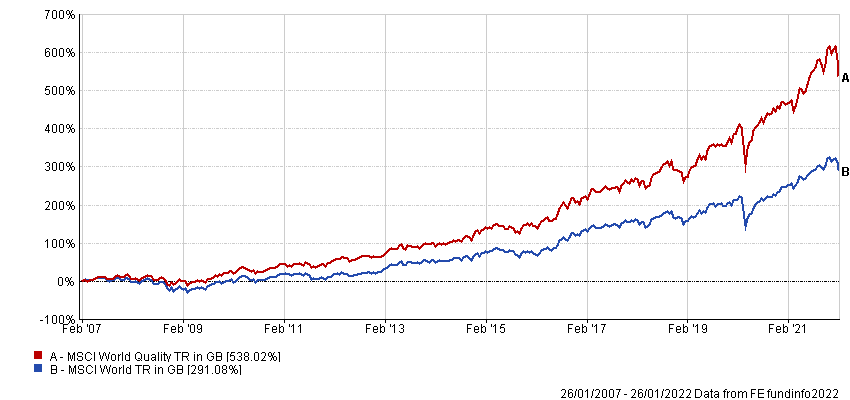

A quality-growth approach has been one of the most lucrative methods of investing since the onset of the financial crisis. Data from FE Analytics shows the MSCI World Quality index has made 538% over the past 15 years, compared with 291.1% from the MSCI World index.

Performance of indices over 15yrs

Source: FE Analytics

This has been an era characterised by low inflation and interest rates, when growth and yield have been hard to find, pushing stocks that offer both characteristics up to high valuations. Yet value managers have warned that, with inflation rising, growth will be easier to come by, while a subsequent increase in interest rates would make dependable dividends less attractive.

Vitaliy Katsenelson, chief executive of Investment Management Associates, said this would lead to a re-rating in fast-moving consumer goods (FMCG) companies in particular, even though, in many cases, the underlying businesses are as solid as ever. He pointed to Coca-Cola as an example, but said he could have used almost any FMCG company instead.

“Coca-Cola is a high-quality company,” he said. “It can raise prices along with inflation on its namesake product, which is about half of its revenue.

“Nobody questions whether Coca-Cola will be around in 10 or 20 years. Most importantly, investors are convinced Coke will continue to manufacture its 2.6% dividend till the end of time.”

However, Katsenelson warned that investors were so focused on the predictability of this dividend, they have ignored how much it cost.

At present, Coca-Cola is on a price-to-earnings (P/E) valuation of around 30 times, but if interest rates rise then the “infinite” dividend will come under pressure and shares should fall back.

“If the 10-year Treasury is yielding 5%, Coke’s dividend will lose its lustre and the stock will decline to a valuation multiple with a ‘1’ in front of it. Today, many Coke shareholders are experiencing what behavioural economists call ‘empathy gap’,” he said.

“They tell themselves, ‘I am fine, even if the stock declines 30 to 50%: I will stick with getting my 2.6% dividend, which will rise with inflation’. However, when the stock price declines and safe alternatives offer double the yield, they’ll change their thinking – thus the gap.”

Most quality-growth managers disagreed with Katsenelson’s assessment, however. Nick Train, manager of the Finsbury Growth & Income Trust, pointed to advice from Sir John Templeton (of Franklin Templeton) about the best time to buy sound stocks being when times look especially tough.

“Holding shares in decent companies may have been uncomfortable at times, but if the goal is to preserve the purchasing power of your capital over time, they did the job,” he explained.

“Sir John’s advice seems pertinent today, although I have no view about the likelihood or not of uncontrollable inflation. I would also say that consumer companies are always a good place to start looking for ‘sound common stocks’ – if they offer products or services that are relevant and prized by consumers.”

However, Train (pictured) warned this didn’t mean that the great consumer companies of the 20th century were necessarily going to be around forever.

“Look out for great 21st century consumer companies, too,” he said.

James Harries (pictured), who manages the Securities Trust of Scotland, also rejected Katsenelson’s original premise.

He said it would be a useful exercise to break Katsenelson’s statement into three questions. The first was how Coca-Cola would cope with rising interest rates – but said he did not expect rates to rise excessively, making it a moot point.

The second was how it would cope with inflation. If higher prices remained persistent but rates stayed low, Harries said a company such as Coke would be fine, making use of its competitive advantages to raise prices.

“The mistake is to view such assets as similar to nominal bonds (in the sense that they are correlated over shorter periods with interest rates), whereas in fact they are much more akin to index-linked bonds,” he explained.

“When viewed in this way, such equities still appear to offer decent long-term value.”

The third question was, what could you buy instead? Harries said he wouldn’t be tempted to ditch high-quality businesses for value stocks, no matter how cheap they were.

“We view this as putting capital at risk longer term, as so-called value companies tend to be low quality and have low returns on capital, plus high levels of capital intensity and cyclicality,” he said.

“Having said all that, a normalisation of policy to us means a normalisation of valuation is very possible. While some of our investments are richly valued relative to history, we are generating a 5.5% free cashflow yield at the portfolio level, which will grow reliably, funding a 2.6% dividend yield.”

Richard Scrope, manager of the VT Tyndall Global Select fund, pointed out that investors should not just focus on consumer goods companies, as there are more sectors within quality growth.

The manager pointed out the ability of FMCG companies to respond to rising input costs by increasing prices depended not only on the strength of their brand, but ‘substitutability risk’: “After all, one can easily switch between Corn Flakes and Shreddies at breakfast and vice versa,” he noted.

He said companies that were “higher on the desirability scale”, such as cosmetics and luxury goods, had more protection due to consumer demand, thus had greater pricing power.

“In 2021, most FMCG companies put through price increases of 10 to 15%, but whether this was enough to offset increases in the cost of goods sold, and thus cash flows and profit margins, depends in part on a company’s purchasing power over suppliers and gross profit margins,” Scrope continued.

He pointed out cosmetic companies such as Estée Lauder and L’Oréal have gross margins of 77% and 73% respectively, and luxury goods companies such as Louis Vuitton and Hermes have gross margins of 66% and 69%.

These compared with the 53% average for FMCG companies, and were higher than Unilever, which has a gross margin of 43%, and Nestlé (50%).

“The market, however, recognises this advantage and applies a higher valuation to the cosmetic and luxury goods companies, so an investor needs to balance exposure to inflation against valuation premium,” Scrope finished.