Despite choppy markets last year, 140 funds have maintained top-quartile results in three back-to-back calendar years, Trustnet research found, more than double the 69 funds that achieved the feat a year ago.

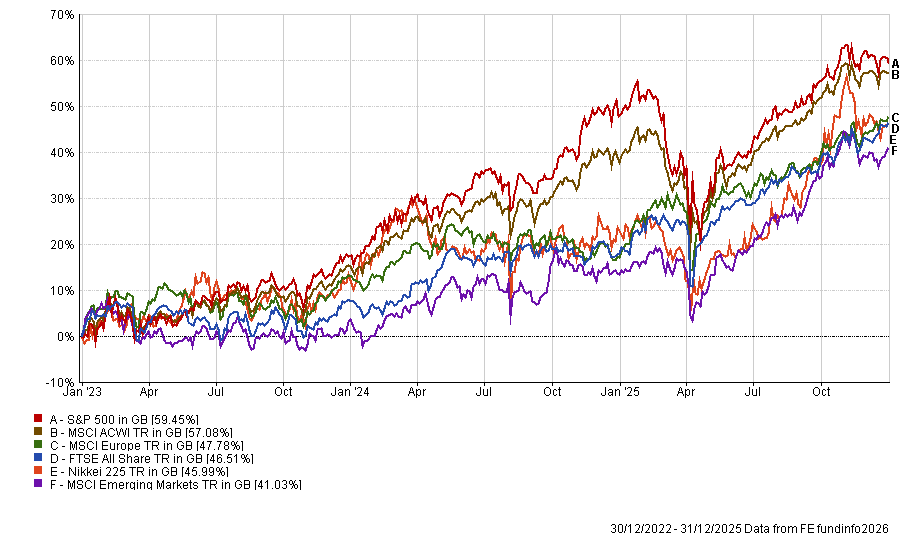

But that does not mean that 2025 was a re-run of the previous two years. While equity markets ended the year in the black, US equities were at the bottom of the pile, with the S&P 500 up just 8.4%. Meanwhile, the MSCI Europe rocketed up 26.1% and the FTSE All Share rose by 24%, according to data from FE Analytics.

This marks a sharp contrast to 2023 and 2024, when US equities topped the charts. During these years, markets were largely driven by the rise of artificial intelligence (AI) and the dominance of mega-cap US growth stocks such as the Magnificent Seven.

This turnaround is the result of a tumultuous first half of 2025, with US president Donald Trump’s aggressive trade policy and tariffs causing the S&P 500 to slide 18.5% by early April. Additionally, the AI giants stumbled at the start of the year as the Chinese chatbot DeepSeek shook the tech narrative.

That said, while the US stumbled in 2025, this was not enough to dethrone it as the top-performing equity market over the full three years.

Performance of equity markets over the past three years

Source: FE Analytics. Data to 31 December

For fund managers, outperforming across these very different investment environments was challenging, but not impossible.

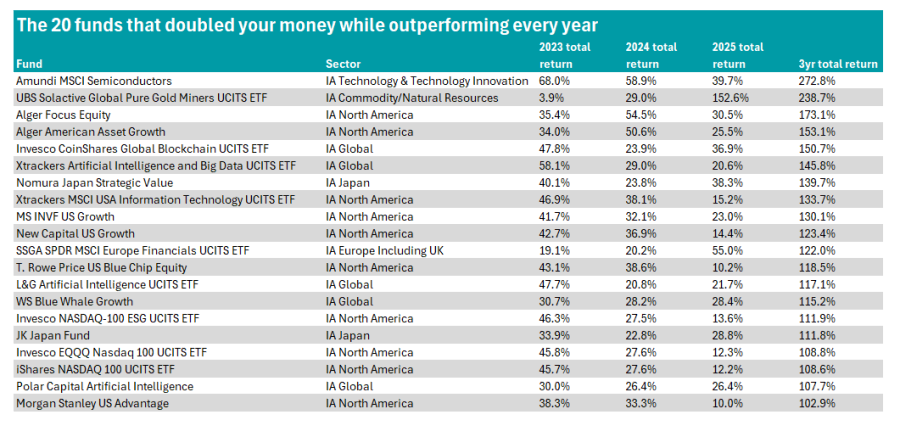

The table below shows the 20 funds that have more than doubled investors’ money since 2022, while achieving a top-quartile return in all three calendar years. In 2025’s study, no funds achieved this feat, due to the poor performance of many strategies in 2022 when rising interest rates were a major headwind.

We have excluded funds from the IA Unclassified, IA Specialist, IA Volatility Managed, IA Targeted Absolute Return and IA Property Other sectors that do not have quartile rankings.

Source: FE Analytics. Three-year returns to 31 December

Topping the table is the Amundi MSCI Semiconductors UCITS ETF, with its three-year total return of 272.8%.

The strategy has benefited from the rise of technology stocks since 2023. For example, it holds a 31% allocation to Nvidia, which made 1,040% in sterling terms over the past three years, according to FE Analytics data.

While it posted a lower return in 2025 than in 2023 and 2024, it was still the second-best performing fund in the IA Technology and Technology Innovation sector.

However, the UBS Solactive Global Pure Gold Miners UCITS ETF took the crown for the highest single-year performance during this period. In 2025, the fund returned 152.6%, a significantly stronger performance than its results in 2023 (up 3.9%) and 2024 (up 29%).

It was one of the best funds of 2025 as investors concerned about the weakening dollar fled towards gold, causing the price of the yellow metal to rise by $1,700 per ounce.

However, the most common sector to appear in the top 25 was IA North America, with 11 funds making the table.

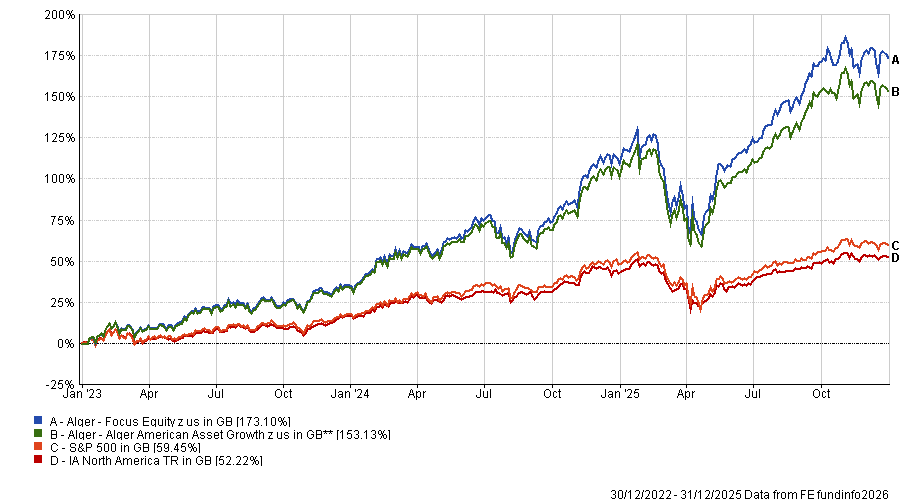

Heading up the list of US funds over three years is the Alger Focus Equity fund (up 173.1%), led by FE fundinfo Alpha Managers Patrick Kelly and Ankur Crawford.

The managers target companies experiencing positive dynamic change – businesses taking market share in high-growth areas or innovating their products. This emphasis on innovative companies has led it to favour members of the Magnificent Seven, as well as stocks in areas such as utilities.

It is the top fund in the North American peer group in both 2024 and 2025, demonstrating its ability to outperform in different market conditions. Its sibling strategy, the Alger American Asset Growth fund, also appeared in the table with a 153.1% total return over the past three years.

Performance of funds vs sector and S&P 500 over the past 3yrs

Source: FE Analytics. Performance to 31 December.

In the IA Global sector, five funds made the shortlist, led by the Invesco CoinShares Global Blockchain UCITS ETF, which made 150.7% over the past three years.

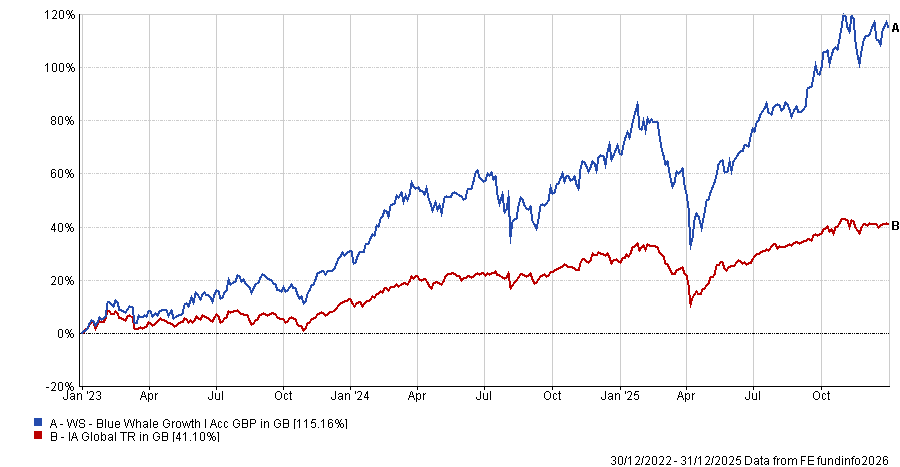

The top active global fund was the WS Blue Whale Growth fund, which delivered a 115.2% return over the past three years. Managed by Alpha Manager Stephen Yiu, the fund focuses on the strongest companies that exhibit quality characteristics and an economic moat, according to analysts at Rayner Spencer Mills Research.

While the fund has historically favoured US companies, Yiu has taken steps to make the portfolio more diversified recently, analysts said.

Performance of fund vs sector over the past 3yrs

Source: FE Analytics. Performance to 31 December.

In the IA Japan sector, Yoshihiro Miyazaki’s Nomura Japan Strategic Value also demonstrated consistency. The fund combines qualitative analysis with a quantitative screen based on three key metrics: price-to-book ratio, earnings yield and M&A activity.

Another Japanese fund which doubled investors' money was the JK Japan fund, led by Alpha Manager Simon Jones.

The manager targets companies that are undervalued based on their long-term growth and business prospects. The portfolio is currently overweight in areas such as financials and materials, while being underweight in information technology and healthcare.