Now is the perfect time to buy bonds if you haven’t already, according to Myles Bradshaw, head of global aggregate fixed income strategies at JP Morgan.

Bonds are typically seen as ‘safe haven’ assets that investors can fall back on when equities are underperforming, with the contracted element of the returns offering more security than unpredictable markets.

Yields on bonds often travel in the opposite direction to equities for this reason, with demand for fixed income funds usually increasing during difficult times in the cycle.

This has not been the case in recent months, with the value of both bonds and equities declining together.

Fixed income funds had £18m in outflows in April which, although negative, was not as bad as the £435m worth of withdrawals from equity funds over the same period.

However, investors have pulled out more than £6bn from portfolios trading bonds and gilts since the start of the year, while they have removed £2.4bn from equity funds.

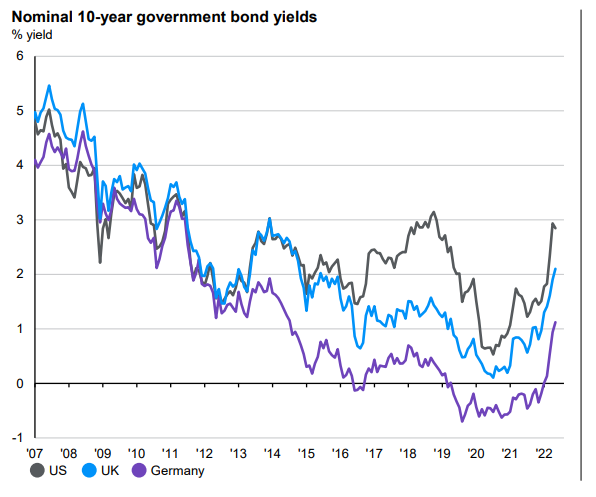

Yet Bradshaw pointed out that yield are showing some signs of improvement. Yields on nominal 10-year government bonds have risen sharply this year as they climb back from the lows of 2020, creating an attractive buying point.

Source: Bloomberg, J.P. Morgan Asset Management.

He said: “Investors now need to start thinking about increasing allocations to fixed income.”

Bradshaw added that the higher interest rates implemented by central banks in order to subdue soaring inflation may have a positive impact on bond yields.

The Bank of England (BoE) has already hiked rates to 1% as UK inflation reached 9% in April, and many commentators are anticipating tighter monetary policy as the cost of living continues to rise.

This kind of environment could not only be good for bond yields, but the regular coupons they provide could be an attractive source of extra income as inflation bites into investors’ pockets.

Bradshaw said: “I think people who don’t have bonds in their portfolio will start buying bonds because valuations are more attractive. It makes sense because it’s a good form of income at this stage.”

John Bilton, head of global multi-asset strategy at JP Morgan, agreed that inflation is at the forefront of investors’ minds at the moment, but it is showing some signs of slowing.

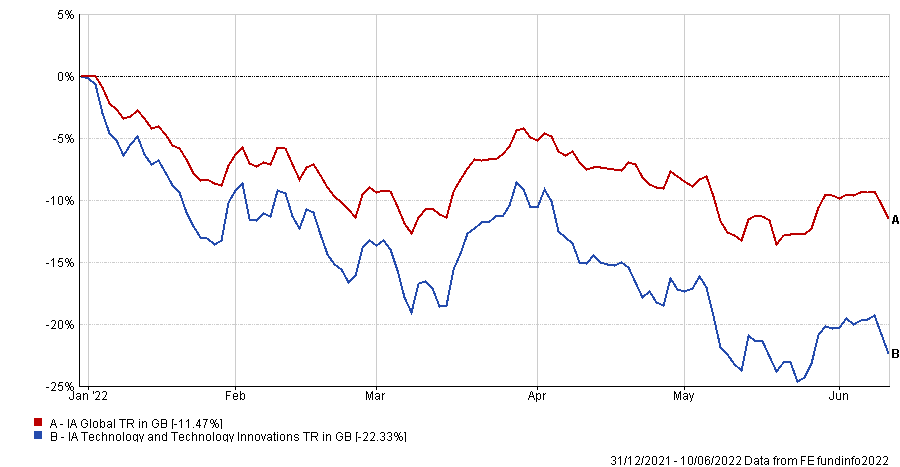

However, the big question is what effect this will have on growth assets over the long term. Already this year markets have flipped in favour of value investing, with growth-heavy sectors such as IA Technology and Technology Innovations declining 22.3% since the start of the year.

Total return of sectors since the start of the year

Source: FE Analytics

Bilton said: “If you start to worry about growth, then bonds at the yield level they’re at now become a much better diversifier.”

Malcolm Smith, head of international equities at JP Morgan, agreed that fixed income assets will play a crucial role in this cycle, stating: “The diversification potential as a multi-asset investor is about minimising risk and still achieving those outcomes.”

He added that there has not been a market rotation comparable to this one for more than 20 years and newer investors will have to adopt new strategies to cope with rising inflation and declining growth stocks.

Smith said: “I think there’s a large cohort of the market that has never been in an environment like this. We have a generation of investors who re-risk and by more every time there’s a sell off – that’s worked out well over the decade but we’re in a very different environment now and people will have to be much more selective.”

With bonds becoming an increasingly attractive diversifier, Bilton said that first time buyers first need to consider what they are trying to achieve.

Those taking a liability stream approach, which involves matching income streams with future outgoings, should seek bonds that pay dividends around the same time as planned expenditures.

He said: “The two sides of your ledger should more or less be moving together and that’s a really good chart type.”

Others may be on the look-out purely for income, in which case bonds “offer a really good opportunity to diversify much more”, he noted.