June was a month of economic news and stock market falls as investors digested interest rate hikes, higher inflation and weakening consumer confidence.

In the month, the Federal Reserve hiked rates by 75 basis points, the biggest increase in 30 years, while the Bank of England made a more modest 0.25 percentage point increase. Both had to contend with inflation that hit a 40-year high in the UK and US at 9.1% and 8.6% respectively.

Even the European Central Bank got involved, finally suggesting it will raise rates within the next couple of months.

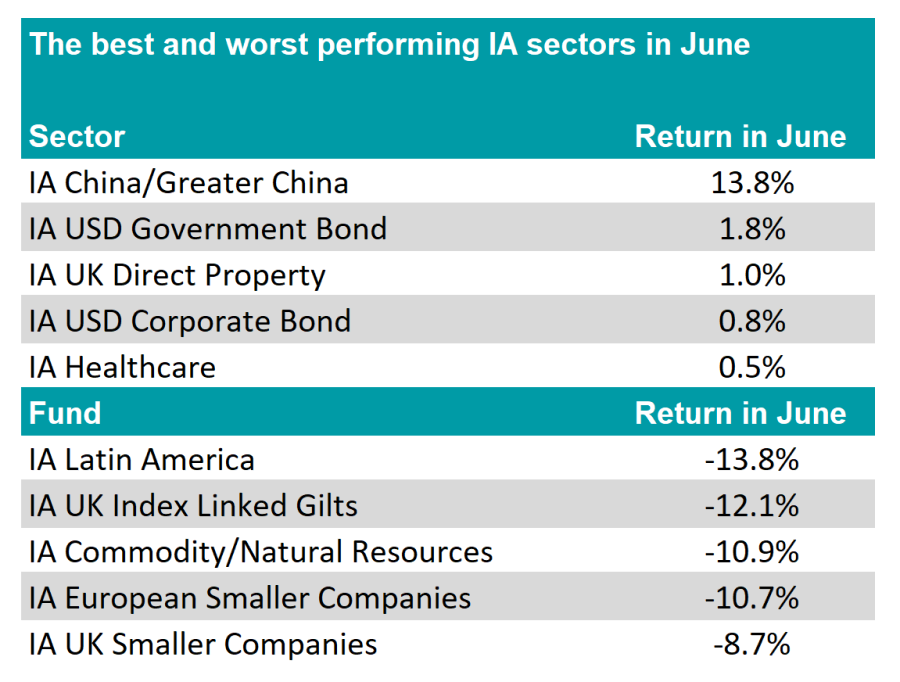

Investors who wanted to make gains during June had to look further afield, to China in fact, with the IA China/Greater China sector by far and away the best performer for the month.

Source: FE Analytics

The average fund here made 13.8% over the past 30 days, with the IA USD Government Bond sector finishing a distant second with a gain of 1.8%.

Ben Yearsley, director at Fairview Investing Limited, said: “Interestingly on China, managers are saying they can see the light at the end of the Covid tunnel now and the next five-year Congress, scheduled for this autumn, will coincide with the ending of their zero covid policy.

“China is also on a different fiscal and monetary path with easing happening rather than tightening,” he noted.

At the other end of the spectrum was the IA Latin America sector, which pipped IA UK Index Linked Gilts as the worst performer for the month.

The Latin America sector has been a rollercoaster for investors over the year-to-date, topping the charts in March and May, but sitting at the bottom in April and June.

Investors unwound some of the trades made this year. Indeed, the presence of the IA Commodity/Natural Resources sector in the bottom five as well suggests people are moving out of the big resources trade of the first half of 2022 and allocating elsewhere.

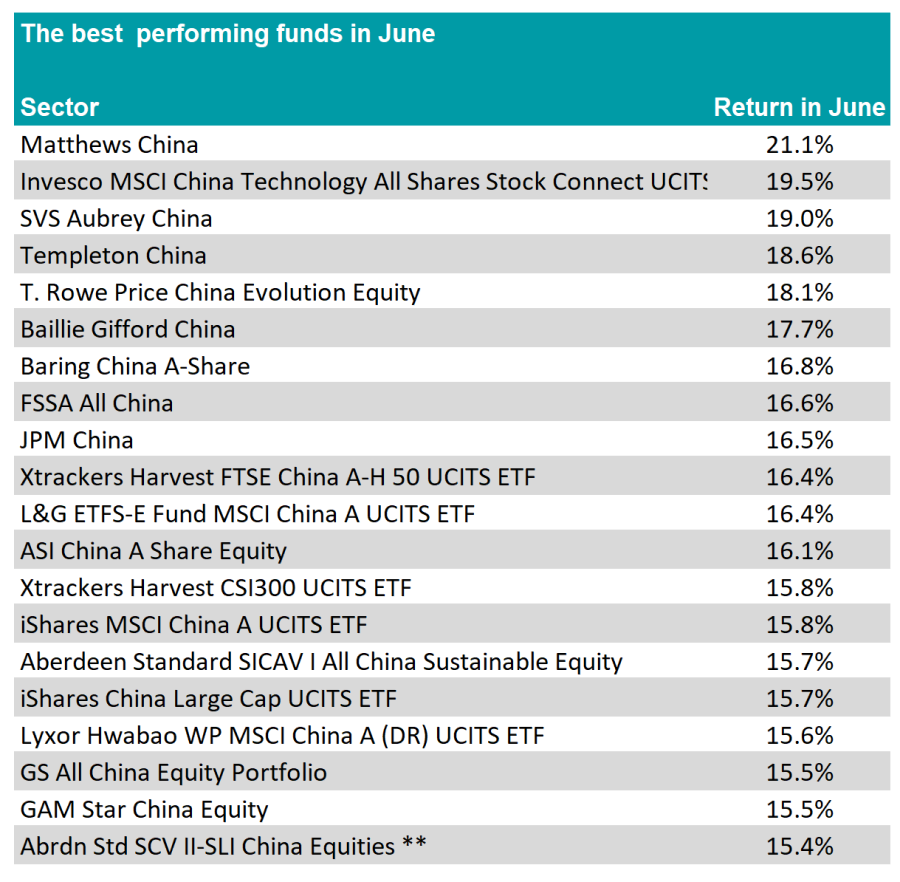

Looking at individual funds, the top was unsurprisingly dominated by China portfolios, with all of the top 20 coming from the sector.

Source: FE Analytics

In fact, the top 60 funds of the month were all China-related funds, with the first non-China portfolios – Pictet Biotech – making a return of 10.2%.

Neil Wilson, chief market analyst at Markets.com, said: “Chinese markets performed well as data improved as the easing of Covid measures led to a strong pickup in services activity. Manufacturing activity rose for the first time in four months. Unless you’d followed JPM advice back in May to pivot back into China tech, it’s been a horrible month for stocks."

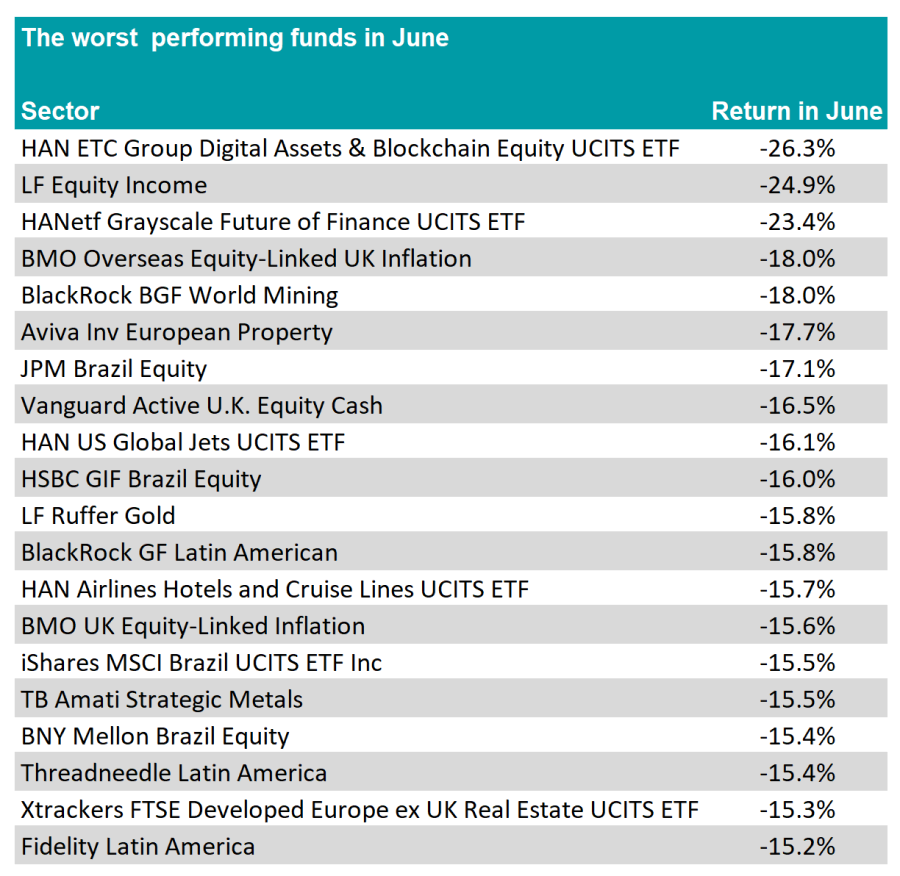

Indeed, at the other end, HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF propped up the list as investors continue to sell cryptocurrencies on the back of higher inflation. The hope that these assets would hold up during an era of rising prices has so far proved false.

Source: FE Analytics

However, the bottom of the list is much more varied, although there are themes. Indeed, commodities winners such as BlackRock BGF World Mining and LF Ruffer Gold were among the hardest hit in June.

Similarly, Latin America funds were near the bottom, as we UK index-linked gilt specialists, with BMO Overseas Equity-Linked UK Inflation losing 18%. Aviva Investors European Property also made the list, down 17.7%.

It was a similar theme in the closed-ended space as well. Here, the IT China/Greater China sector rose 19.3%, while in second place was the IT Insurance & Reinsurance Strategies sector, up 3.4%. They were the only two sectors to make a more than 1% gain in the month.

Among the biggest losers, the IT Growth Capital sector fell 15%, while European smaller companies, commodities specialists, Latin American and Financials trusts rounded out the bottom five.

Yearsley said: “The trust world was unusually consistent in June with JZ Capital Partners taking top spot with a gain of 25.7% followed by four China trusts – Baillie Gifford China made the top five, probably a welcome relief for them after their own ‘annus horribilis’ in 2022.”

Small specialists dropped the most, with BENS Creek Group down 46.8%, although the firm said it had no idea why shares had tanked.

Kuala Seed Innovations and Seraphim Space rounded out the bottom three, down 39.5% and 33.6% respectively, while real estate investment trust Hammer