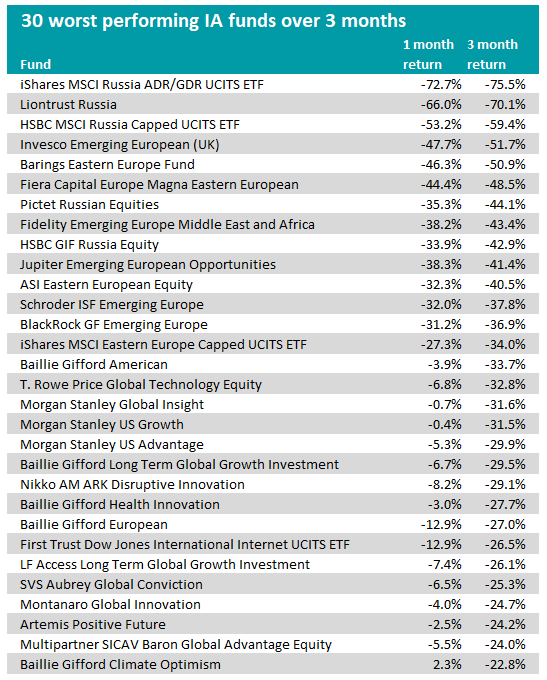

Some 18 funds in the Investment Association (IA) universe have lost more than 30% in just three months of trading, according to the latest Trustnet study as investors have had to deal with a number of issues.

Russia funds – and those invested more broadly in eastern Europe – have lost the most as the invasion of Ukraine and subsequent economic sanctions have caused share price collapses over the past month.

However, US and global growth funds that have yet to recover from higher inflation and interest rate expectations also remain down.

Indeed, strategies run by growth-leaning fund giants Baillie Gifford, Morgan Stanley and T. Rowe Price have suffered more than 30% declines in value over the past three months.

These funds have been hit hard by the market rotation away from highly valued technology stocks as investors braced for higher inflation and interest rates.

Below are the 30-worst performing funds of the past three months. The one-month performance is also shown to easily differentiate between those affected by the Russia-Ukraine conflict and those hurt by the rotation out of high-growth.

Source: FE Analytics

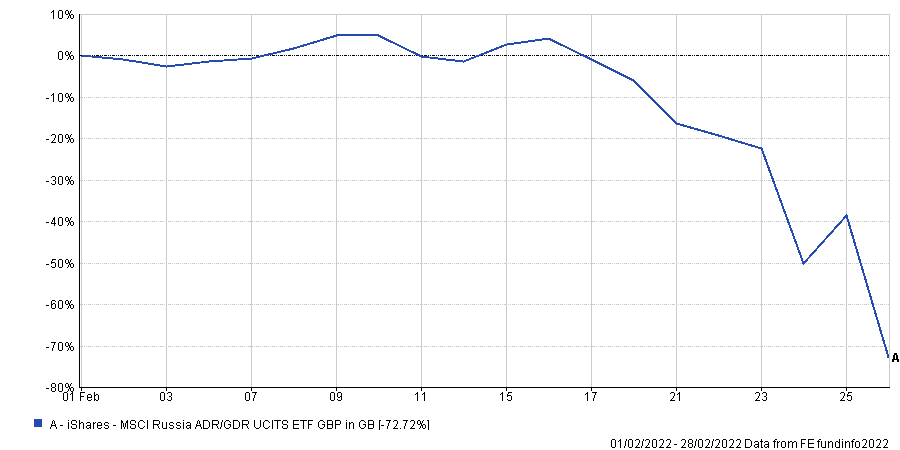

Funds exposed to Russian assets have been hit much harder and much quicker than those exposed to highly valued technology stocks.

After Russia banned the sale of its local securities by foreigners, investment firms such as JP Morgan and Liontrust were quick to suspend redemptions from their funds in response.

As the Ukraine-Russia conflict drags on, experts have warned that more open-ended funds will eventually have to freeze redemptions or gate funds if enough investors choose to cash-in.

Although Russia’s central bank has kept the Moscow stock exchange closed for the past three days, investors can still buy and sell American Depositary Receipts (ADR’s) for Russian equities.

This is why certain exchange-traded-funds (ETFs) such as BlackRock’s iShares MSCI Russia ADR are still trading and continue to fall in value.

However, there are some actively managed Russian-focused funds in the list above that have already been frozen, such as Liontrust Russia and Pictet Russian Equities.

Performance of iShares MSCI Russia ADR over one month

Source: FE Analytics

Aside from the Russian-exposed funds, strategies with high-conviction positions in high-growth technology stocks have suffered from large declines in recent months.

The Baillie Gifford American fund stands out as one popular strategy that has lost a third of its value over the past three months.

Run by Scottish Mortgage’s Tom Slater, alongside Gary Robinson Kirsty Gibson and Dave Bujnowski, its top-10 weightings to Shopify, Netflix and Moderna have dragged its performance down in recent months.

In particular, its position in e-commerce technology firm Shopify, which was the fund’s largest holding at the end of 2021, has suffered from a roughly 50% decline.

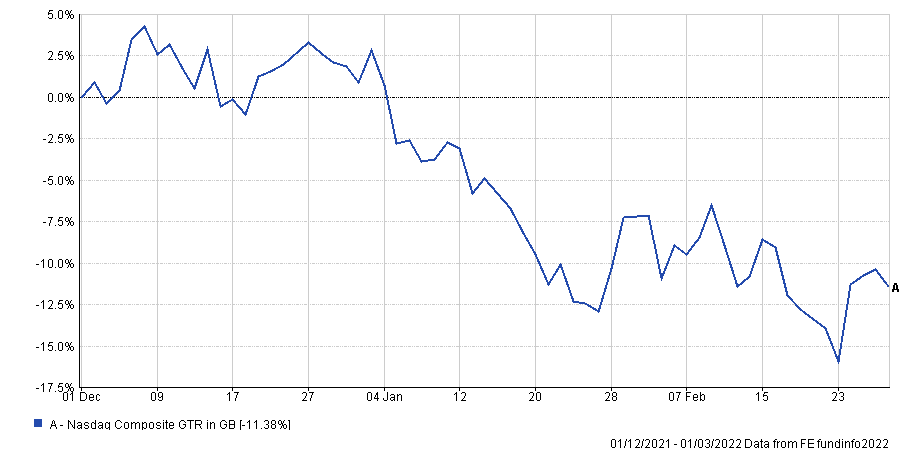

Shopify has been affected by the broader sell-off in technology stocks which has rattled the broader Nasdaq composite index over the past three months.

Performance of Nasdaq composite over three months

Source: FE Analytics

Shopify was hit by another blow when it fell by roughly 20% in one day after it guided for lower revenue growth in 2022 in its latest earnings report.

For similar reasons, the T. Rowe Price Global Technology Equity fund – which also has a top-10 position in Shopify – is down more than 30% in the past three months.

Manager Alan Tu has not had his other high-conviction stocks spared by the broader sell-off in technology stocks. His largest position in American-Australian software company Atlassian, despite delivering strong earnings and beating expectations, is down roughly 30% from its highs.

Software company Hubspot –another top-10 position for the fund – has also failed to buck the broader technology sell-off despite it beating its earnings expectations in early February.

Elsewhere in the table, strategies run by Morgan Stanley’s Dennis Lynch and his team are all down roughly 30%. These include the Morgan Stanley Global Insight fund, US Advantage and US Growth.

The US Growth fund, for example, has been hard-hit by its high-conviction positions in cloud and security software companies which have borne the brunt of the recent rout in technology stocks.

Cloud-computing data warehousing firm Snowflake and website security firm Cloudflare make up the largest two positions and are down 36% and 48% respectively from their highs just a few months ago.

The Nikko MA Ark Disruptive Innovation fund – often seen as the poster child for speculative high-growth technology stocks also features as a hard-hit fund, down 29% over the past three months.

However, the strategy is down roughly 50% over the past year because its holdings, many of which are not yet profitable or are early-stage biotechnology firms, have been under considerable pressure since February 2021.

Its manager Cathie Wood gained notoriety for being a successful early backer of electric manufacturer Tesla, but she has not yet been able to repeat the same success with some of its more recent stock picks.

The most recent example was its investment and subsequent sale of big data analytics software firm Palantir, which had fallen by roughly 50% before Ark eventually sold out of its position.