Investment trusts’ ability to outperform open-ended peers is well documented and is one of the core reasons why FE fundinfo Alpha Manager Peter Walls invests in them exclusively.

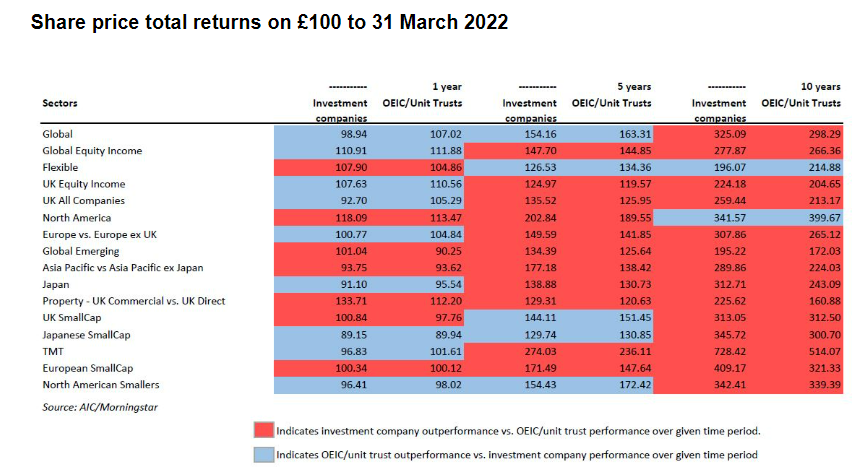

Data from the Association of Investment Companies (AIC) revealed that across 16 sectors investment trusts made better returns than funds over 10 years, the only exceptions being the Flexible and North America sectors.

The AIC said that this trend was mainly down to the structure of investment trusts, such as gearing, the ability to invest in illiquid assets and more exposure to smaller companies.

Wall himself highlighted all these benefits, but for him the choice between investment trusts and funds was much simpler.

“I just love these things, but maybe sometimes I bore people with my enthusiasm for it. But I do think they are probably the best form of collective investment for most people,” he said.

Despite his fondness for the closed-ended structure, Walls said he would not run his own, saying he “is not clever enough for that. I couldn't choose between Alphabet or Facebook or Twitter to Netflix or Marks and Spencer’s”.

Instead, he leaves those choices to the hoard of investment trust managers within the Unicorn Mastertrust.

The fund-of-trust holds 52 investment companies, which Walls said allow him to access parts of the market that would be out of his reach in the open-ended universe.

“If you want to differentiate from the crowd, you've got to do things differently, as John Templeton said.”

Long-term this process has served the Alpha Manager well, generating 512.7% since it launched in 2001. The average IA Flexible Investment fund made 200.5% over the same time frame.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Below Walls explains why this could be the toughest time to be a fund manager ever and why investors overstate the importance of fund charges.

What is the fund’s process?

We’re aiming to produce long-term capital growth by investing in closed-ended, UK-listed investment trusts. We particularly like investment trusts that take advantage of the unique structural features to invest in assets that have historically proven to generate superior returns compared to mainstream equity market indices. This leads us to have a structural bias towards specialist trusts, often investing in relatively illiquid assets, as well as an overweight position in smaller companies. We also hold private equity trusts.

We like discounts and look for opportunities where a trust has been out of favour, but where we think we can identify catalysts for an improvement, making us quite contrarian.

Why should investors pick your fund?

Mastertrust is a one stop shop for investors who recognise the advantages and attractions of investment trusts but are perhaps deterred by factors such as drawdown volatility or illiquidity. And because of how we invest we provide a lot of diversification.

What have been the best and worst performers in the past year?

The top performer has been the Blackrock World Mining trust, which is our biggest holding now. It’s up 31.7%.

We added it to the portfolio in 2019 when it had just gone through a really sticky patch having lost around $65m in a mining deal gone wrong, which forced it to cut its dividend. Everything was going against it then.

It’s obviously doing well at the moment with this commodities super cycle, but like most things the music will stop and cycles turn. I'm not calling it at the moment, but it will eventually lag.

The biggest bomber is the Biotech Growth trust, which is down 30% in the past 12 months.

I do kick myself with Biotech because it was a classic case of biotechnology being overbought and overhyped throughout the pandemic. There were a few M&A deals which really inflated valuations and we started taking profits.

But then the price went against us. Rather than cutting and having the courage of our convictions at ever falling prices we didn't complete our sale and we're paying the price for that now.

The performance has ranked third quartile over 12 months, why?

Normally I would say, why bother looking at the one year numbers, but I think 2022’s first quarter has been a tough one and for us I’m 70% in overseas in a year where the UK market was pretty strong, plus we’re also a growth fund.

Would you ever buy a trust on a premium?

It is rare. Obviously, if you buy a new issue you’re effectively paying a premium. But we rarely do that. I’d prefer to wait and be patient or find something else to do with the money.

What areas do you avoid?

We tend to avoid single country trusts but I think in future we might make exceptions for China and India. They’re such big markets and we think that they will be bigger markets in the future. So they might be an exception but right now we really don't believe that we would have the expertise to be able to say if one or the other was over or undervalued at any given time, so we haven’t taken the plunge yet.

Until now, we have preferred to leave those sorts of decisions to the managers of global emerging markets trust.

There are a lot of social and macroeconomic events going on at the moment, is this the hardest time ever to be a fund manager?

I can understand that sentiment, because not only have you got geopolitical things going on, but you’ve got a lot of investment style questions being asked. The rotation from growth into value has thrown up some pretty profound differences in performance. We know that Baillie Gifford and the other stars of recent years have been struggling since October last year.

We’re also dealing with the disruption caused by digitalisation, which has been profound in the past decade.

There’s the increased competition in terms of traditional fund management from exchange-traded funds (ETFs) – people are increasingly having to try to differentiate themselves from the passives as well as their peers, which is pushing people to get more involved in private companies.

And you have environmental, social and governance factors coming in as well.

Generally, there is always a lot going on but we’ve had the pandemic and we’ve had and a war in Europe so I would say that there are plenty of challenges out there.

What do you find most frustrating in your job?

The conversations around fees, especially when it’s about fund-of-funds.

People want to criticise this type of fund. They say, ‘well, you're paying two sets of charges. You're paying management fees to Unicorn and then the fees for other investment trusts’.

My answer to that would be, look at the returns, which are net of those costs versus our peers and the markets, and then see which one you want to choose.

I don't believe that having a very low management fee is necessarily a guarantee for good performance. You can find lots of funds with very relatively low management fees that perform poorly and vice-versa. One is not an indicator of the other.

What do you do outside of fund management?

I’m a keen walker, my wife and I recently did the final leg of the Santiago de Compostela walk. I ’m a season ticket holder at Chelsea, although that’s felt hard at the moment.

I’m a cryptic crossword nut. I’m not into Wordle though because I don’t think that you learn anything from it.