Families already under the cosh will take little comfort from the latest wage figures, according to analysts at AJ Bell as, although salaries are on the up, they are struggling to match inflation.

The Office for National Statistics (ONS) released its July labour market overview for the second quarter of 2022, estimating an increase in the employment level by 0.4 percentage points.

This brings the employment rate up to 75.9%, while the number of full-time employees increased to a record high. These figures, however, are still below pre-pandemic levels.

The average total pay including bonuses went up too, up 6.2% from March to May 2022, as shown in the chart below.

Annual growth in nominal total and real regular pay in March to May 2022

Source: Office for National Statistics – Monthly Wages and Salaries Survey

But it is the real-world data that caught the eye of Laith Khalaf, head of investment analysis at AJ Bell, who noted that, adjusted for inflation, total pay fell on the year at 0.9% while regular pay fell of a record 2.8% on the year.

“Wages are rising, but prices are rising much faster. With inflation set to rise even further from here, there looks to be little prospect of the salary squeeze abating any time soon, leaving household finances firmly under the cosh,” he said.

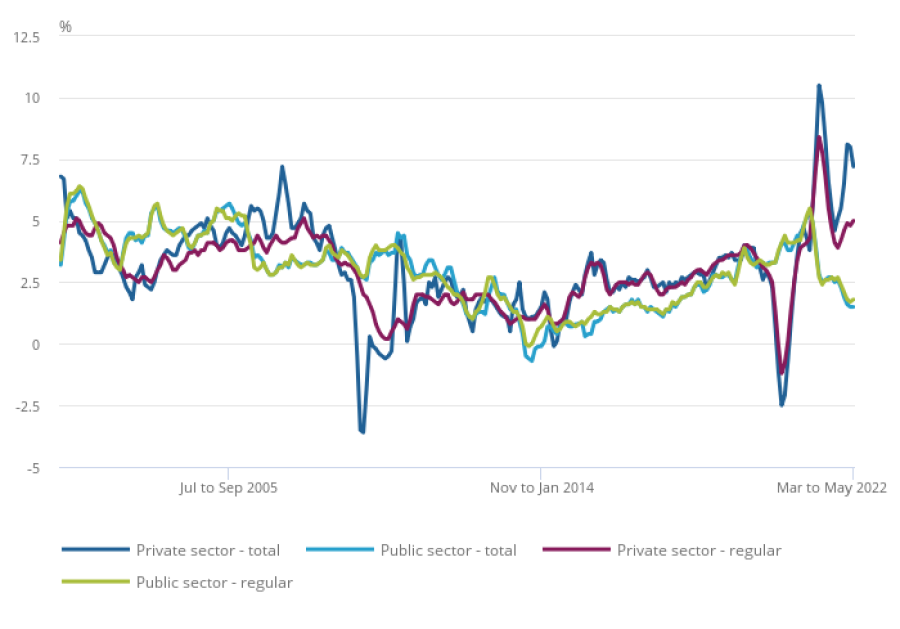

This has particularly affected the salary squeeze is the public sector. The chart below clearly illustrates how the total growth rate is much higher in the private than in the public sector.

Total growth rate in the private and public sector January to March 2005 to March to May 2022

Source: Office for National Statistics – Monthly Wages and Salaries Survey

This, according to Khalaf, should provide some context for the industrial action we are beginning to see emerge in certain sectors.

“It seems the government is exercising pay restraint in the face of runaway inflation, but the private sector is not,” he said, attributing this divergence to the pressures on recruitment that companies are facing.

“Job vacancies stand at almost 1.3 million, slightly greater than the number of unemployed people. Against such a backdrop it’s no wonder businesses are willing to cough up more to get new staff and keep existing employees on the books.”

The latest readings seem encouraging to Khalaf, as they suggest that we may have just crested off the back of the peak and could start to see some normalisation of the labour market.

From April to June, the estimated number of vacancies seemed to have fallen from 1,297,000 to 1,294,000 in March to May.

“But the big concern is that the higher wages paid by the private sector will serve to entrench inflation, while the small pay rises witnessed in the public sector in the face of soaring prices will continue to stoke industrial tensions,” said Khalaf.