Investors could be risking their portfolio’s long-term performance if they shy away from markets in this negative cycle, according to David Coombs, head of multi-asset investments at Rathbones.

It may be tempting to withdraw money when markets are declining and the economic outlook is bleak, but this short-term solution will leave investors feeling regretful over time.

Around £3.6bn has been removed from equity funds between January to May this year according to the Investment Association, but Coombs said that investors should be utilising cheaper share prices to ensure a better recovery when markets pick up again.

He added: “What I know from doing this now for 35 plus years is that your long-term performance is based on three or four crises in your career. You need to get this right – it’s absolutely crucial.

“By investing in those depressed market valuations, you build in a big tailwind to your long-term performance. You miss that and you’re playing catch up for the next five years, so it's absolutely vital that when market turns, you turn with it.”

Rather than reigning back on spending, Coombs has accelerated his investing and allocated a large amount of his cash reserve back into markets.

He held a lot of cash up until the beginning of this year, but has dropped to almost zero over recent weeks as he grabbed new assets at discounted share prices.

“Now is when risk is starting to pay off so I'm spending it,” Coombs said. “That's what you hold the cash for – to use it when those opportunities come along. I’m taking my cash right down because I think it's the most logical thing to do in this market.”

Cash accounts for about 3% of allocations across Coombs’ portfolios now, but many managers have increased their reserves to shelter from market volatility despite high inflation rotting away at its purchasing power.

Coombs pointed out that big players such as JP Morgan are building on their cash reserves, but said that this can be “a sensible thing to do” if you’re in a sector that is being hit by a high number of redemptions.

In his most recent global asset allocation report last month, John Bilton, head of global multi-asset strategy at JP Morgan, announced that the firm would be moving to an overweight position in cash as markets fall further into decline.

He wrote: “We move cash to overweight to have the ability to lean into assets that become dislocated as markets adjust to the weaker outlook over the second half of 2022.

“An overweight cash position gives us the opportunity to take advantage of any such dislocations and distress in asset markets.”

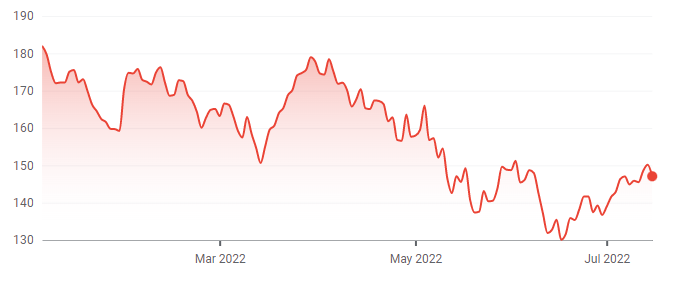

Coombs has already been taking advantage of depressed valuations, adding Apple to his portfolios as the rotation towards value pulls down on the performance of mega-cap US technology assets.

The tech giant has dropped 19.2% since the start of the year and Coombs anticipates that it will “absolutely” get cheaper over the coming months.

Share price of Apple since the start of the year

Source: FE Analytics

Many analysts, such as Russ Mould, investment director at AJ Bell, agree that the valuations of growth stocks are likely to continue falling up until the Federal Reserve stops raising interest rates.

These companies thrived from low rates over the past decade and investors could “catch falling knives” if they time it too early, according to Mould.

Coombs is aware of this, but said that timing markets is a difficult game to play. Instead, he set his own target and waited for Apple to dip below the valuation of luxury goods company, LVHM (which owns the Louis Vitton brand).

He said: “[Buying Apple] has got nothing to do Fed funds rate – that's market timing and I don’t do that.

“The minute Powell steps up and says he’s ending rate hikes, that’s it, the opportunity is gone. The markets will already have gone through the roof, those tech stocks you’ve been waiting to buy are up and you’ve missed the boat.”

IBOSS chief investment officer Chris Metcalfe agreed, noting that if investors wait for the all-clear from Jerome Powell before re-investing, it will already be too late.

He said that the market recovery will be rapid, just as it was after Covid hit markets in 2020, leaving investors a very slim window to act.

Markets were looking pretty miserable after the world stood still in 2020, but the Fed’s announcement that it would be buying corporate bonds was “an absolute game changer”.

Investors “went off to the races” as valuations jumped back sharply and Metcalfe can see a similar scenario occurring when rate hikes are eventually halted.

“I think if Powell came out with one speech where he changed his language slightly and suggested we can potentially see the end of the interest rate cycle, you will see a massive rally in growth assets – absolutely huge,” he said.

“When that happens, there's a risk of being left on the side-lines and then trying to work out how you get back in.”

Everything that investors do now will have an impact on how their portfolio performs in the recovery, according to Coombs. Failing to act on those opportunities the market is presenting will dampen future returns while the rest of the market bounces back.

“I'm totally focused on that recovery,” he said. “I don't know when it's going to be, but I know I've got to buy all the way down. I can’t try and pick the bottom date because I'll never be able to do that, so I add more at every new low because that will drive on next five, maybe even 10 years of performance.”