Investors are getting more interested in equity income funds at the expense of growth strategies such as Fundsmith Equity, CFP SDL UK Buffettology and those run by Baillie Gifford.

With millions of pageviews on funds in the Investment Association universe, the activity in Trustnet’s fund factsheets can offer an insight into the research trends of investors.

To see what these trends looked like in recent months, this article took the share of factsheet views each fund captured in 2022’s third quarter and compared it with the research share over the previous 12 months. This allowed us to see what is becoming more or less popular with our users.

As the below chart shows, the peer group with the biggest increase in factsheet views during past three months was IA Global Equity Income. It accounted for 4.1% of the Investment Association pageviews on Trustnet during the third quarter – up from 3% over the previous 12 months.

Change in Investment Association research share during Q3

Source: Trustnet

On a similar note, there was an increase in the amount of research going into IA UK Equity Income funds. They made up 5.9% of pageviews in the third quarter, up from 5.1% over the 12 months before.

Part of the increase in interest in equity income funds can be attributed to the surging inflation that has dominated 2022 – investors could be looking for funds that can generate a level of income that is competitive with rising prices.

In addition, it could be linked to growing worry that the global economy is heading into a recession. Equity income funds tend to invest in companies with strong balance sheets and cash flows, which can hold up better in time of economic difficulty and market volatility.

The IA Global Equity Income funds that grew their Trustnet research share by the most in the third quarter were Guinness Global Equity Income, Vanguard Global Equity Income, JPM Global Equity Income, Trojan Global Income and BNY Mellon Global Income.

Over in the IA UK Equity Income sector, BNY Mellon Equity Income Booster, BNY Mellon UK Income, Fidelity Moneybuilder Dividend, Vanguard FTSE UK Equity Income Index and Allianz UK Listed Equity Income were the funds that Trustnet users were more interested in than over the previous 12 months.

This increase in equity income strategies came at the expense of the growth-orientated sectors.

The IA Global sector accounted for 16.3% of pageviews on Trustnet over the 12 months to the end of June 2022, but this declined to 13.3% in the third quarter.

Well-known global funds that Trustnet users were researching less often during the past quarter include Baillie Gifford Positive Change, Baillie Gifford Global Discovery, Fundsmith Equity, Rathbone Global Opportunities and LF Blue Whale Growth.

IA UK Smaller Companies, IA UK All Companies, IA Europe Excluding UK, IA Technology and Technology Innovations and IA Global Emerging Markets were other sectors that Trustnet users were less interested in.

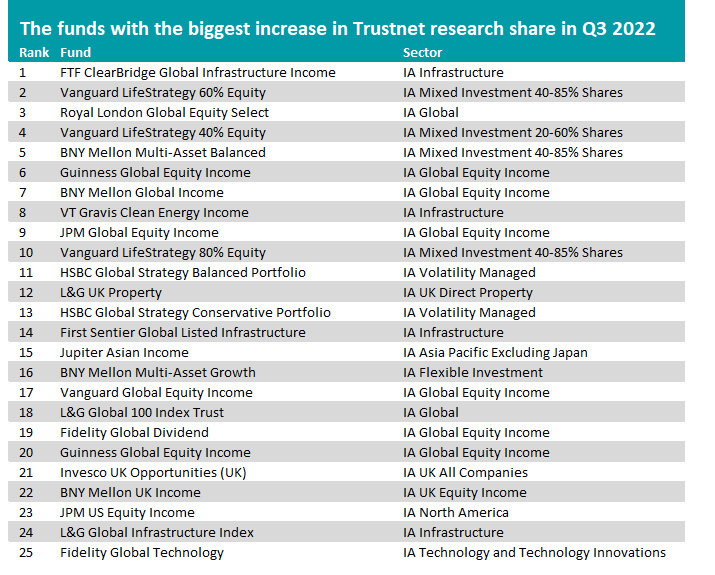

When it comes to individual funds, the 25 with the biggest increases in research share on Trustnet can be found in the table below.

Source: Trustnet

Several on the list are global and UK equity income funds mentioned earlier in this article as well as some more targeted strategies such as VT Gravis Clean Energy Income, Jupiter Asian Income and JPM US Equity Income.

However, the fund with the biggest increase in research activity is FTF ClearBridge Global Infrastructure Income, while peers such as First Sentier Global Listed Infrastructure and L&G Global Infrastructure Index also appear in the table.

Investors have grown more interested in infrastructure funds as inflation has continued to rise because they tend to own assets that can grow their earnings in line with inflation. This has allowed the IA Infrastructure sector to post a small positive return in 2022, while many other peer groups have been hit with losses.

The table below shows the 25 funds that have suffered the biggest falls in their Trustnet research share over the past three months. It suggests that, as investors have been looking for different ways to keep up with inflation, they have been spending less time researching some of the bigger funds that are struggling this year.

Source: Trustnet

Many of the listed funds are managed by Baillie Gifford, which enjoyed incredibly strong returns when interest rates were low and the growth stocks it specialises in surged. However, now rates are rising and growth stocks are suffering, many of the group’s previously sector-leading funds have dropped to the bottom of the performance tables.

Other funds on the list that have made lacklustre returns this year and found themselves being researched less by Trustnet readers include Fundsmith Equity, Rathbone Global Opportunities, GAM Star Disruptive Growth, CFP SDL UK Buffettology and abrdn Global Smaller Companies.