Investors have flocked to add commodity funds to their portfolios over the past few months as inflationary pressures, exacerbated by the war in Ukraine, drive up prices.

Around $6.5bn (£5bn) flowed into commodity exchange traded products (ETPs) in February as investors began vacating European equities, according to data from Blackrock.

Although the sector has been relatively unloved over the past decade, with its most recent sizable spike in interest during the 2008 financial crisis, sentiment has increased significantly this year.

Since the start of the year, the IA Commodity/Natural Resources sector is up 19% as the IA Global declined 6.9%.

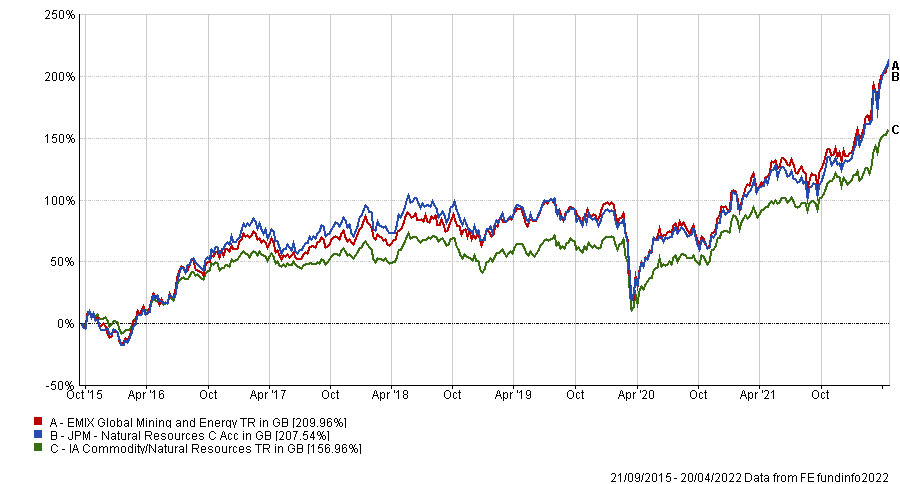

Total return of sectors over the past 10 years

Source: FE Analytics

Lisa Thompson, equity portfolio manager at Capital Group, said that these elevated prices are likely to remain high as the Ukraine invasion and global supply chain issues continue to drive up inflation.

This gives a positive outlook for commodity valuations, but with 34 funds and trusts to choose from in the IA and IT Commodity/Natural Resources sectors, investors have a gluttony of choice.

Here, Trustnet looks at industry experts’ favourite picks for investors looking to increase commodity exposure in their portfolios.

Amati Strategic Metals

The Amati Strategic Metals fund was launched just over a year ago, but Rob Morgan, chief analyst at Charles Stanley, said the experienced management team means the young portfolio is in good hands, with co-manager Georges Lequime running commodity funds since 2008.

Morgan added that the fund’s flexibility also makes it an appealing option, giving the managers the freedom to switch between industrial and precious metals as the markets moves.

He said: “It’s a rather new fund, but Amati Strategic Metals has a philosophy of targeting areas where the demand-supply balance is particularly favourable, and at the same time prioritising companies operating in stable jurisdictions where political risk is likely to be lower.”

Since launch, the £50.5m fund has increased 36.8%, narrowly underperforming the benchmark by 0.6 percentage points.

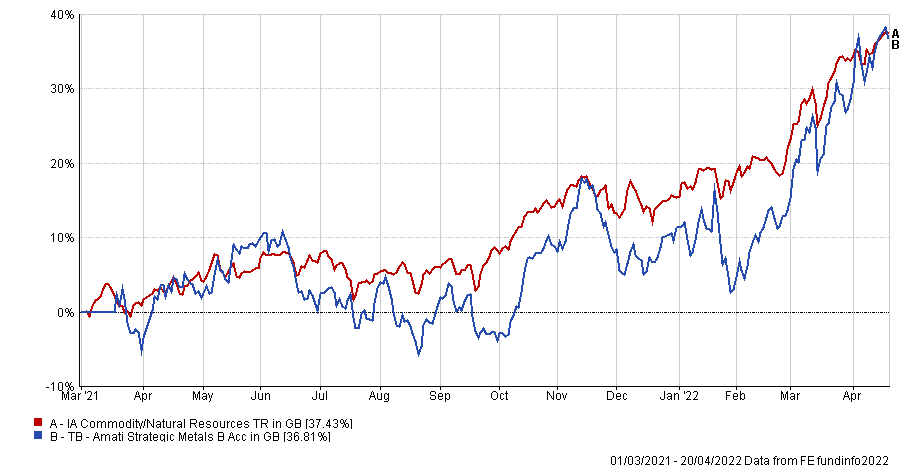

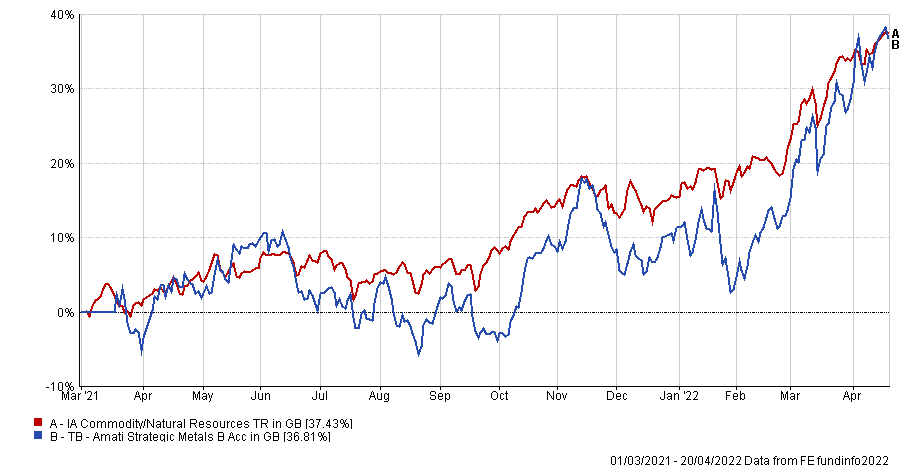

Total return of fund vs sector since launch

Source: FE Analytics

Darius McDermott, managing director of Chelsea Financial Services, said that the fund is likely to perform well for some time as the transition to clean energy drives up the value of nickel, copper and lithium.

In fact, the price of nickel (a crucial component in manufacturing electric vehicles) doubled in early March as investors divested from Russa, which currently provides about 20% of the world’s supply.

McDermott said: “Commodities and resource stocks are likely to continue to do well if inflation stays high. With inflation at 7% or 8%, cash is devaluing quickly and real assets like commodities are becoming more valuable as a result.”

He added that one of most appealing aspects of the portfolio is its 37.9% exposure to gold, which can be defensive against rising inflation and interest rates.

JPM Natural Resources

The JPM Natural Resources fund runs £1bn in assets under management (AUM) and has increased 207.5% over the past 10 years.

Chris Metcalfe, chief investment officer at IBOSS, first invested in the fund more than a decade ago and increased allocations in December 2020 when he sought more exposure to commodities, especially energy.

He said that the industry knowledge exemplified by Christopher Korpan, who has run the fund since 2017, was a significant factor in his decision to choose the portfolio.

Metcalfe added: “In our meeting with the team, we felt that both he and co-manager Veronika Lysogorskaya understood the environmental aspirations we all have for the future but also appreciated the commodity requirement of the here and now.”

Total return of fund over the past 10 years

Source: FE Analytics

Wisdom Tree Broad Commodities

Andy Merricks, fund manager at 8AM Global, said that the Wisdom Tree Broad Commodities fund offers “a broad brush exposure to commodities” to investors looking to get their foot in the door of the sector.

Its diversified range of allocations means it is a less risky option for those looking to gain some commodity exposure, according to Merricks, who added “it has captured the rise in most of the different commodity sectors without being over-exposed to one over another”.

“This should ensure that you don’t get too badly burned if one type of commodity suddenly heads south,” he said.

The fund has increased 59.5% over the past year as limited supply and high demand ramped up prices, accumulating an AUM of $202m.

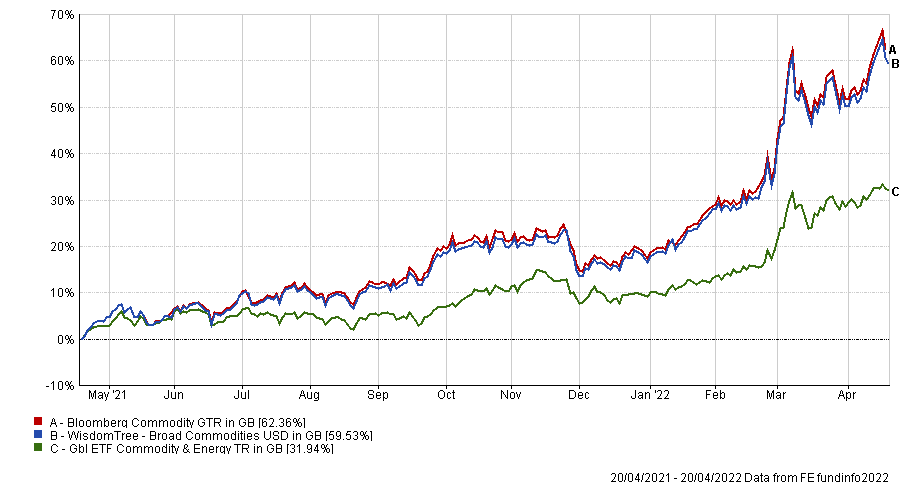

Total return of fund over the past year

Source: FE Analytics

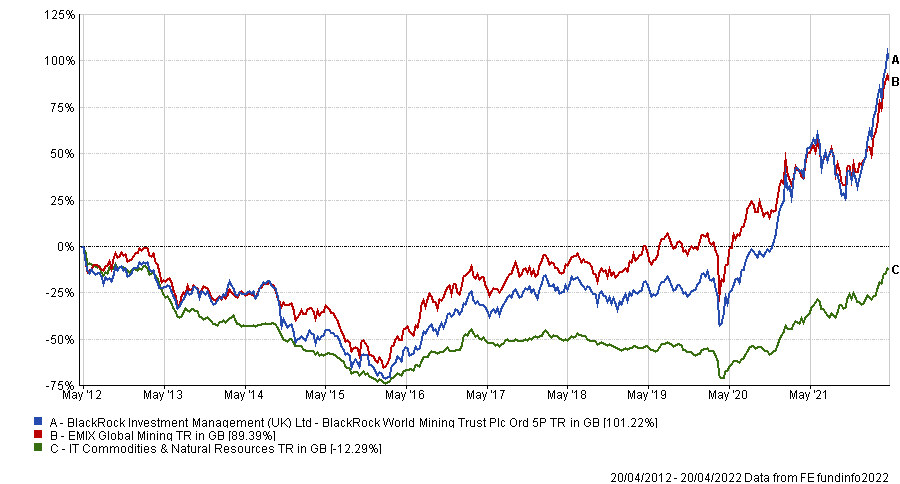

Blackrock World Mining Trust

Like many in the sector, the Blackrock World Mining trust made modest returns over the past decade but exploded in popularity when Covid bought about a period of economic uncertainty.

It is the top of the IT Commodities/Natural Resources sector over the past 10 years, making a total return of 101.2% and beating its peer group by 113.5 percentage points.

Total return of trust over the past 10 years

Source: FE Analytics

Shavar Halberstadt, equity research analyst at Winterflood Securities, said that its diversified holdings and high dividend pay-outs make it an attractive option for investors.

Likewise, the trust’s £1.4bn AUM makes it the largest in its sector and gives it good secondary market liquidity.

Halberstadt added: “The portfolio contains an allocation to two unlisted equities and two royalty investments (representing 6% of the portfolio as of 31 December), which we view as an interesting differentiator from its peers, making good use of the closed-ended fund structure.”