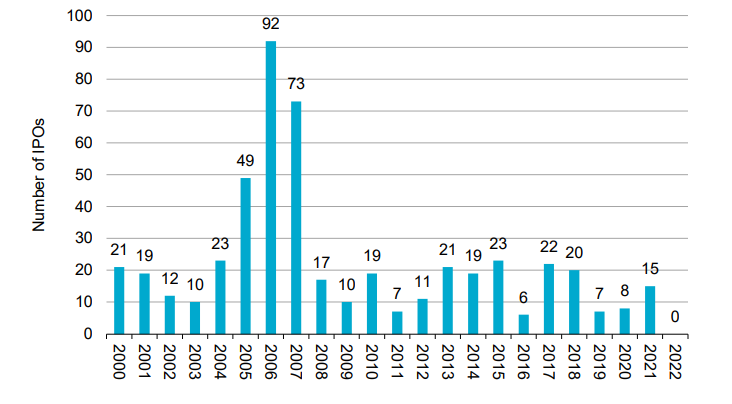

There have been no initial public offerings (IPOs) for new investment companies (ICs) this year, marking the third longest dry spell since records began in 2000, according to new findings from Numis Securities.

The six-month drought is running behind the eight-month dry spell after Covid struck in 2020 and the 10-month gap following the financial crisis in 2008.

Analysts at Numis anticipate this lack of new trusts will continue over the typically quiet summer months and said that there is a strong possibility that there could be no IPOs by the end of the year.

Ewan Lovett-Turner, head of investment companies research at Numis, said: “It would be highly unusual and would compare to an annual average of more than 14 IPOs per year in the period since the global financial crisis. We would not be surprised if something gets away towards the end of the year, but it is currently unclear what that might be.”

Number of IPOs by year since 2000

Source: Numis Securities Research

Asset management groups may be hesitant to launch new trusts in the current environment, with high inflation, rising interest rates and geopolitical tensions creating significant volatility in markets.

Some groups have attempted to launch new portfolios, such as the GCP Co-Living and Cordiant Global Agriculture trusts but both failed to meet the required threshold.

There are other trusts in test marketing but all of them are “very early stage and very speculative,” according to Lovett-Turner, so he does not expect the same flurry of new launches that took place as lockdown restrictions receded in 2021.

He added: “The shift in investor sentiment means that investors are focused on the implications of changing macroeconomic conditions on their existing holdings rather than considering new opportunities.”

Unfortunately for investors, this means less choice in where they can put their money – even in previous crises, eight new trusts were launched in 2020 and 17 in 2008.

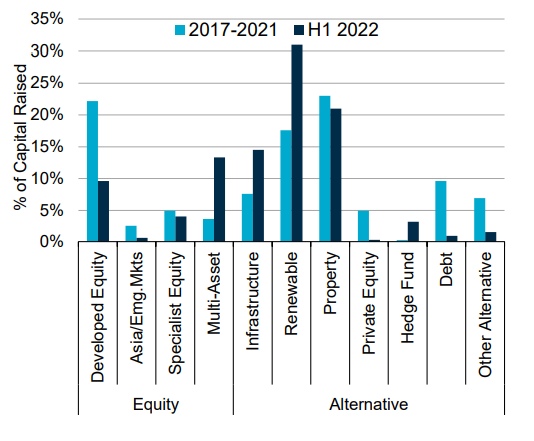

The amount of capital raised by existing trusts also slowed this year – issuance in the second quarter was up 17% from the first three months of the year, but the £4.3bn raised in the first half of 2022 is 36% lower than it was the year before.

Of the money issued, most came from alternative such as renewable energy and infrastructure which have benefited from higher power prices.

A total of £1.3bn was issued by renewable energy trusts in the first half of the year as demand soared and the gap in supply from countries vetoing Russian oil and gas following its invasion of Ukraine, bolstered the transition to green energy.

The Renewables Infrastructure Group and Greencoat Renewables trust led the charge, each issuing £280m and £235m respectively.

Fundraising by asset class from 2017

Source: Numis Securities Research

However, the two largest issuers so far this year were property trusts International Public Partnerships and Supermarket Income REIT, raking in a total of £635m between them.

‘Alternatives’ (property, infrastructure and private equity etc) were the biggest issuers in the first half of 2022, up £3.1bn, although fundraising was still down 27% from last year overall.

Difficult to predict at this stage, Lovett-Turner said that the next IPO is most likely to be in the property universe due to the asset class’ stability through periods of economic uncertainty.

He added: “Over the past 10 years, alternative income has been the focus of most IPOs. We expect this trend to continue, although there is more appetite for returns to be generated through a combination of income and capital growth.

“We are not surprised to see a period of indigestion following recent IPOs and secondary issues. Currently, most investors are more comfortable backing existing issues and building scale for recently launched vehicles.”

Equity IPOs, on the other hand, are least likely to spring up anytime soon as their performance is often more susceptible to choppy markets.

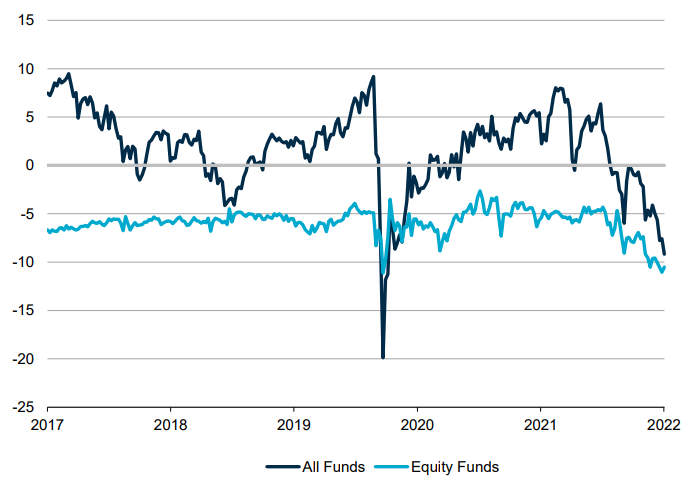

Average trust premium/discounts over the past five years

Source: FE Analytics

Alongside the lack of IPOs and secondary issuance, investment trusts that have come under pressure this year have been quick to buy back shares in an effort to keep the share price discount in check.

It means that, although many trusts are down this year as markets have rotated away from growth stocks and into unloved value names, investors could find it difficult to benefit from discounted prices.

Of the £1.7bn returned to investors in the first half of 2022, around £1.2bn was driven by share buybacks as trusts attempted to keep the discount on their shares low.

Most notably, Monks and Alliance trusts spent £130.9m and £97.5m respectively on buying their own shares.

Shares in the Monks portfolio are selling at a 9.8% discount as returns dropped 28.6% since the start of the year, and Alliance trust is 5.8% cheaper due to its 7.9% dip so far in 2022.

Total return of trusts versus the sector

Source: FE Analytics

These very growth orientated portfolios were some of the worst hit as their style of investing fell out of favour, and were quick to act in keeping their discount under control. Others highlighted by Numis’ analysts included Scottish Mortgage and Polar Capital Technology Trust – two of the worst affected by the market rotation.