Ben Durrant of the Pacific Horizon Investment Trust has claimed China is still a “fantastic market” for investors, despite numerous well-publicised headwinds over the past year or so – although he said there are better countries to commit your money to in Asia.

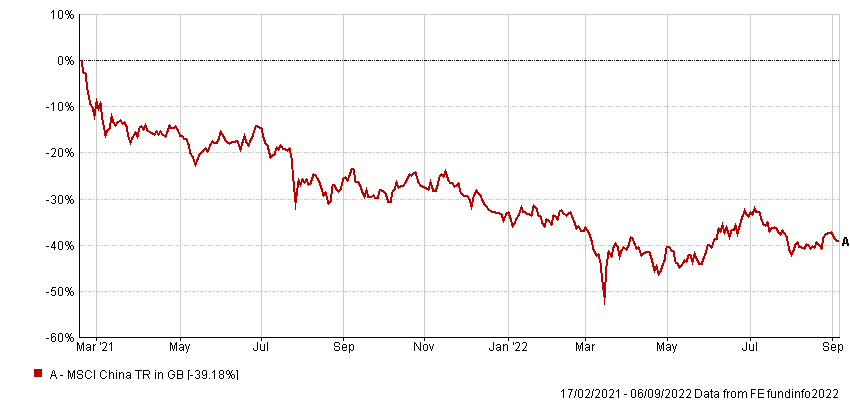

The MSCI China index is down 39.2% since its peak in February 2021, after being hit by heavy-handed state intervention into numerous industries, a housing market collapse, repeated lockdowns and a growth slowdown.

Performance of index since 2021 peak

Source: FE Analytics

Durrant is an investment manager on Pacific Horizon, which has an underweight position in China at 26.6% of assets, compared with 36.2% from the MSCI AC Asia ex Japan index. He admitted that most investors view China as “a complete mess” but noted that the fact so many people have branded it as “uninvestable” has piqued his interest as a stockpicker.

“There are some big challenges there,” he said. “But it's a billion-plus population and there's an entrepreneurial dynamism.

“A lot of reporters and politicians refer to China in a very us-and-them kind of way, and investors exacerbate that – there are only two things you can really do, buy it or sell it. You can't even visit it to get any nuance now.

“But when people see it in that kind of way, it makes us excited about finding companies that are addressing big problems.”

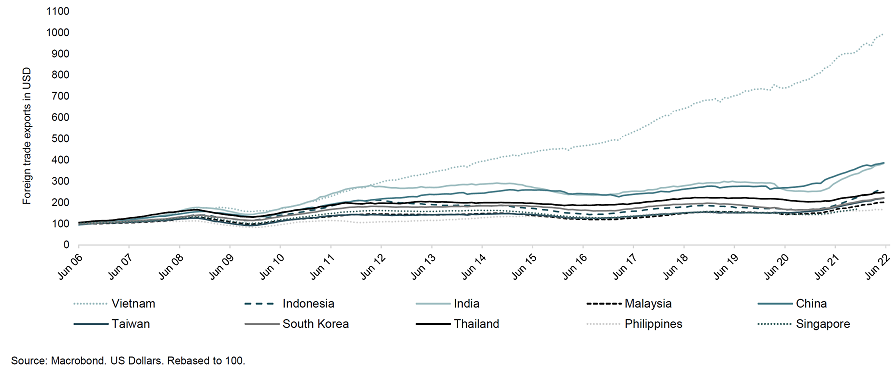

While he is more positive on China than some of his peers, Durrant said this is not where he is finding the biggest opportunities. For example, he referred to Vietnam as “simply the best long-term growth story on a country level in Asia”, pointing out it has increased exports 10-fold over the past 15 years to $300bn, before adding: “That's probably still peanuts in terms of the global opportunity.”

“If any companies are looking at diversifying exposure away from China, they're looking very hard to Vietnam – it's in the right place geographically and geopolitically, and it's got the competence to really serve some of these companies,” he said.

Asian exports

However, the trust only has 5.5% of assets in Vietnam, as there aren’t enough companies there that are big enough for the managers to express their positive view. Instead, the trust’s biggest overweight position is to India.

Durrant noted that 300 million people have come online in Asia in the past two years, allowing them to leapfrog old physical infrastructure and weak local knowledge pools, and start small businesses that wouldn’t previously have been viable.

The manager said India is the best example of this, in part thanks to a growing trend among expatriates returning from promising careers in US tech companies to help tackle the problems in their home market.

Examples Durrant has met in the past month include a founder who previously worked at Intel, Google and Microsoft. He returned to India to launch a LinkedIn-style site helping match rural grey- and blue-collar workers with jobs. It has already recruited for 100 million positions, although Durrant admitted this included a lot of double counting due to the temporary nature of many of the roles.

Another example involved an entrepreneur who built a WhatsApp-based system that organises grocery logistics more efficiently than traditional routes.

“These are real and significant problems being solved,” Durrant continued. “This isn't some of the venture money we've seen flying around in the West, helping people like us get vouchers to have ice cream and wine delivered to our doors a few seconds quicker. These are real problems being solved for billions of people.”

Durrant said his favourite example is Reliance Industries’ founder Mukesh Ambani, who made a “stupendously ambitious bet” 10 years ago by spending $40bn to build the world's best 4G network from scratch.

“It’s the kind of bet only billionaires can really make, and he did it mainly to prove people wrong,” the manager continued.

“Now India has the cheapest data in the world. Some of those businesses I mentioned before have been enabled by that and the government is building on top of it as well.”

This technology revolution is not the only way in which India is being modernised. The introduction of pro-business reforms and the removal of archaic laws are helping it become more competitive against its emerging market peers, which many businesses are using to their advantage.

For example, the trust’s largest holding in India is the logistics company Delhivery, which is used by the majority of multi-national e-commerce companies that have opened hubs in the country.

“Up until about six years ago, all of India's 29 states had different tax systems, which meant that moving goods was a tremendous challenge,” Durrant continued.

“A journey from Mumbai to Delhi should take about a day, but it would often take four days. You had to have your paperwork checked at the state border, and if you got it wrong, your goods would have to get unloaded and checked, then you would have to pay a fee to the border guards.

“The outcome was that all of the logistics companies focused on their individual states and there were few truly national Indian players. Delhivery came along shortly after the introduction of the Goods and Services Tax, investing heavily. It has a massive advantage in being able to outcompete those purely local players there.”