Picking stocks that score well for environmental, social and governance (ESG) principles has been a growing trend in recent years, but performance has been poor in 2022.

Many of these portfolios have focused on the US, where tech companies have led the way. While this has worked for a long time, this year it has been a headwind.

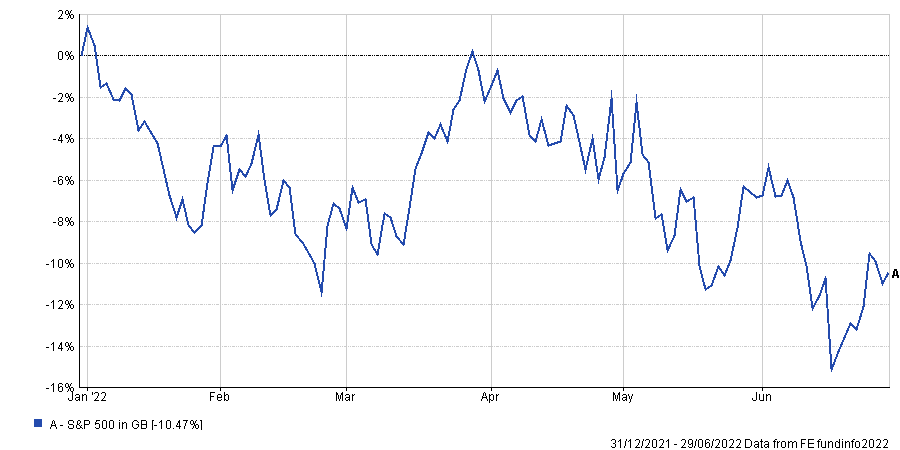

Indeed, the S&P 500 index, which is dominated by highly priced growth investment opportunities, has sunk 10% since the beginning of 2022, as the line chart below shows.

S&P 500 since year start

Source: FE Analytics

One person that has not lost faith in the US is AXA portfolio manager David Shaw, who took charge of the AXA Global Sustainable Distribution fund last year.

The portfolio, which is 55% weighted to equities and 45% towards bonds, has something of a penchant for US firms, with nine of its top 10 largest equity positions in American stocks.

The fund was the third best performer in the IA Mixed Investment 20-60% Shares sector last year, making a return of 13.9%, but it has dropped to the bottom quartile among its peers in 2022 as the market has rotated.

Below, Shaw outlines three stocks – two from the US – that he is hoping can turn around the fortunes of the five FE fundinfo Crown-rated fund.

First up is the US market leader in fibre optic communications equipment, Ciena, which has dropped 41.7% so far this year.

Ciena’s high-speed fibre optics allow for fast data transfers over long distances, which allows telecoms and hyperscale data centres to serve businesses from remote areas, where land is cheaper and space is available to build and gain power from solar farms.

“One such data centre company, Switch, has based one of its mega-campuses in Nevada, where it can serve businesses in Silicon Valley,” he said.

“Not only is the land needed to build such a data centre campus cheaper in Nevada, but the space available has allowed Switch to power its data centres with a solar farm, something that would have been both costly and impractical in Silicon Valley.”

Shaw’s second choice in the US is Planet Fitness, the leading US healthcare and gym provider with about 20% of the total market share in the country.

“While 10%-15% of gyms in the US have gone out of business due to Covid-19, Planet Fitness has closed none of its sites and is in a great position to fill the gaps left by its competitors”, he said.

The pandemic has changed the way people think about their health, with a recent survey suggesting around six in 10 people had gained weight in recent years.

The company is particularly interesting because it has an “inclusive environment” and is more welcoming than other peers. Trials including the free entry for teenagers this summer should attract new customers, while its inclusive image should encourage people that want to return to, or join, a gym to choose Planet Fitness. Despite this, shares are down 27.6% year-to-date.

Lastly, on this side of the Atlantic (but with plants across the world, including the US), Shaw highlighted Befesa, whose shares are down a third this year.

The firm specialises in the disposal of steel dust, which is produced in the steel production process and is typically removed as a hazardous waste.

Befesa collects it and recycles it back into the steel production process, “thereby eliminating waste and creating a fully circular production for steel manufacturing,” Shaw said.

The recycling company is in a “great position as it continues its global expansion”, with plants across the US, western Europe and South Korea as well as plans for two new operations in China this year.

“There may be major opportunities in other countries in the future. In India, for instance, steel dust is disposed of in potentially unsafe ways, often ending up in landfills where it could harm people who breathe in the dust and adds to overall pollution levels,” said Shaw.

“With pressure for safety and recycling requirements only going to get stronger, increasing numbers of countries are likely to make safe disposal of steel dust mandatory.”