Funds tackling the transition towards clean energy have been in high demand since over 190 countries signed the Paris Agreement in 2015, giving a sturdy institutional backing to the move towards net-zero.

However, the already popular environmental, social and governance (ESG) movement has been given an added boost this year as tensions with Russia highlight the need for greater energy independence.

Nine European countries are reliant on Russia for more than half their natural gas supplies, something that Tara Clee, ESG analyst at Hargreaves Lansdown, described as “a dependence which is no longer sustainable”.

When the Nord Stream 1 pipeline that supplies Europe’s gas from Russia was turned off for maintenance at the start of July, many panicked at the prospect of it not being switched back on.

It was resumed (at 40% capacity), but the affair underlined the need for more domestic production and Clee said the move towards clean energy will hence be treated with more urgency.

“The rush for renewables is driving further instability in the energy market, as we don’t yet have the infrastructure to support this demand,” she added. “The inconsistency that comes with renewables creates further challenges – and shows the clear need for investment in the sector.”

Here, Hargreaves Lansdown highlights three portfolios it considers best positioned to benefit from the energy transition.

Greencoat UK Wind

The Greencoat UK Wind trust produces energy from its 40 wind farms up and down the country, supplying power to over 1.5 million homes.

It invests directly into the farms and has a majority ownership in 33 of the sites – jointly, they generate 1,422 net megawatts.

The trust has returned 147% since it launched in 2013 and has continued to power 5.6 percentage points ahead of the IT Renewable Energy Infrastructure sector this year, up a second-quartile 12.3%.

Total return of fund vs sector since launch

Source: FE Analytics

Although the trust has consistently outperformed, Clee pointed out that its wind-powered assets’ ability to generate power is reliant on weather conditions, which is something out of the manager’s control.

She also warned that “investors should be aware that it can be harder to sell your shares as there might be limited buyers for the underlying investments”.

That being said, Greencoat UK Wind’s strong performance in difficult markets and yield of 4.8% could present an appealing case for investors.

SDCL Energy Efficiency Income

The SDCL Energy Efficiency Income trust invests in companies that are helping to reduce the amount of power that commercial, industrial and public sector buildings use.

Not only does energy efficiency benefit the environment, but it also reduces power costs – around 66% of energy is lost on the supply side, with a further 25-30% being lost in distribution.

Solutions for this include on-site generation such as heat and power units or solar panels, as well as demand reductions like efficient lighting.

Through these methods SDCL Energy Efficiency Income slashed £500,000 from the energy bill of St Bartholomew’s Hospital in London. With that money, the hospital instead spent it on hiring 15 new nurses.

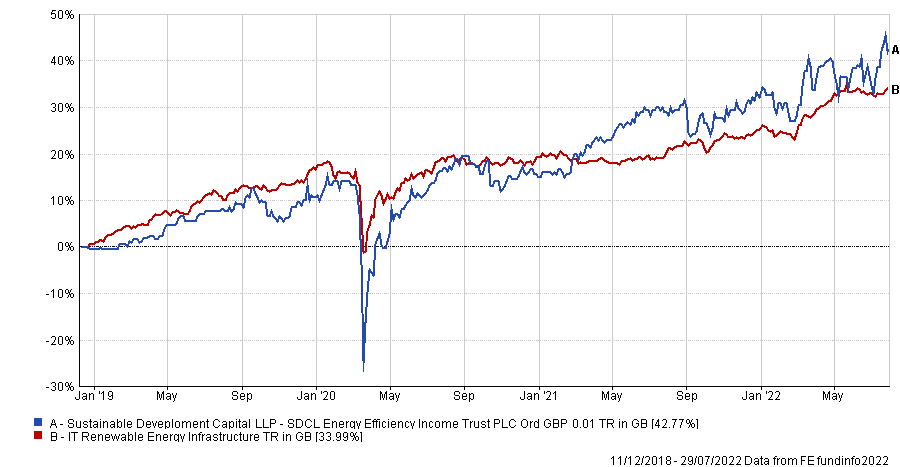

Although it is a relatively new trust, it is up 42.8% since launch in December 2018, beating its peer by 8.8 percentage points.

Total return of fund vs sector since launch

Source: FE Analytics

The £1bn portfolio has continued to outperform in the short term, with making 7.2% since the start of the year.

Gresham House Energy Storage

The Gresham House Energy Storage fund invests in battery storage systems across the UK that hold excess power and reduce wastage.

In 2020, the UK paid wind farm owners £274m in ‘constraint payments’ to switch off turbines when the national grid was at capacity.

Battery storage systems collect this excess energy and stop it going to waste, releasing it when supplies are down and demand is higher.

This also opens up extra revenue streams for the trust – when power stockpiles are low and the national grid is struggling to keep up with the demand, the UK government pays Gresham House Energy Storage a fixed-fee to help out in these situations.

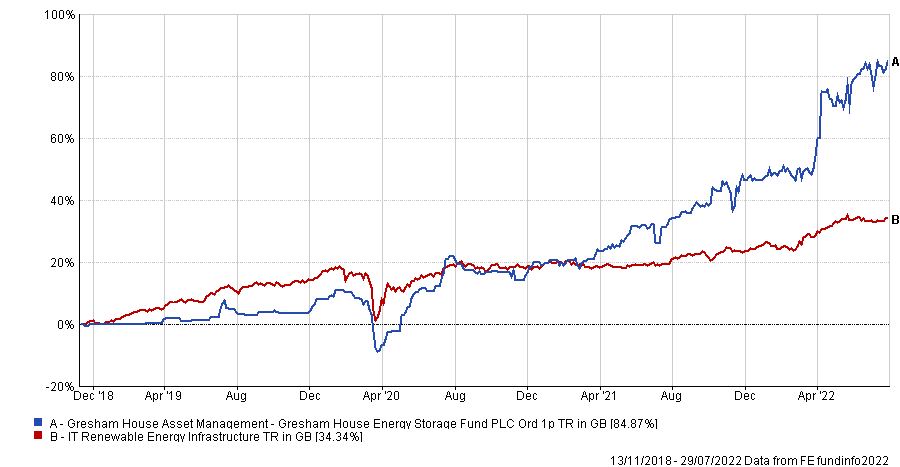

Since launching in 2018, the £850m portfolio has leapt 84.9%, more than double that of its peer group which was up 34.3% over the period.

Total return of fund vs peer group since launch

Source: FE Analytics

Since the start of the year, the trust is up 25.7%, making it the best performing fund in the IT Renewable Energy Infrastructure sector.