Although bonds have historically offered protection against recession, investors should turn to defensive multi-asset strategies and equity income funds this time around, Hargreaves Lansdown analysts argue.

The UK is expected to go into recession by the end of 2022 and spend the bulk of the following year in this state, leading many investors to ask how to protect their portfolios.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said: “While the UK may be heading for recession, this isn’t new news for investors. As the market is already anticipating recession, much of the bad news is reflected in stock market prices. During the Covid-induced recession in 2020, and the global financial crisis of 2008-09, bond funds held up relatively well.

“Traditionally, bonds are a safe haven during tougher times for the market. But investors should be mindful the environment we’re in now is different. In the previous two recessions, the Bank of England slashed interest rates, making investments in bonds and the income they pay more attractive.”

However, today the Bank of England is raising interest rates to curb inflation. Marshall pointed out that this makes bonds less attractive and recommended investors look at multi-asset funds and dividend-paying funds instead, highlighting one of each that the platform likes.

First up is the £6.4bn Trojan fund, which is run by Troy Asset Management’s Sebastian Lyon with Charlotte Yonge as deputy. Like all of Troy’s funds, balancing returns with capital preservation is a priority for Trojan and the managers seek to do this by allocating to four pillars of quality stocks, index-linked bonds, gold and cash.

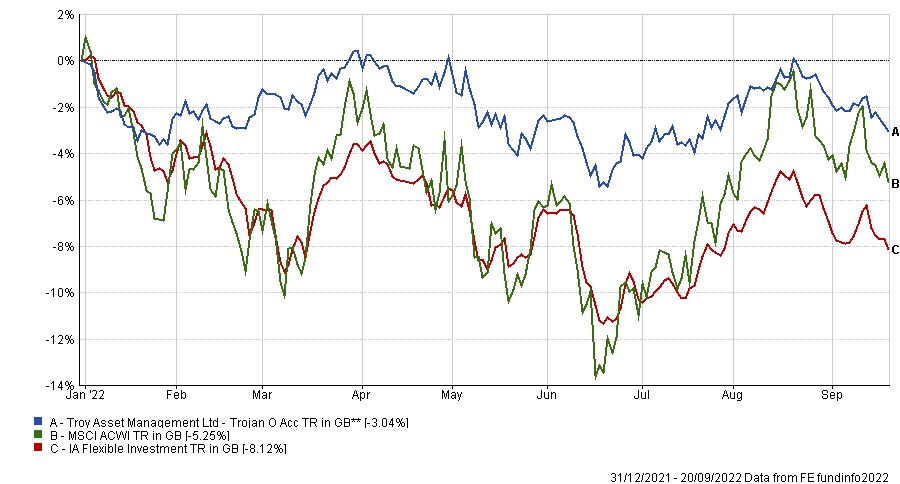

While Trojan’s cautious stance means it has underperformed its average IA Flexible Investment peer over the long run, with a bottom-quartile total return of 55% over 10 years versus 85.6% from the sector, it comes into its own in tough markets. As the chart below shows, it has outperformed its peers and global equities by a decent margin while markets have been sinking this year.

Performance of fund vs sector and index in 2022

Source: FE Analytics

Marshall said: “With an expectation that markets will be volatile while there is continued economic uncertainty, a total return fund like Troy Trojan could be a good choice. It typically invests in a mix of investments including shares, bonds, commodities and currencies. This could help provide modest growth over the long term and help provide some shelter when stock markets fall.

“The fund tries to experience less ups and downs than the broader global stock market or a portfolio that's mainly invested in shares. As a result, it could form the foundation of a broad investment portfolio, bring some stability to a more adventurous portfolio or provide some long-term growth potential to a more conservative portfolio.”

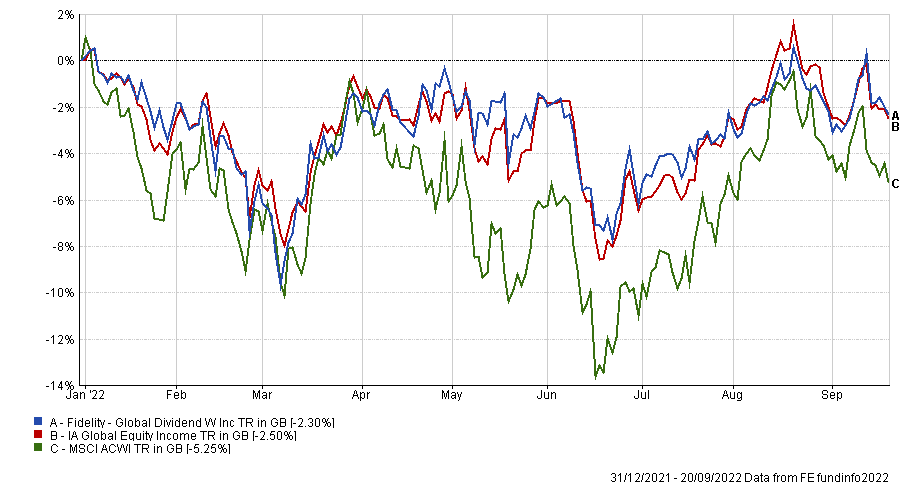

Hargreaves Lansdown’s second pick for a fund to protect against recession is Fidelity Global Dividend. Managed by Daniel Roberts, the fund has slightly outperformed its average peer this year and has held up better than global equities; over 10 years, its 188.9% return is comfortably ahead of the 138.8% made by the average IA Global Equity Income fund.

Roberts’ approach focuses on companies' profitability over a three-year time horizon and he has established a reputation as a genuine long-term investor, who is willing to back his long-term holdings against short-term market noise.

Performance of fund vs sector and index in 2022

Source: FE Analytics

“The Fidelity Global Dividend fund aims to deliver long-term income and growth, with a focus on providing some shelter in weaker markets. The manager’s unconstrained investment approach allows him to invest anywhere in the world, but he tends to favour large companies from developed markets. He won’t compromise on quality and is mindful of valuation – how much a company’s share price should be compared with its prospects,” Marshall said.

“The fund could provide international diversification to an income-focused investment portfolio and work well alongside ‘growth’ orientated funds. There’s a broad range of themes in the fund with a focus on more defensive sectors like consumer staples and pharmaceuticals.”