Russia’s invasion of Ukraine and the prospect of open war in Eastern Europe has shaken equity markets in February, with just under 10% of funds and only six sectors making a positive return for the month.

Tensions between Russia and the Ukraine had been building for several weeks and many countries imposed sanctions on Russia in a bid to dissuade it from invading. However, these proved futile as Russian president Vladimir Putin announced a “special military operation" against Ukraine last week.

Since then, fighting on the ground has escalated while economic sanctions imposed on Russia by other countries have ramped up.

Many leaders have condemned Putin’s attack, calling it “unprovoked” and “unjustified” and took measures to target Russia’s banking system in a bid to disrupt funding for the attack. These have included cutting Russian banks off from Visa and Mastercard as well as Apple Pay and Google Pay.

There has also been an attempt by the US, Britain, the EU and Canada to block Russia’s access to the Swift international banking payment system.

Issues were compounded this week as the Russian central bank banned investors from selling local securities in an effort to prevent a stock market collapse, forcing some funds to gate in an effort to avoid withdrawals.

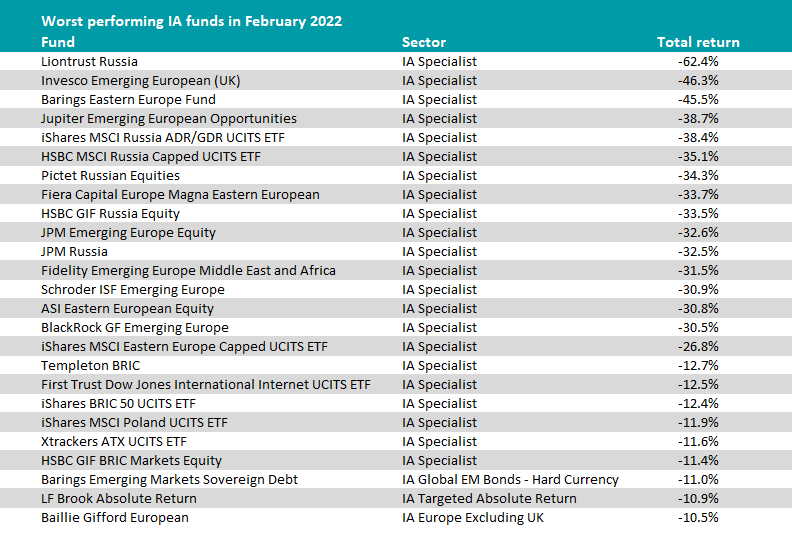

As a result, funds solely invested in Russia, or those with large allocations, crashed to the bottom of February’s performance table.

Source: FE Analytics

Liontrust Russia suffered the month’s biggest losses, down 62.4%. Its investors’ woes were worsened by Liontrust announcing it had suspended all dealings on the fund yesterday, meaning that investors will be unable to make redemptions on the portfolio.

Liontrust said that, given the sanctions, it believed “this is in the best interests of all investors”. Several other Russia-heavy funds including JPM Emerging Europe Equity and Russia Equity funds were also suspended for similar reasons.

Other dedicated Russia funds posting steep losses included Pictet Russian Equities and the iShares MSCI Russia ADR/GDR UCITS ETF. Emerging market funds with a higher exposure to Russia were also impacted, including Barings Eastern Europe and JPM Emerging Europe Equity, which had at least 70% invested in the region.

Invesco Emerging European (UK) was the second worst performer overall, losing 46.3%. However it was already in the process of being wound up before the crisis started.

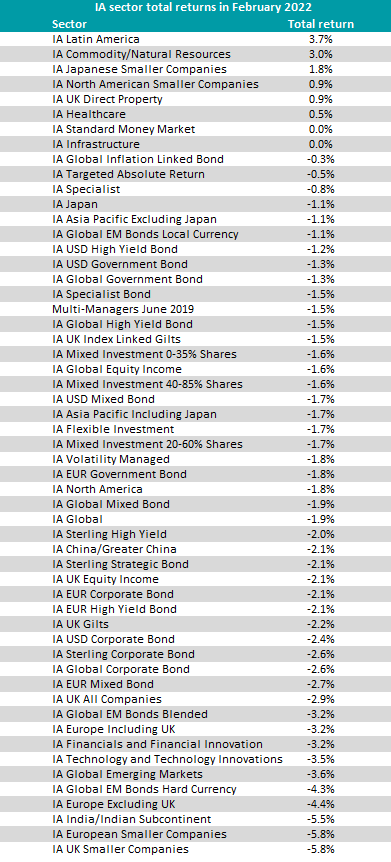

It was not just Russian funds that took a hit in February. All major European sectors were down at the end of the month due to their physical proximity to the crisis, with the IA European Smaller Companies sector making the second largest losses among Investment Association (IA) sectors, down 5.8%.

Source: FE Analytics

The IA UK Smaller Companies sector was also down 5.8%, although Ben Yearsley, co-founder of Fairview Investing, said had there been a separate Emerging European or Russian sector, their falls would have far outstripped the declines of UK small-cap funds.

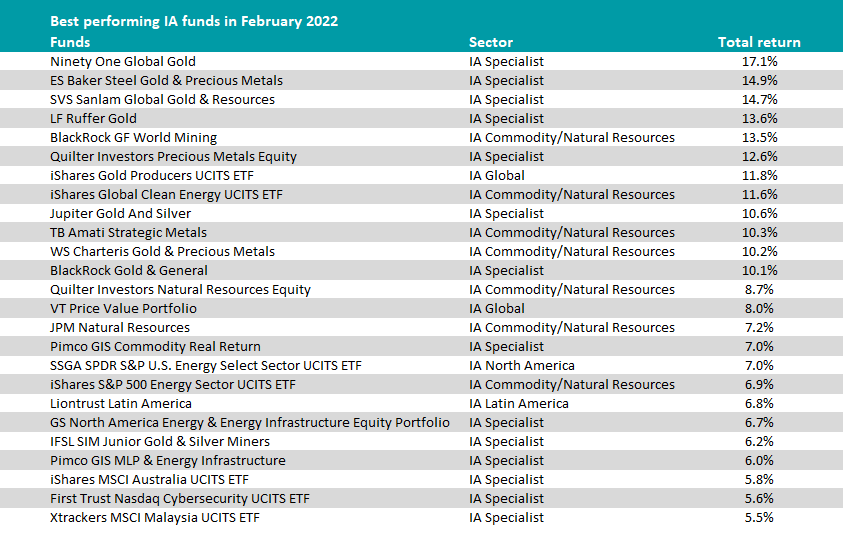

Few assets held up well in February but two that did were oil and gold, with both rallying following the invasion. Immediately after the news broke, gold and oil spot prices spiked, with Brent crude going above $100 (£74.30) while gold rallied to its highest level since 2020, hitting $1,950 (£1,453).

Gold has historically been a ‘go-to’ asset for investors during periods of heightened volatility, providing some defensiveness against equity markets.

Source: FE Analytics

As such, the top of the table was full of oil and precious metal funds, including Ninety One Global Gold, which made the best returns of the month (17.1%).

Others at the top included ES Baker Steel Gold & Precious Metals, LF Ruffer Gold, BlackRock GF World Mining and the iShares S&P 500 Energy Sector UCITS ETF.

Meanwhile, the rising oil price was behind the success of the IA Latin America sector, which was the best performer for the month (3.7%). The sector is driven by the performance of Brazilian equities, which are intrinsically linked to the oil price.

IA Commodity/Natural Resources, which includes portfolios centred around oil, gold and other metals, made the second highest returns (3%).

Oil and energy prices are inherently linked to Russia as it is one of the biggest suppliers globally. Even before political tensions began, the price of these assets had already been pushed up by inflation, although the Ukrainian crisis has overtaken this as the number one investor concern, Yearsley said.

“As one door opens (Covid restrictions being abolished in the UK and elsewhere), another closes (Russia invading Ukraine). It is clearly difficult thinking of investment when war is raging, and life is being lost,” he noted.

Yearsley added that if a resolution to the crisis was not found quickly, it would have a long-term impact on gold and oil prices.

“The rest of the world (particularly Europe) depends on Russia for many commodities but particularly energy (it is the second largest producer of oil & natural gas and accounts for 30% of oil and 40% of gas imports to Europe),” he said.

“But it is also a major player in fertiliser, and wheat (30% from Russia & Ukraine) which could push up food prices and prolong inflationary pressures”.

Away from commodities, Cybersecurity ETFs First Trust Nasdaq Cybersecurity UCITS ETF and L&G Cyber Security UCITS ETF also performed well after cyber warfare increased globally on the back of the invasion.