With high inflation remaining sticky in most of the developed world and looming interest rate hikes on the horizon, valuation multiples for stocks are coming down across the board.

The latest January consumer price index (CPI) figures for the UK came in at 5.4%, Eurozone at 5.1% and the US at an eye-watering 7.5%. Meanwhile, interest rates are still nailed to the floor in these regions.

However, there is one developed market that isn’t experiencing the same levels of inflation: Japan. The latest CPI figure in country showed a 0.2% increase year-on-year, a stark difference to the other developed-market regions.

Japan has struggled for decades with low inflation and negative interest rates, and the coronavirus pandemic has not seemed to change this.

If the major threats to equities are inflation and rising interest rates battering valuation multiples, then with low inflation, low interest rates and a low index-level price-to-earnings (P/E) multiple, Japan might be well positioned.

Kamal Warraich, investment analyst at Canaccord Genuity Wealth Management, said: “It’s worth noting that whilst Japan does look cheap at a headline level, this has been the case for decades.

“The reasons behind this are that Japan’s economy is no longer dynamic due to its ageing population, and many of the listed companies are considered to be facing some form of structural decline (primarily due to chronic underinvestment in R&D and cash hoarding).

“It’s a key reason why most active Japanese equity managers adopt a ‘growth’ approach, whereas the TOPIX is more ‘value’ oriented in style. On the other hand, it does mean that US levels of inflation are highly unlikely, and therefore we expect little change to the monetary policy outlook in the region.”

With this in mind, Trustnet asked several market experts to share their preferred exposure to the Japanese equity market.

SPARX Japan fund

Warraich selected the SPARX Japan fund, managed by Masakazu Takeda. He said the strategy has a concentrated and high-conviction approach, but with “deliberate diversification” at the sector level that provides a “well-balanced portfolio”.

Its top-10 positions make up more than half of its portfolio, with Sony Group being the largest at almost 8% of the fund.

Warraich added: “The team invests in quality companies, defined as businesses with durable competitive advantages and sustainable earnings growth, primarily targeting manufacturing excellence and technology or consumer related franchises.

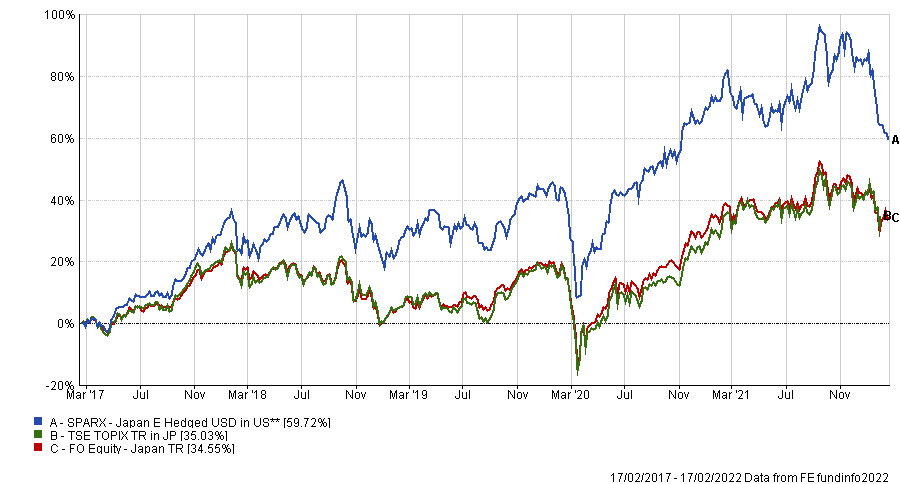

“The risk-adjusted returns have been very strong over the long term,” he noted. Indeed, the fund has made 59.7% over the past five years, compared to a 35% return from the TOPIX index.

Performance of the fund versus sector & benchmark over 5yrs

Source: FE Analytics

Baillie Gifford Japan Trust

FundCalibre managing director Darius McDermott, highlighted the Baillie Gifford Japan Trust, run by Matthew Brett. While Japan’s digital investment is still below that of other developed nations, McDermott pointed to the prime minister’s plans to address this by promoting Japan as a science and technology nation and creating a ‘Digital Garden City Nation’ – something that should benefit the growth style of the fund.

When it comes to the trust’s manager Brett, McDermott said he had “recently reiterated that Japan has some of the strongest protections for shareholders globally”.

“Its companies are increasingly technology focused and its management teams are more entrepreneurial than they have been in decades,” he added.

“Japan’s legendary manufacturing prowess also means roughly half of the major global robotics companies are listed there, so it’s ideally placed to benefit from many of the world’s long-term structural trends.”

The trust invests in high-growth, small and medium-sized companies, with a high conviction approach typically holding between 40 and 70 stocks.

McDermott said: ““The other thing I really like about Baillie Gifford is that it always treats its own shareholders well. For example, ongoing charges for this trust have fallen from 1.27% to 0.66% over the past decade, mainly due to fee reductions and the trust’s increasing scale, which means shareholders keep more of the return.”

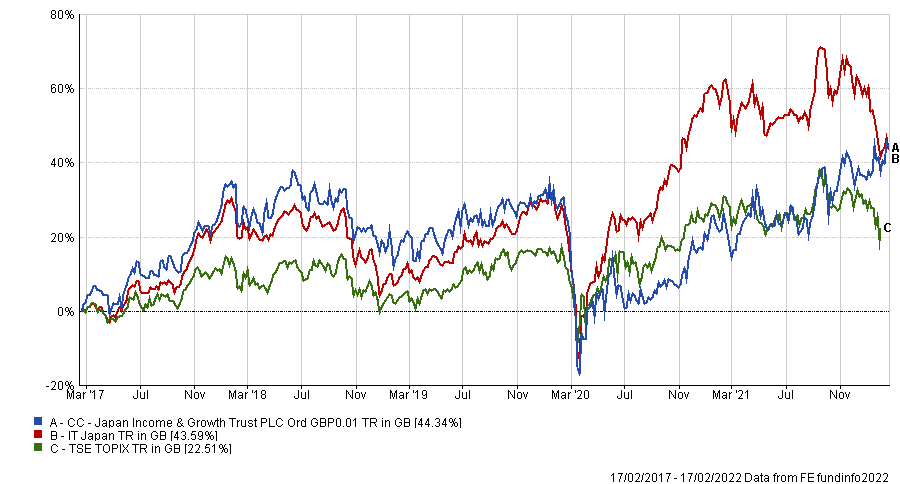

Performance of the trust versus sector & benchmark over 5yrs

Source: FE Analytics

Coupland Cardiff Japan Income & Growth trust

Ryan Hughes, head of investment research at AJ Bell, highlighted the Coupland Cardiff Japan Income & Growth trust, managed by Richard Aston, who previously led the Japan team at JP Morgan before he joined Coupland Cardiff a decade ago

Hughes said: “Japan has continued to be a shining example of how to manage company balance sheets in recent years with many sat on huge amounts of cash without the millstone of enormous debts.

“This is translating into strong dividend growth for investors in the country at a time when income feels like a scarce commodity.”

The trust is yielding 3% and Hughes noted that it managed to “impressively” grow this during the pandemic as the strength of Japanese companies came through.

He said: “The trust does use long-term gearing and therefore will be a little more volatile than peers, but for those wanting a potentially growing income stream and diversification away from the traditional income companies, this trust looks interesting.”

Performance of the trust versus sector & benchmark over 5yrs

Source: FE Analytics

Jupiter Japan Income fund

Ajay Vaid, investment research analyst at Square Mile Investment Consulting and Research, picked the Jupiter Japan Income fund.

He said: “In our view, the fund's managers, Dan Carter and Mitesh Patel, are accomplished and dynamic stock pickers who work collegiately to identify firms that are financially stable, with high-quality and committed management teams and net cash on their balance sheet.

“The managers primarily focus on companies they believe will sustainably grow their earnings and cash flows to enable them to pay rising dividends.

“However, the portfolio also provides some balance, as it has exposure to lower yielding, faster growing companies, that they believe will likely pay a dividend in the future.”

The fund is mostly invested in large and medium-sized companies, although the fund may also invest in less liquid, smaller-cap holdings.

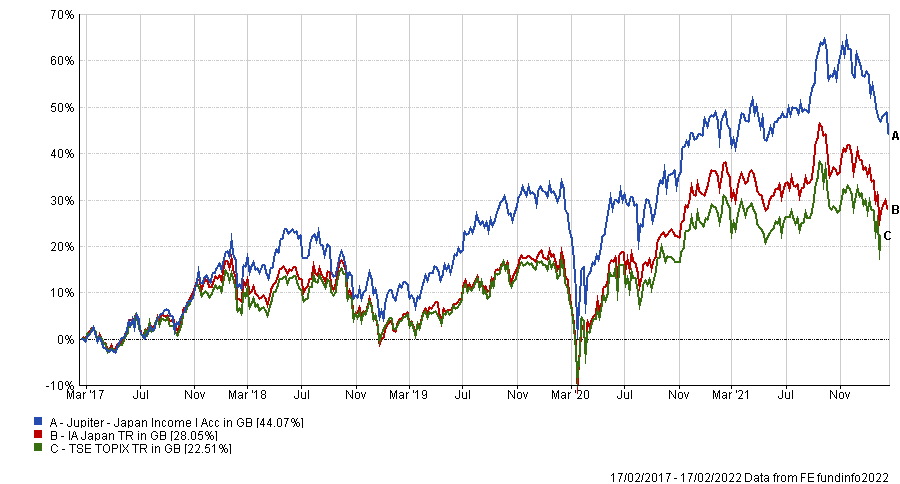

Performance of the fund versus sector & benchmark over 5yrs

Source: FE Analytics

But Vaid warned that it may experience periods of variable relative performance to the wider TOPIX index when investment styles such as value or growth are in favour.

“That being said, the managers' emphasis on steadfast businesses ought to work well during falling markets, although ultimately this is dictated by what is driving the Japanese market at the time,” he explained.

| Name | Sector | Fund Size(£m) | Fund Manager | Yield (%) | OCF (%) | Launch Date |

| The Baillie Gifford Japan Trust | IT Japan | 957 | Matthew Brett, Praveen Kumar | 0.7 | 0.66 | 15/12/1981 |

| CC Japan Income & Growth Trust | IT Japan | 219.9 | Richard Aston | 3 | 1.05 | 15/12/2015 |

| Jupiter Japan Income | IA Japan | 927.6 | Dan Carter, Mitesh Patel | 2 | 0.98 | 17/09/2012 |

| SPARX Japan | FO Equity - Japan | 1,167 | Masakazu Takeda | 1.07 | 21/08/2014 |