Dividends are an important source of income, especially for those in retirement, but funds paying a high yield while also making strong capital gains can be difficult to come across.

A high yield is sometimes viewed as risky by the market, as it can mean lower pay-outs in periods of underperformance.

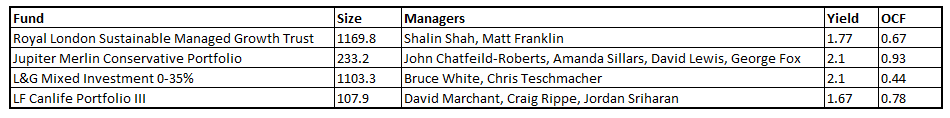

Here, Trustnet looks at IA Mixed Investment 0%-35% Shares funds with the perfect pairing of above-average dividends and top-quartile returns over the past five years. After looking at around 70 funds in the sector, just four ticked the boxes for both criteria.

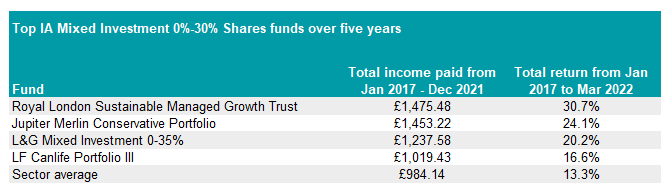

The table below shows these four funds, along with how much investors were paid from an initial £10,000 investment from the start of 2017 to end of March 2022 and the total return since the start of 2017.

Source: FE Analytics

The Royal London Sustainable Managed Growth trust paid the most in dividends over the period, with pay-outs almost 50% higher than the sector average.

It also had the highest return of any other fund in its peer group over the past five years, gaining 30.7% and powering 17.4 percentage points ahead of the sector.

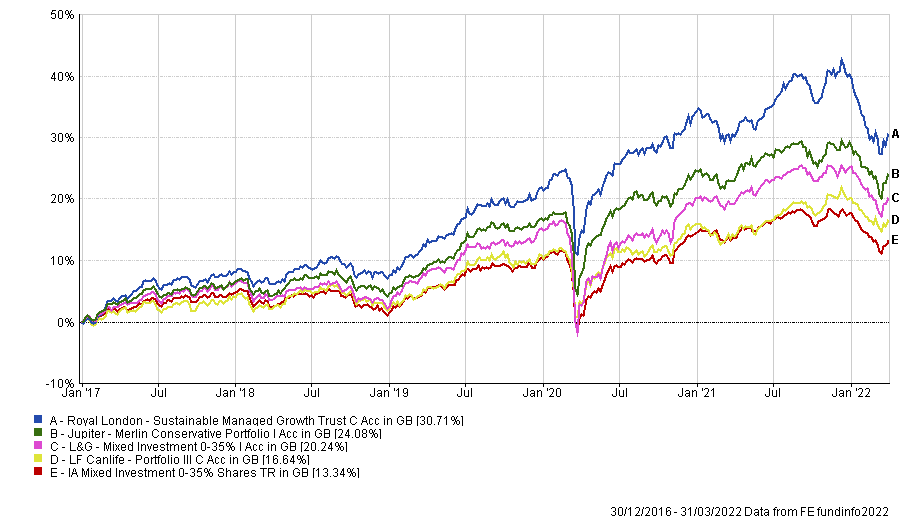

However, it has suffered the biggest decline out of any other fund in the list over the past 12 months as the market has struggled with higher inflation and rising interest rates.

It has sunk to the bottom quartile over the past year as it has lost 12% from the start of 2022.

Total return of funds over the five-year period

Source: FE Analytics

Following was the Jupiter Merlin Conservative Portfolio, which paid investors 47.7% more than average over the five-year period.

The multi-manager fund returned 24.1% over the period and although it suffered a 5.5% loss over the past year, put it in the sector’s third quartile.

Among its concentrated portfolio of 17 holdings are Wisdom Tree Core Physical Gold and Blackrock Natural Resources Growth and Income, which make up 6.5% of the portfolio, could help the fund if commodities continue to surge.

L&G Mixed Investment 0-35% also had the perfect pairing of top-quartile returns and high pay-outs, with dividends 25.8% higher than the sector average.

Returns were up 20.2% over the period, with a large portion of the portfolio made up of credit and emerging market debt assets at 45.9%.

In the past 12 months, it has lost 4.9% and moved into the IA Mixed Investment 0%-35% Shares sector’s third quartile.

Lastly, the LF Canlife Portfolio III fund has been a top-quartile performer over three and five years whilst paying dividends that were 3.6% higher than average compared to its peers.

The £108m portfolio is the smallest on the list, with the Royal London and L&G funds each holding over £1bn in assets under management (AUM).

With a loss of just 1.4% over the past year, it is the only fund to retain its spot in the top quartile in the past 12 months.

Total return of funds over the past year

Source: FE Analytics