Funds with exposure to rising commodity prices continue to top the performance rankings in 2022, data from FE fundinfo shows, while those more vulnerable to rising interest rates are stuck at the bottom.

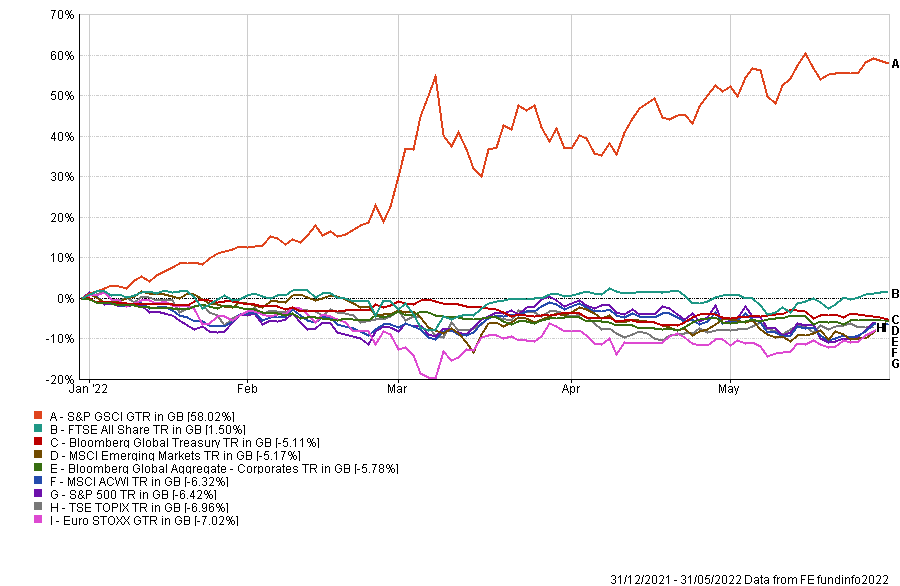

Five months into 2022, it is still a struggle to find any part of the market where good returns can be made. Commodities have surged but global equities, government bonds and corporate bonds are still sitting on losses, even after a better month for stocks in May.

Performance of markets in 2022 to date

Source: FE Analytics

This has translated into losses for the majority of funds in the Investment Association universe.

FE fundinfo data shows just seven of the 57 IA sectors are in positive territory for 2022 so far – although a not-terrible May means this is a slight improvement on last month (only six sectors made positive returns between the start of the year and the end of April).

When it comes to individual funds, 781 of the 5,062 in the Investment Association universe are positive. That means around 85% of funds are making a loss this year.

What's worse, more funds are posting a double-digit loss than a positive return: 1,283 funds (or one-quarter of the universe) are down at least 10% for the first five months of 2022.

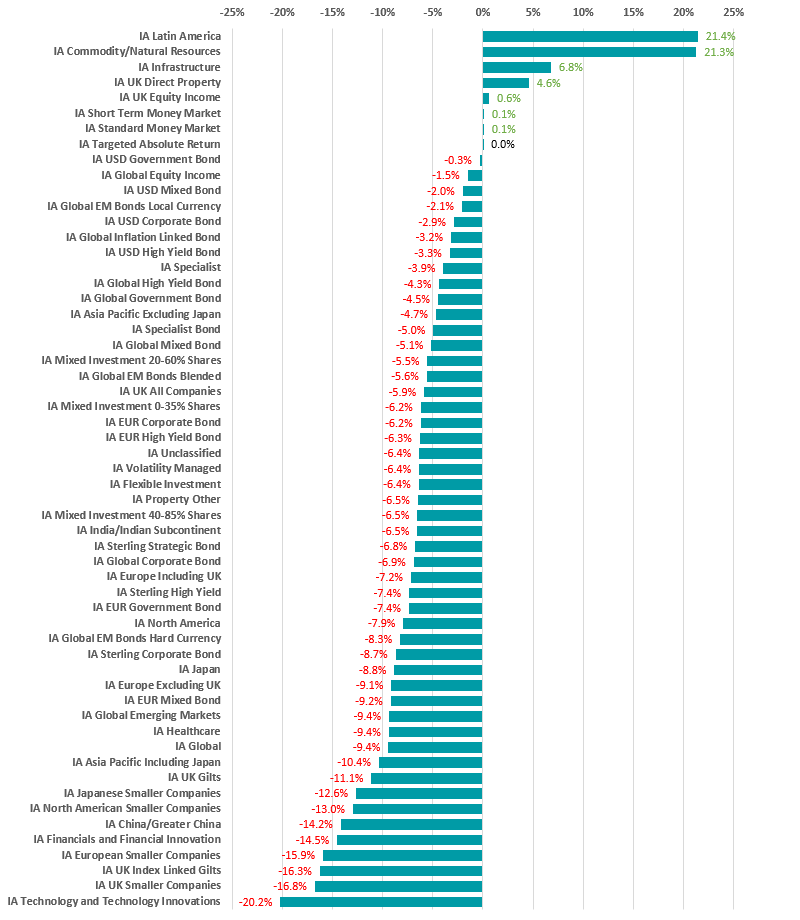

Average total return by Investment Association sector in 2022 to date

Source: FE Analytics

The IA Latin America and IA Commodity/Natural Resources sectors have held onto their position at the top of the performance leaderboards, both adding around 5 percentage points to their 2022 return over the past month.

Both of these sectors are benefitting from the same trend of soaring commodity prices. In the case of the IA Commodity/Natural Resources sector the explanation is obvious, while for IA Latin America funds it is down to the fact that the region is a net exporter for commodities and therefore benefits from rising prices.

Total returns of more than 20% mean these two sectors are leading in 2022 by a significant margin – IA Infrastructure, thanks to its status as a classic inflation hedge, trails in third place with an average return of 6.8%.

At the bottom of the table, the average IA Technology and Technology Innovations fund is down just over 20%. Like other growth stocks, tech companies are vulnerable to rising interest rates as it makes investors less willing to accept lofty valuations today for the promise of future earnings.

It’s a similar story for the smaller companies sectors at the bottom of the chart as well (IA UK Smaller Companies, IA European Smaller Companies, IA North American Smaller Companies and IA Japanese Smaller Companies are all among the year’s worst performance). The future growth of smaller companies look less attractive to investors when interest rates are rising today.

Source: FE Analytics

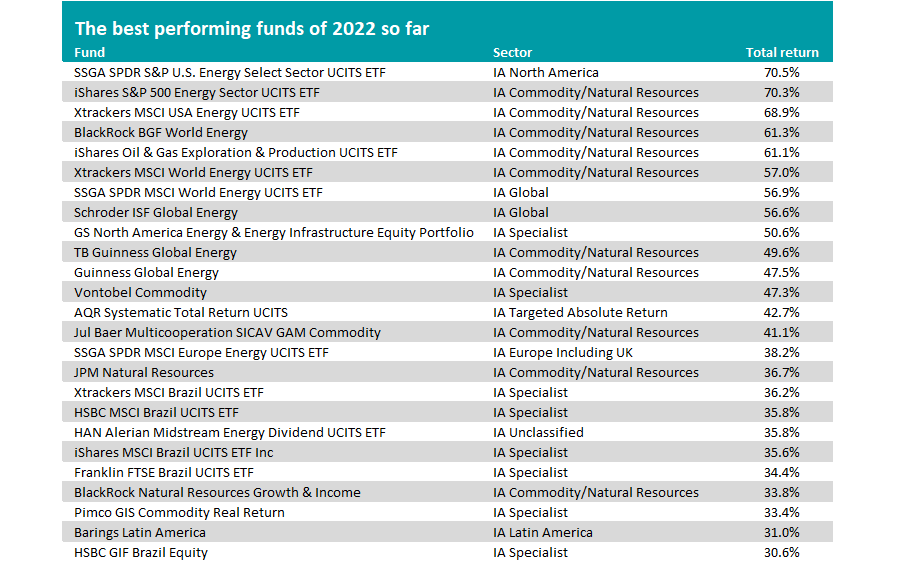

Turning to individual funds, the table should contain barely any surprises, given the trend discussed above.

Energy funds such as SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF, iShares S&P 500 Energy Sector UCITS ETF, BlackRock BGF World Energy, iShares Oil & Gas Exploration & Production UCITS ETF and Schroder ISF Global Energy dominate the list of 2022’s highest returners.

Energy has posted some of highest price rises in the commodities space. The cost of oil and gas was already rising before Russia’s invasion of Ukraine, but Russia’s status as a major energy exporter and the heavy sanctions laid on the country have exacerbated the issue.

There’s only one fund among the top 25 that isn’t focused on commodities, energy or Latin America: AQR Systematic Total Return, which resides in the IA Targeted Absolute Return sector.

Source: FE Analytics

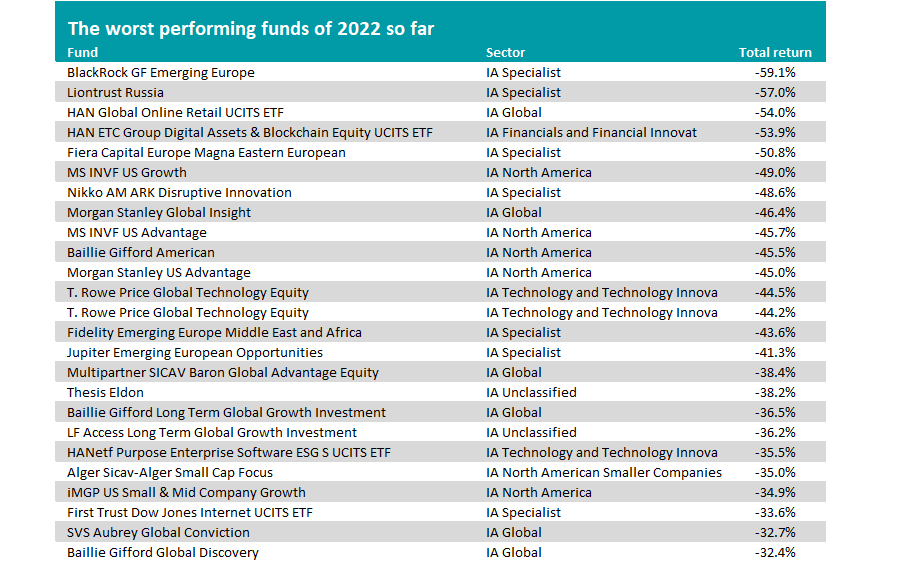

There’s a few more trends at play when we look at 2022’s worst performers.

The freezing out of Russia from the international community because of its war in Ukraine caused its stock market to tank and fund houses to suspend their Russian and eastern European equity strategies.

Two such funds have made the biggest loss of the year so far: BlackRock GF Emerging Europe and Liontrust Russia.

The impact of rising interest rates on growth stocks can be seen in the losses posted by the likes of MS INVF US Growth, Nikko AM ARK Disruptive Innovation, Baillie Gifford American and T. Rowe Price Global Technology Equity.

The reappraisal by investors of the ‘Covid winners’ that surged during the pandemic but reached expensive valuations is a story that is also linked. HAN Global Online Retail UCITS ETF and HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF would be examples of this.