Having spent the first half of the year undergoing a heavy sell-off, markets turned around in July and handed investors some handsome returns.

However, one month is a very short time frame and many of the concerns that sparked the volatility – such as soaring inflation, worries over the health of the global economy and the war in Ukraine – have not disappeared.

Jim Wood-Smith, head of research at Hawksmoor Investment Management, said: “The question now being asked is whether we have finally turned a corner, or if July was no more than an overdue bounce. There are no signs that the jury will be returning with a verdict any time soon.”

So while investors await this verdict on the direction of markets, Trustnet has looked at how the first half’s trends in terms of asset classes, geography, industry and investment style were upended in July.

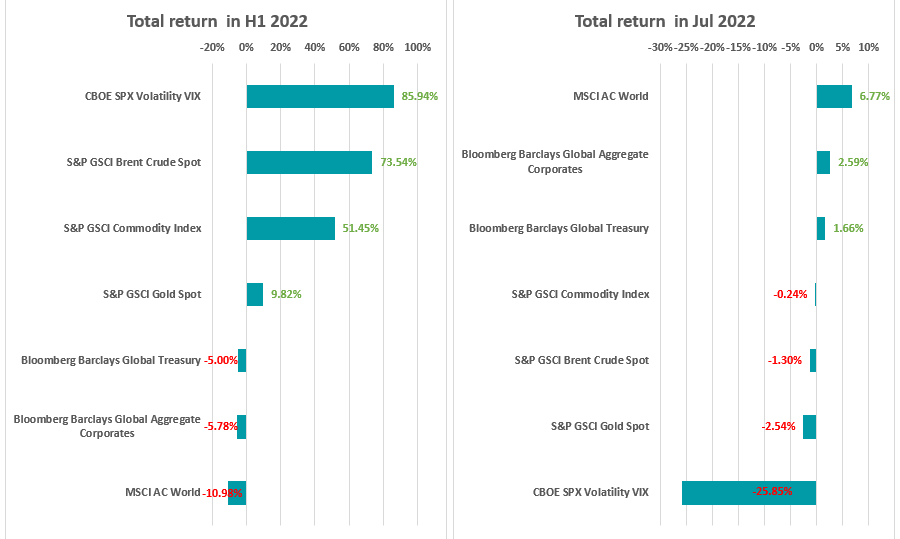

Performance by asset class

Source: FinXL

The first two charts show how the market reversed on the broadest of levels: while global equities (MSCI AC World) were the worst place to be invested during 2022’s opening half after losing 11%, they jumped to the top of rankings in July after making close to 7%.

Conversely, commodities – which surged in the prior six months – posted modest declines as investors started to worry that demand will slump if the global economy goes into recession.

Steven Bell, chief economist EMEA at Columbia Threadneedle, said: “July was an exceptionally strong month for equites – and for bonds – which came as a great relief for investors after one of the most miserable half years in history. So, can we look forward to continuing gains for the rest of 2022? I’d like to be wrong, but I believe that the answer is no.”

Bell pointed out that the rally appears to have been driven by weakening economic data and the expectation that this would prompt the Federal Reserve to ease the pace of its interest rate hikes before cutting them in 2023.

However, he added that the flaw in this view is that it assumes interest rates are close to a level that will subdue inflation and that this can happen without a ‘proper’ recession. In his view, inflation will not fall back to the Fed’s 2% target level without a recession that causes a “significant” rise in unemployment – which would probably come with a fall in corporate earnings.

“It is true that investor sentiment became exceptionally bearish a month ago and most expect a recession,” Bell concluded. “It may therefore be that equities don’t have too far to fall from here, but my guess is that they are still headed lower.”

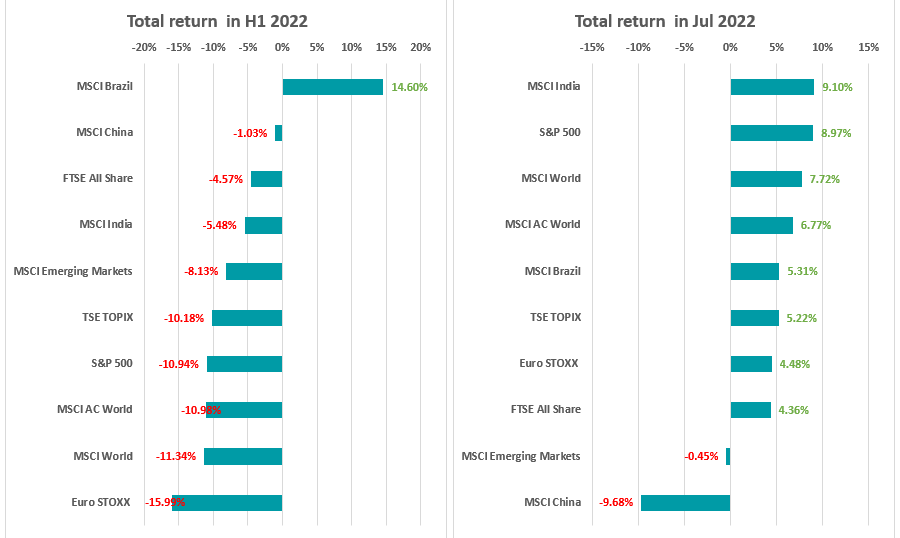

Performance by geography

Source: FinXL

Above, we can see how performance by geographical region changed over the two periods under consideration. The UK, with its overweight to cyclical stocks like oil & gas companies, was one of the best performers in 2022’s first half but made some of the lowest returns in July.

Conversely, the S&P 500 struggled in the six months to June as the US central bank aggressively raised rate. But it was one of the best performers in July, rallying 5% towards the end of the month even though the Fed raised rates and the country was confirmed as going into technical recession.

George Lagarias, chief economist at Mazars, said: “If a year ago, anyone suggested that the US Federal Reserve, the world’s de fact central bank, would produce a triple rate hike, and that this rate hike would be celebrated with a 5% rally in equities, they would probably be laughed out of the room. Yet, last week capped one of the best monthly performances for the S&P 500 in more than two years, despite the US central bank’s aggressive tightening.”

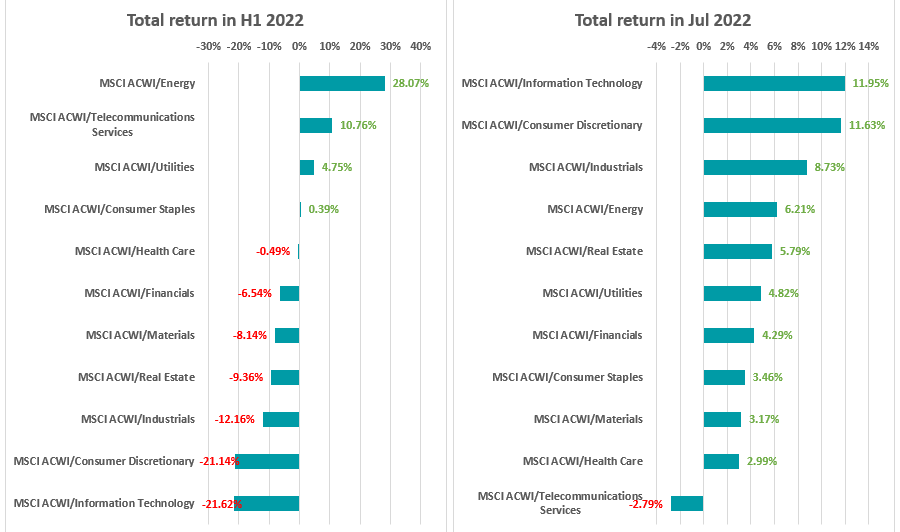

Performance by industry

Source: FinXL

As can be seen, the opening half of 2022 saw most equity sectors make a loss but this reversed in July and every bar telecommunications stocks rose.

One of the most notable turnarounds came from tech stocks. Following a decade of spectacular returns, tech stocks were the hardest hit by rising interest rates as investors became reluctant to pay lofty valuations for future earnings; however, they topped the leaderboard in July thanks to a gain of almost 12% from the MSCI AC World/Information Technology index.

Ben Yearsley, director at Fairview Investing, said: “The performance over the last month shows the problem with trying to time markets. Who would have guessed the response to another 0.75% rate hike would be the best day since November 2020 for tech and Nasdaq?

“At the same time, old economy stalwarts such as banking and oil were releasing good profit numbers and bonds made a recovery. With so much uncertainty, portfolio balance is crucial - don’t have all your eggs in one basket.”

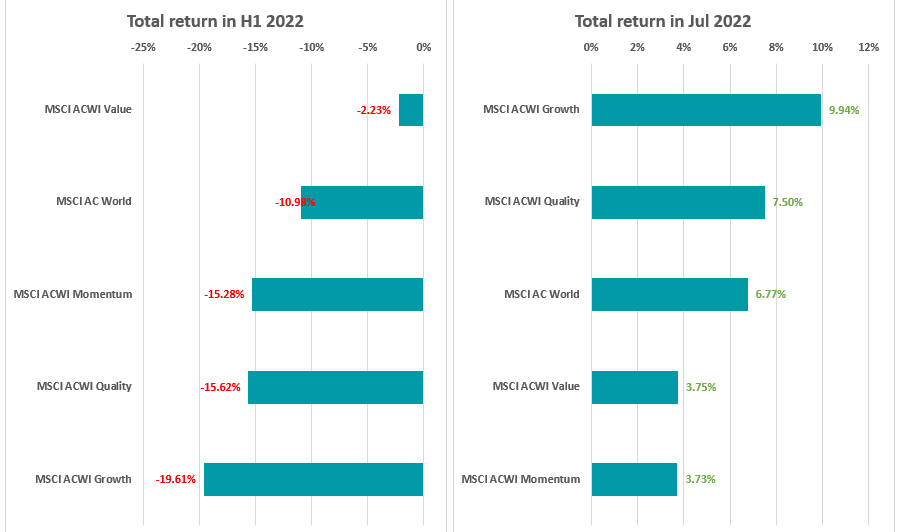

Performance by investment style

Source: FinXL

Our last two charts show the change in fortunes for investment styles between the first half of 2022 and July.

All styles lost money in the first half as markets went through their sell-off, but value stocks held up the best because they tend to outperform in times of rising inflation and interest rates. While value did make a positive return in July, it lost its position as the best performing investment style.

Growth, on the other hand, made close to 10% last month and took to the top spot on the leaderboard. Growth stocks had been the worst performers in the opening six months of the year after rising inflation and interest rates pushed investors towards more cyclical companies.