Most young people won’t be able to retire until much later than their target age of 60, according to a new study by Evelyn Partners, in partnership with the Centre for Future Studies.

Data indicated that, with longer retirements to fund, more complex family structures, and a significant risk of job loss because of automation and tech advancements, people face “an even more challenging path to retirement” over the next two decades.

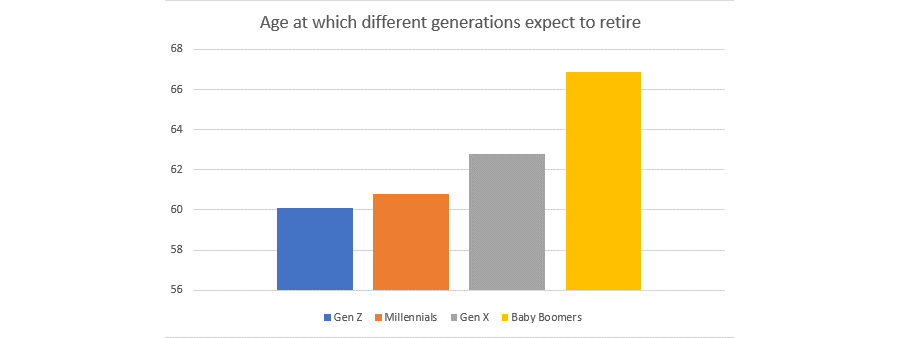

Generation Z (aged 18 to 24) and millennials (aged 25 to 34) aim to retire at the age of 60, according to the survey, but few will find this to be a realistic goal.

“It will require these generations to fund a 25-year retirement, at a time when the cost-of-living shows no signs of moderating,” the report said.

Source: Evelyn Partners

By 2040, retirement will be two years longer than the average retirement today, due to improvements in health, lifestyles and science, which will prolong life, the report found.

Based on Evelyn Partners’ analysis of the PLSA Retirement Living Standards, which adjust for inflation, this extension of just two years will require single retirees to save an additional £67,200.

However, there will also be constraints on the state pension in the 2040s, as the number of people at pensionable age per 1,000 of the population is likely to rise from 280 in mid-2020 to 341 by mid-2045.

“With the proportion of people of pensionable age outgrowing the working population in the 2040s, public finances could be put under even more strain and could see the state pension age raised further, thereby making millennials’ aspirations to retire at the age of 60 even more unrealistic,” the report said.

“The Centre for Future Studies has forecast that with this outlook for UK demographics, it is a near given that the state pension age will be raised to 69 in 2041.”

This is in stark contrast to the dream promised to previous generations, said Dr Frank Shaw, foresight director at the Centre for Future Studies, who noted that, historically, the road to retirement has been linear.

“The transition from retirement to working has been distinct and final, with many people being fortunate enough to retire once they hit the milestone age of 65,” he said.

“In the future, the milestone of retirement is going to be even harder to reach and an automatic retirement at the age of 65 will be for the fortunate few, rather than the many.

“In the past, working and being retired were two contrasting points in life; however, in the future, they will become blurred as the UK’s ageing population will need to financially supplement its increased longevity.”

However, it is not just the future generations that will struggle, according to the report. Those currently in or around retirement age also have problems.

The report found that baby boomers had postponed their retirement by four years and a quarter and many have been forced out of retirement to enhance their income during the current cost-of-living crisis.

Henrietta Grimston, associate director of financial planning at Evelyn Partners, said: “People reaching the age of 65 today are younger [relative to life expectancy] and healthier than they were 50 years ago.

“Now as people enter their ‘golden years’, there is a bigger demand for an active, varied and exciting lifestyle. Retirement has become a chapter when people can tick off life milestones from their bucket list, doing things they couldn’t do when they had busy careers.”