A decade of free cash has supported the growth-heavy Royal London Sustainable Diversified Trust in making the best return in the IA Mixed Investment 20-60% Shares sector, up 127.4% over the past 10 years.

It made double that of its peer group over the period, outperforming by 67.26 percentage points, but it was not a risk-free journey.

The trust ranked in the bottom quartile in terms of volatility over the past decade, but it did have the best Sharpe ratio at 0.7, meaning the high risk taken was worth the end return.

However, with the fund dropping 15.4% since the start of the year, investors who already hold the £3.6bn portfolio may be on the lookout for another portfolio to balance out these losses.

Here, Trustnet asks analysts which funds are best to hold alongside the relatively cautious Royal London Sustainable Diversified trust.

Total return of trust vs sector since over the past 10 years

Source: FE Analytics

Schroder Global Sustainable Value Equity

The Schroder Global Sustainable Value Equity fund is another environmental, social and governance (ESG) themed portfolio that will give investors different exposure to the Royal London fund, according to Ben Yearsley, director of Shore Financial Planning.

He said that its value approach means it’s invested in a “completely different subset of companies and sectors”, such as financials, oil and energy that aren’t found as often in growth portfolios.

The fund underperformed its MSCI World benchmark by 103.1 percentage points over the past decade with a total return of 131.6%, but there are signs of a turnaround. Indeed, the Schroders fund has made a positive return of 1.1% over the past year.

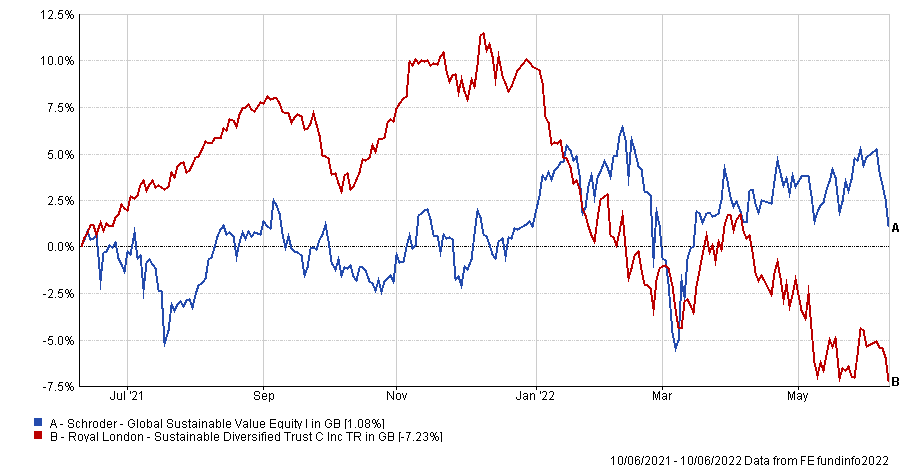

Total return of funds over the past year

Source: FE Analytics

In this cycle, having exposure to value ESG assets is a good way of hedging some of those losses made by sustainable growth portfolios, Yearsley said.

“Crucially, it will give you a contrast – there’s no point in buying another growth ESG fund because you’re getting the same again, so you want something a bit different,” he added.

M&G Episode Income

Another portfolio that offers contrasting exposure is the M&G Episode Income fund, according to Darius McDermott, managing director of Chelsea Financial Services.

Over the past decade, it outperformed other funds in the IA Mixed Investment 20-60% Shares sector by 16.5 percentage points, making a total return of 76.6%.

This fund exists within the same sector as the Royal London portfolio, but its ‘behavioural finance’ approach means allocations are more based on alpha than the Sustainable Diversified Trust’s more beta approach, McDermott said.

Total return of fund vs sector over the past decade

Source: FE Analytics

When they first met six years ago, Royal London fund’s manager, Mike Fox, told McDermott that he would maximise exposure to equities because “they’re the best performing asset over long periods of time”.

For example, in his 20-60% funds equity allocations would stay at 60% and in 40-85% portfolios they would remain at 85%, according to McDermott.

He added: “Some funds in the sector are more flexible, not to say that’s a good or bad thing, but its always going to be one of the higher beta funds in the sector.”

M&G’s equity exposure of 46% is far lower than Royal London’s, according to McDermott, who said: “It’s structurally at the upper end of the equity weight and M&G is much lower equity, so if you’re looking for something to put alongside it, we’re looking at something quite different.”

The fund’s current yield of 2.9% may also be an attractive factor for those looking for a source of income in today’s inflationary environment.

Baillie Gifford Positive Change

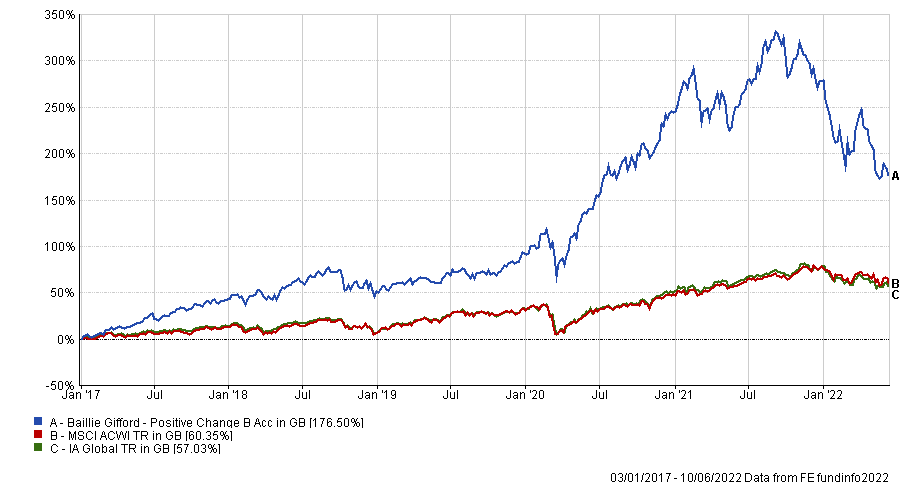

The Baillie Gifford Positive Change fund would complement the Sustainable Diversified Trust while staying in the sustainably theme, according to Tom Sparke, investment manager at GDIM.

Although it is barley five years old, the fund has made more than double the returns of its peers in the IA Global sector, up 176.5%.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

It has boosted performance so rapidly by taking more risks than many in its peer group and “investing in the winners of tomorrow in areas that have very high return prospects over the longer-term”, according to Sparke.

However, its higher volatility has meant a sharp drop in performance since the start of the year, with returns down 27% since January.

Although it’s a riskier option, Sparke said that it “an excellent complement” alongside Royal London’s more defensive structure, but most investors would probably want a smaller exposure to it in their portfolio.

He added: “It should possibly be held in a lower allocation than the Royal London trust, depending on risk tolerance, but it would supply a strong degree of diversification.”

JPM Global Macro Sustainable

Sam Buckingham, investment analyst at Kingswood, said it is difficult to find a diversified ESG fund because the assets they hold are often biased towards growth.

He recommended the JPM Global Macro Sustainable fund for investors seeking a sustainable fund that diversifies their existing portfolio.

The £130m fund, which is up 31% over the past decade, aims to “generate positive returns that are uncorrelated to traditional asset classes”.

Total return of fund over the past 10 years

-1.png)

Source: FE Analytics

Although performance took a 5.8% hit over the past year, Buckingham said that the fund has performed through several market cycles and increases the overall diversification of an existing portfolio.

Bonds account for almost half (49.8%) of asset holdings, while equities make up 34.5% of allocations, which differentiates it from Royal London’s equity heavy portfolio.