If you have been watching the FTSE 250 plummet since 2021, you might now be wondering if the small- and mid-caps are due a comeback any soon and if now is the right time to take the plunge.

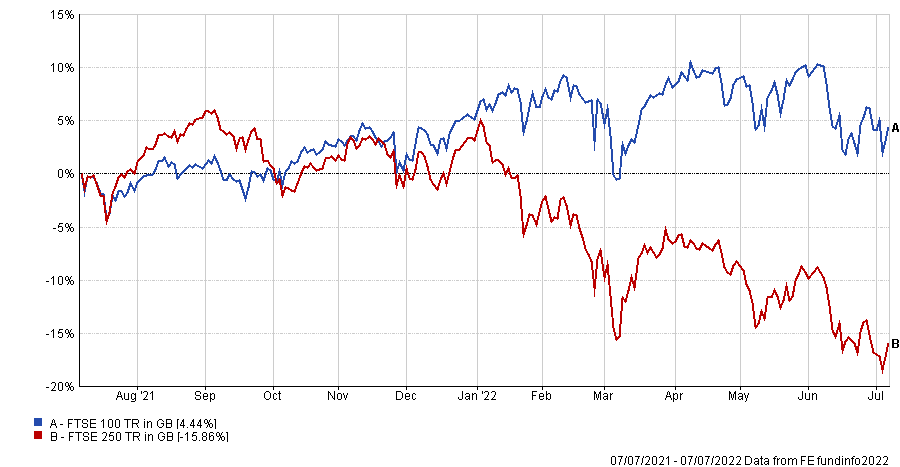

UK small and mid-cap companies have been decimated since 2021, with the FTSE 250 down 20% over 12 months. Conversely, larger companies remained on a steadier course, with the FTSE 100 index registering a 4% gain over the same period, as shown in the graph below.

Total return of the FTSE 250 and FTSE 100 over 1yr

Source: FE Analytics

There are several reasons for this. For starters, Brexit hit smaller companies the most, as they have fewer means to tackle import/exports obstacles, navigate new employment policies and endure regulatory changes, while also having fewer resources to fall back on.

Inflation eating into their buying power also puts them at greater risk, as they are less likely to be able to pass on the raw material costs to customers.

Still, smaller companies are a strong option for investors with a long time horizon as they are renowned for their capacity for innovation and potential to grow – something that large-caps struggle with.

Lead investment analyst at Hargreaves Lansdown Kate Marshall is certainly among the ranks of those who see opportunities in small-cap.

“While they can be more volatile than the household names in the FTSE 100, we think they have a place in an investment portfolio with a truly long term outlook,” she said in a recent interview published by Trustnet magazine.

While Marshall looks further ahead, James Penny, chief investment officer at TAM Asset Management suggested opportunities might lie even in the short and medium term, noting that the resignation of current prime minister Boris Johnson may offer a good entry point.

“It’s likely that his successor will have a softer stance on Europe and Brexit negotiations, boosting positivity for UK domestic businesses found in the mid- and small-cap space, which have been battered as of late,” he said.

He was also hopeful that the successor would manage to right the UK ship and stabilise the pound, thus boosting domestic businesses in the FTSE 250 as well as the alternative investment market.

For those convinced now is the time to seize the opportunity, Andrew Merricks, fund manager of 8AM Focussed fund, said the VT Downing UK Unique Opportunities was a good option, noting his appreciation for its manager, Rosemary Banyard.

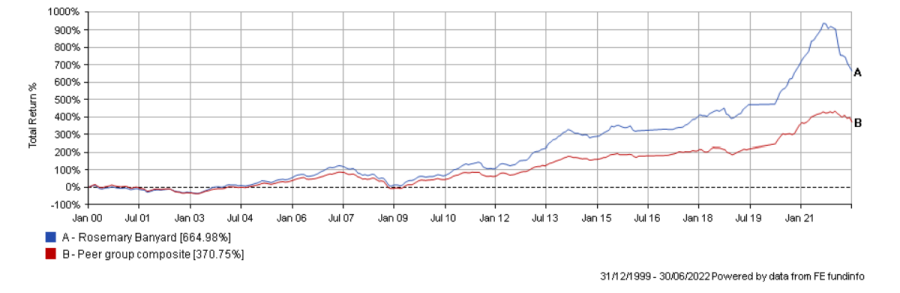

“During uncertain times, such as the one we’re in, I prefer to rely on managers who have experience running money across a range of economic circumstances rather than focussing just on recent performance,” he said.

“Her discipline and experience are important qualities at times like this and will reward investors who get involved now after a horrendous year to date for the [IA UK All Companies] sector with relative outperformance in the years ahead.”

VT Downing UK Unique Opportunities has underperformed versus its peers, ranking in the bottom quartile over the medium term, but Banyard herself has been outperforming her peers for at least 20 years, Merricks noted.

Track record of manager vs average peer over her career

Source: FE Analytics

Ben Yearsley, director at Fairview Investing Limited, said small and mid-caps had the “best long-term growth outlook” for investors that can swallow the volatility.

He suggested the Montanaro UK Smaller Companies investment trust, as “a true specialist” in the sector. With a market capitalisation of £179m, it has a focused investment portfolio with about 50 stocks and focuses on long-term growth investing.

As this investment style has grown out of favour since the end of last year, the trust went through a tough patch, as shown in the graph below. But Yearsley highlighted that this might present a buying opportunity as shares are on a near 9% discount to net asset value.

Total return of trust vs sector and benchmark over 3yrs

Source: FE Analytics

A third option, selected by investment manager at GDIM Tom Sparke, is Chelverton UK Growth. The small and mid-cap biased fund has been “impressively resilient” during some very testing times, returning 71.7% over five years, while its IA UK All Companies sector lagged behind at 12%.

Over 10 years, the fund almost tripled the distance to its sector, with a divide of 167.2 percentage points.

Total return of fund vs benchmark over 5yrs

Source: FE Analytics

“It’s long-term track record is very strong and its commitment to a strong ethos of quality and growth has been rewarded,” Sparke said.

Its market cap of £1.2bn might raise some concerns, he admitted, but “the fund has not yet showed any signs of wavering from its impressive position”.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| LF Montanaro UK Income | IA UK All Companies | £57m | Charles Montanaro, Guido Dacie-Lombardo | 3.4% | 0.80% | 31/01/2020 |

| MI MI Chelverton UK Equity Growth | IA UK All Companies | £1,213m | James Baker, Edward Booth | 0.0% | 0.83% | 20/10/2014 |

| VT Downing Unique Opportunities | IA UK All Companies | £45m | Rosemary Banyard | n/a | 0.89% | 17/03/2020 |