Troy Asset Management’s global equity income portfolios are popular with investors saving for retirement due to their low-risk philosophy to the stock market, according to James Harries, but they have been increasing allocations to more cyclical sectors and taking on more risk in recent months.

Harries, who manages the Securities Trust of Scotland, Trojan Global Income and Trojan Ethical Global Income funds, which together have assets under management (AUM) of almost £1bn, has tried to generate consistent income for investors whilst keeping volatility to a minimum.

He said: “When you're young, volatility is your friend but that isn’t so much the case when you're a bit older – you don’t have enough time to repeat the steep losses if you do suffer greater volatility.

“So if we can produce a reliable income from investing on a global basis and do it in a way that doesn't scare people too much, then we think that's an excellent place for people to be allocating capital today.”

However, the transition from growth towards value that has shaken up markets means riskier sectors have become more attractive to Harries, who’s cautious approach would previously have led him to avoid them.

He said: “Rather than being concerned about what we have, we’re getting excited about what we don’t yet have which is coming down a lot. You could see some big changes in the portfolio over the coming weeks and months if things continue as they are.”

One area that has caught Harries interest is consumer discretionary, with high inflation dragging down valuations in the sector significantly.

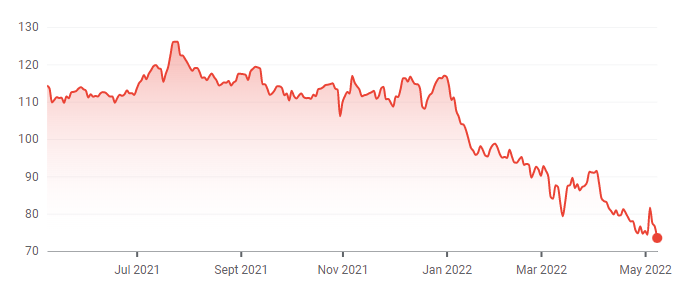

Starbucks is a company he currently has his eye on as its share price dropped 35.7% over the past year.

Share price of Starbucks over the past year

Source: Google Finance

Although it is selling at a lower price, Harries said that the company still has high return on capital and plenty of room for growth everywhere except China.

He has held off buying shares in the company for now as he anticipates a “significant risk” of a recession within the next 12-18 months that could damage performance.

Harries added: “Starbucks is a lovely business – I think we’ll have the opportunity to buy a business like that in the coming weeks or months at a really attractive valuation.”

Likewise, the cyclical nature of industrials businesses previously did not suit the trust’s low-risk threshold, but different market conditions have made some of them an attractive purchase.

One of the main issues with industrials is that they’re very capital intensive, according to Harries, so he has sought out stocks that display innovation and provide support for other companies.

He said: “We’ve got a group of really lovely industrials businesses that are integrated into other companies’ work flows. They provide a particular service to that company and therefore they have pricing power, which is absolutely mission critical.”

One of these businesses is Fastenal, a provider of industrial supplies that has differentiated itself from many of its peers by selling directly to consumers.

Co-manager, Tomasz Boniek, said: “I know it doesn’t sound too exciting but I promise you it’s one of the best businesses I’ve seen. It’s a great business because they’ve transformed from being a traditional distributer to opening branches at customer premises and they’re really good at it.”

By cutting out the middleman it has become a more efficient way of sourcing supplies and at a cheaper price for customers.

It currently accounts for 3% of assets for the Securities Trust of Scotland, with Harries stating: “We’d like to own more of Fastener but we’re trying to be careful about allocation.”

Industrials as a whole make up 6% of the portfolio, but Harries said that this is likely to rise due to their companies’ track record for performing well in cyclical downturns.

Another company on their radar is Rockwell Automation, which provides technology for the industrials sector.

Boniek said that while it is difficult to speculate the future performance of many companies, the demand for automation will be a strong driver of growth for many years to come.

He added: “Rockwell is a key player in a long trend and our job as income managers is to invest in business that are not being disrupted. In my opinion, high-quality industrial businesses have some of the best staying power in the world.

“We can speculate whether big tech businesses will exist in the same shape and form in 10 years, but these industrial businesses are incredibly hard to disrupt.”

Share price of Fastenal and Rockwell over the past year

Source: Google Finance

The other sector that has become more attractive in this rotation is non-bank financials, with the managers increasing allocations to wealth managers, asset managers and private equity operators.

Harries said that the drop in share prices may appear bad on first impression, but “indices overall have not come down a great deal”, creating an ideal environment for financials.

He added: “These are excellent businesses but they tend to be geared into the overall activity and valuations of markets themselves so we wanted to buy into them when the market is better value.”