Equity

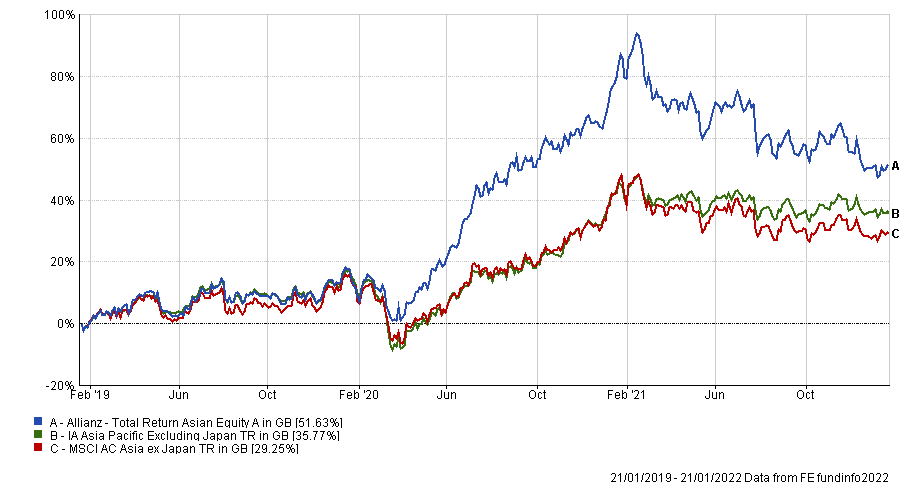

The Allianz Total Return Asian Equity fund has returned 51.6% over the past three years, beating the MSCI Asia ex Japan benchmark by 22.3 percentage points, and has been in the top quartile of the IA Asia Pacific Excluding Japan sector over five and 10 years as well.

Total return of fund vs sector and benchmark over three years

Source: FE Analytics

Yet the fund, managed by Alpha Manager Yuming Pan, has just £61.4m in assets under management, suggesting it is unknown to many investors.

Most of the fund’s holdings are in the technology sector (38.4%), in particular from China, which has a 39% weighting in the portfolio.

Independent financial commentator Adrian Lowcock said this hampered the fund last year, but has helped it over the long term.

“Asian markets have been largely unloved throughout the crisis and indeed, with the exception of Chinese technology stocks, for much of the past 10 years. The fund has clearly benefited from that, although it has impacted performance over the past six months.”

China has become an increasingly volatile market for investors due to the government’s crackdown on businesses. The country’s policy of ‘common prosperity’ has impacted the technology sector especially, with China’s largest technology groups losing $1trn (£740m) in market capitalisation collectively between February and August 2021.

This impacted Allianz Total Return Asian Equity’s performance in 2021, when it lost 18.3% – 11 percentage points below the benchmark – but there were winners, including the fund’s holding in Taiwan Semiconductors, which benefited from the burgeoning electronic car industry as well as semiconductor supply disruptions, which forced prices higher.

Lowcock said that the fund’s focus on high-quality, sustainable growth, high earnings growth and low stock valuations, could make for an interesting option for investors if the market returned to the conditions of the past 10 years, rather than those of 2021.

JOHCM Asia ex Japan

Next up, the JOHCM Asia ex Japan fund has gone up 188.4% since its launch in 2011, yet Darius McDermott, managing director of Chelsea Financial Services, said it has gone “under the radar” with just £38m in assets under management.

The portfolio has had a better 12 months than the Allianz fund above, thanks to its large investment in India (36.5% of assets), which was the best performing market of 2021. The MSCI India index rose 28.3% across the year as the Indian economy recovered from a poor year in 2020 when the country was adversely hit by the pandemic.

However, it was unable to avoid the falls in the Chinese market, as the country is the second-largest weighting in the portfolio at 22.3%.

Though it outperformed the MSCI Asia ex Japan benchmark over the past year, the fund was down 7.3% overall. Samir Mehta, the fund’s manager since launch, remained optimistic, and said that “a benign US dollar environment could be the perfect set up for the start of a bull market in Asia”.

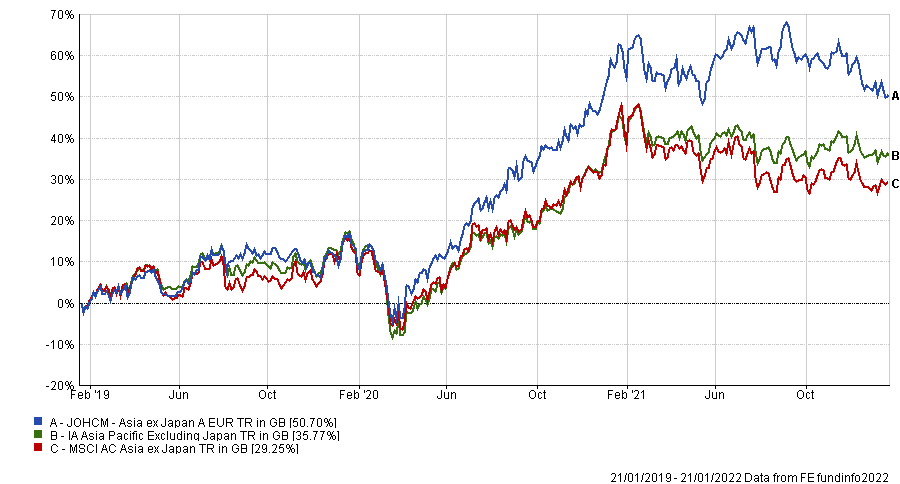

Like the Allianz fund, this large position in China has helped it over the long term, with the portfolio ranking in the top quartile of the sector over three years. It has also beaten both its average peer and benchmark over the past decade.

Total return of fund vs sector and benchmark over three years

Source: FE Analytics

McDermott noted that the fund is made up of “sustainable, long-term quality-growth companies,” which leads to big weightings in the technology, consumer and healthcare sectors.

“The fund has had good performance and I think it’s a solid pick for Asian equities unless you expect the markets to be dominated by cyclicals in the near future,” he said.

Fidelity Japan

Turning to Japan, the Fidelity Japan fund is the final portfolio on the list headed by an Alpha Manager (Ronald Slattery, who took over from Takuya Furuta in 2020) and with a strong track record, but with low assets under management (£108.7m).

Unlike the funds above, the manager invests with a value bias, which helped last year as unloved stocks rebounded when investors anticipated the end of the pandemic and the return to economic normality. As a result, the fund is up 4.4% over the past 12 months, compared to the IA Japan sector which made a loss of 3.9%.

The fund has been a top-quartile performer over one, three and five years, and has beaten both its benchmark and average sector peer over 10 years, although Slattery only joined the fund in June 2020.

Total return of fund vs sector and benchmark over three years

Source: FE Analytics

Fiammetta Valentina, fund analyst at FE fundinfo, said: “Slattery follows a bottom-up approach that places emphasis on valuation analysis, focusing on stocks that are undervalued relative to their balance sheet quality, cash flow, and earnings growth potential.”

Many of the fund’s 60 to 80 holdings are in large-cap companies such as Hitachi, Sony and Denso which jointly make up the top 14.3% of the portfolio’s assets.

Valentina credited the fund’s strong performance in 2021 to Slattery’s value approach to investing as large companies were trading at a cheaper valuation in the pandemic.

She added: “Despite not taking high sector bets, given its focus on valuation, it tends to find more opportunities into cyclical areas of the Japanese market.”