The year-to-date returns of funds have been hammered by June’s volatile markets with many sectors being pushed further into the red, analysis by Trustnet shows.

As covered at the end of last week, few of the fund sectors in the Investment Association universe could boast of positive return last month after rising inflation and interest rate hikes continued to unnerve investors.

Markets have been volatile for all of 2022 because of these factors and in June this intensified as even areas that had been doing well previously – such as commodities – took a hit from worsening sentiment.

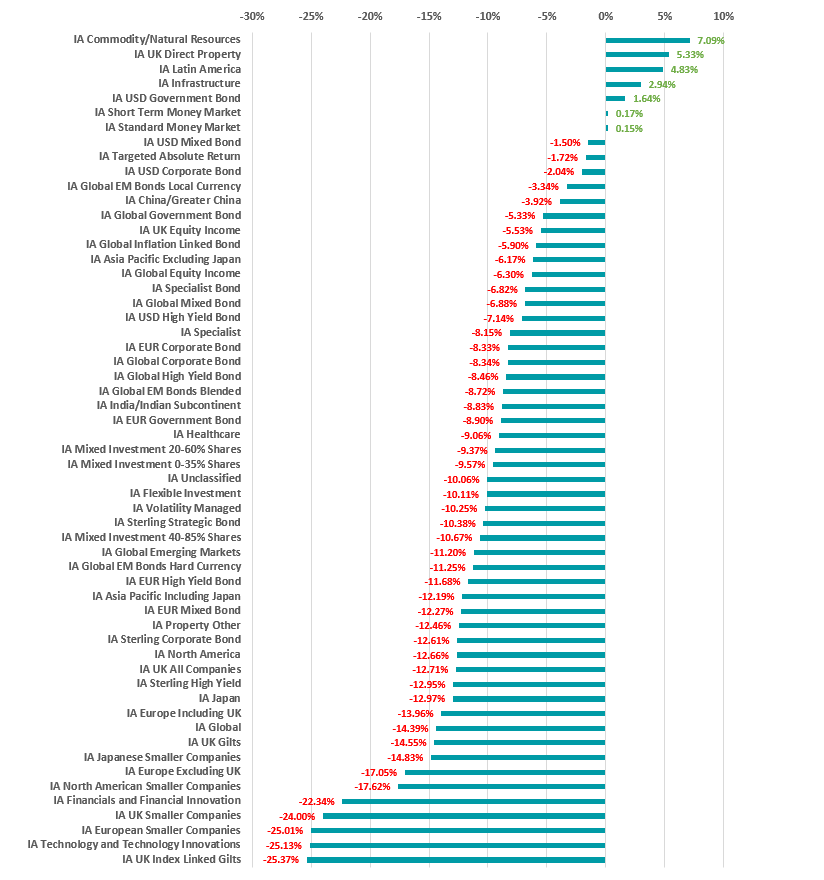

The table below shows the average year-to-date total return of the 57 Investment Association sectors. As can be seen, it’s been a lean time for investors.

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2022

Just seven sectors are posting a positive average return for the opening six months of 2022 and two of these are the money market peers groups.

Those with the highest returns tend to be those that investors have been using to inflation-proof their portfolios: commodities (which have surged because of supply bottlenecks and the war in Ukraine), Latin America (where many countries are commodity exporters) and real assets such as property and infrastructure – both classic inflation hedges.

At the bottom of the rankings are the IA UK Index Linked Gilts and IA Technology and Technology Innovations sectors. The average fund in both of these peer groups is down 25% in 2022 so far.

Comparing the sectors’ year-to-date returns to where they stood just one month ago highlights just how volatile markets are.

Take the IA Commodity/Natural Resources sector as an example: at the end of May, its year-to-date average return stood at 21.8% but the broad-based dive in markets in June shaved 13.7 percentage points from this. The average fund here is up just 7.1% today.

The fall in the IA Latin America was even heavier, going from a 21.2% return between 1 January and 31 May to just 4.8% for the year to date.

Sectors that were already at the bottom of the performance rankings last month – such as IA European Smaller Companies, IA UK Index Linked Gilts and IA UK Smaller Companies – have fallen even deeper into the red.

Indeed, the year-to-date return has deteriorated in all but eight sectors since last month. The most notable exception is the Chinese market, which was tanking just a few months ago but surged in June to turn a 13.2% loss into a more modest year-to-date decline of 3.9%.

Mark Dowding, chief investment officer at BlueBay, said: “It seems natural that investors will want to reflect on an exceptionally challenging first half and may be left looking ahead with some degree of scarring and trepidation. There remains a lot of uncertainty, and price action has grown more erratic as liquidity conditions have deteriorated.

“However, it strikes us that in the coming period, we should look for more stability, relatively speaking, given what has now been built into forward market pricing. Major central banks are set to hike rates materially in the coming several months, but this has already been signaled to markets. Consequently, at this point, there may appear to be more risk of central banks under-delivering rather than over-delivering on rate hikes, compared to what is discounted.”

But Dowding added that investors should maintain a cautious approach rather than being too aggressive, as there is still the potential for plenty of disruption in markets. He argued that investor sentiment will only start to strengthen when there are clear signs that inflation is starting to move back towards central banks’ targets.

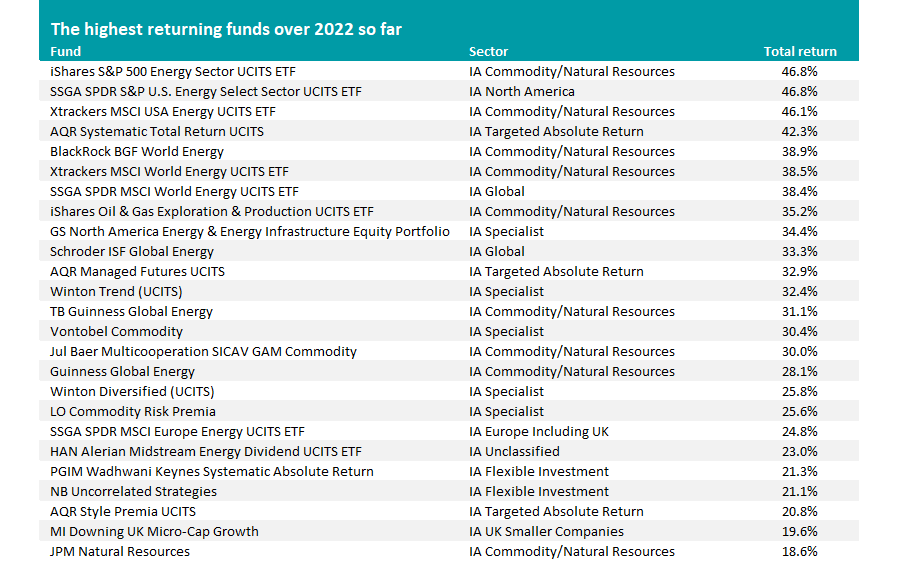

Turning to individual funds, the list of the best performers over 2022 so far is still dominated by commodity funds despite their recent dip.

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2022

As the table above makes clear, it is those with a focus on energy commodities that have tended to make the highest returns. This reflects the fact that energy prices were already surging before war between Russia and Ukraine took even more supply out of the market and made the situation even worse.

The likes of iShares S&P 500 Energy Sector UCITS ETF, SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF and Xtrackers MSCI USA Energy UCITS ETF have consistently sat at the top of the performance tables this year on the back of this.

Aside from energy funds, some multi-asset funds that specialise in finding diversified sources of alpha – such as AQR Systematic Total Return UCITS, Winton Diversified (UCITS), PGIM Wadhwani Keynes Systematic Absolute Return and NB Uncorrelated Strategies – are making some of the year’s highest returns.

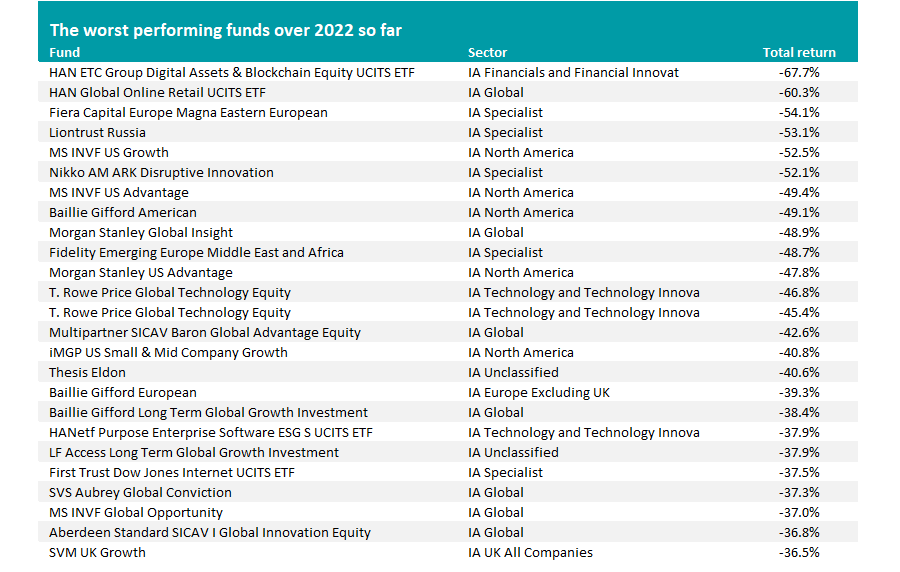

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2022

When it comes to the bottom of the table, the story is also largely the same as it has been in the earlier months of 2022, with funds that invest using the growth style or in tech stocks posting the biggest losses.

The likes of MS INVF US Growth, Nikko AM ARK Disruptive Innovation, Baillie Gifford American and T. Rowe Price Global Technology Equity made strong returns in the past when interest rates were low and investors were willing to pay up for future earnings.

However, soaring inflation and rising interest rates have turned this dynamic on its head in 2022 and sent investors fleeing from stocks with high valuations based on the promise of higher profits in the future.

HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF and HAN Global Online Retail UCITS ETF, the two worst performers, reflect the harsh sell-off in cryptocurrencies and a fall in many of the online retail ‘pandemic winners’.

Meanwhile, funds such as Fiera Capital Europe Magna Eastern European, Liontrust Russia and Fidelity Emerging Europe Middle East and Africa are sitting on heavy losses because of Russia’s invasion of Ukraine and the regional instability this created.