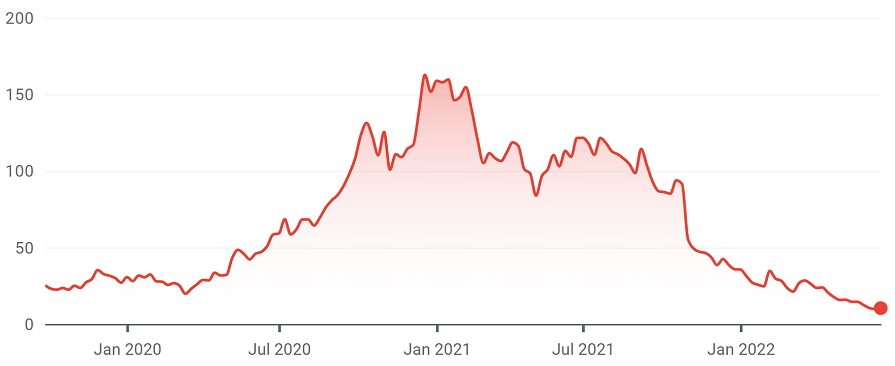

Investec Bank has reiterated its ‘buy’ rating on the Monks Investment Trust after it endured a “perfect storm” that has caused its share price to fall by close to 40% since its 2021 high.

Performance of trust over 3yrs

Source: FE Analytics

With Monks being run by growth house Baillie Gifford, it has been hit hard by the spike in inflation and interest rates this year.

In Monks’ annual results, its managers Spencer Adair and Malcolm MacColl said that while they had been reflecting on a period of strong performance just 12 months before, they recognised that “the speed and size of the reversal since then has been jarring for shareholders”.

Investec warned the “macroeconomic storm” that has caused so much pain for growth investors is still some way from passing, and last week downgraded another Baillie Gifford trust, Scottish Mortgage.

However, it said it was “shocked by the brutality of the sell-off” in Monks’ shares, considering the majority of companies in the portfolio continue to perform well operationally and are financially robust.

“Revenue growth is accelerating, with sales forecast to grow at 17% over the next five years versus 10% for the broader market,” said analysts at Investec.

“Meanwhile, the managers’ analysis found that the portfolio is skewed towards businesses with a high degree of flexibility to cope with a surge in inflation.”

Spencer Adair and Malcolm MacColl, the managers of Monks, look for exceptional companies with the potential to deliver attractive earnings growth over the long term.

The portfolio comprises three growth categories: rapid growth at 39.7% of assets, which comprises early-stage businesses with a vast opportunity, or innovators attacking existing profit pools or creating new markets; growth stalwarts at 34%, which are businesses with a durable franchise and competitive advantage that allow them to deliver robust profitability in most macroeconomic environments; and cyclical growth at 26.3%, meaning companies that are subject to macroeconomic and capital cycles but have significant structural growth prospects.

The managers don’t always get it right and some poor stockpicking decisions have also contributed to the trust’s decline in the past year.

For example, they referred to home fitness company Peloton as a “disappointing holding” – it is down by more than 90% since they bought it in August 2021.

Performance of Peloton stock since IPO

Source: Google Finance

“The company has significantly overestimated demand and committed too much capital to the production of its hardware (bikes),” said Adair and MacColl.

“This has undermined the prospect of future profitability. A new CEO in Barry McCarthy, formerly of Netflix and Spotify, is a move in the right direction; however, this stock remains firmly under review.”

Yet they were happy with most of their holdings, saying it is important not to make any rash decisions when the market is moving against you.

“Periods of share price weakness can bring behavioural challenges, not just for investors, but also for management teams, and may be deeply unsettling for employees,” they explained.

“One of the risks in the current portfolio is that management teams react to the signals they are getting from the market, shortening their own time horizons and reining in investment. There would likely be a significant opportunity cost to such actions.”

As a result, they have encouraged management teams of their portfolio holdings to separate operational decision-making from share prices. Where this has not been the case, or where management isn’t investing for the long term, they have sold.

One example of this was the recent sale of ride-sharing app Lyft.

“We felt that the scale of ambition at Lyft – having once been to bring fleets of autonomous vehicles to market – has been curtailed,” they explained.

“This has been coupled with egregious stock-based compensation payouts which, in our view, are not appropriate given underwhelming operational progress, nor aligned with the long-term interests of shareholders.”

Investec said this focus on the long term despite short-term pressure is one of the reasons why it continued to back the trust.

“In the results, the managers reaffirm the philosophy and process, and we agree with the chairman who notes that, at times like these, it is of utmost importance that they stick to their longstanding approach.

“Although the past 16 months have been painful, we continue to regard Monks as a core holding for investors looking to achieve a diversified exposure to Baillie Gifford’s best global ideas.”

Even after its recent problems, Monks’ returns of 201.9% over the past decade are well ahead of the 155.1% made by its IT Global sector. However, it has slipped behind its FTSE World benchmark.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

Meanwhile, its 10% discount is potentially attractive considering it has traded at a premium for most of the past five years.

Investec said: “We have recently expressed frustration when companies adopt an asymmetric approach to share issuance/buybacks. However, in this case, following several years of share issuance, the board has provided additional liquidity to the market through buybacks.

“During the last financial year, it purchased 8.8 million shares at a cost of £98m, and, since the beginning of this calendar year, it has bought 11.7 million shares or 5% of shares in issue.”