Technology is a vast sector that can be difficult to navigate. It encompasses different types of areas and companies, not all of which are as attractive as the next and prosper in the same conditions.

The sector as a whole has been one of the biggest – and perhaps most surprising – losers this year as the market rotated from growth to value. Investors have moved into income-generating, cheaper investments as inflation and interest rates have risen, moving away from long-term growth stocks that have been valued at a high price.

But, with the tech-heavy Nasdaq index now down 18.7% year-to-date, as shown below, one of the well-publicised discussion areas around ‘big tech’ has recently been where valuations ought to normalise following months of volatility and a 10-year bull market for the sector.

According to Chris Elliott, manager of the Evenlode Global Equity fund, tech valuations have come down sufficiently to offer selective opportunities.

While he believes that the market can fall further still, there are resilient businesses with long-term growth rates for which this looks “a very attractive entry point”.

Below, Trustnet gathered three such areas where experts believe interesting opportunities can be found despite the headwinds.

Performance of index year to date

Source: FE Analytics

Enterprise resource planning

Jacob Mitchell, chief investment officer at Antipodes Partners, said several resilient businesses in the enterprise software space that suffered a widespread drawdown in valuations over recent months fit the bill.

“We believe larger market leaders in the space are well placed to outcompete many of the single-feature companies, where high-growth rates will deteriorate rapidly in a more testing economic environment,” he said.

Enterprise resource planning (ERP) refers to software that is designed to improve finance department back-offices and logistics productivity.

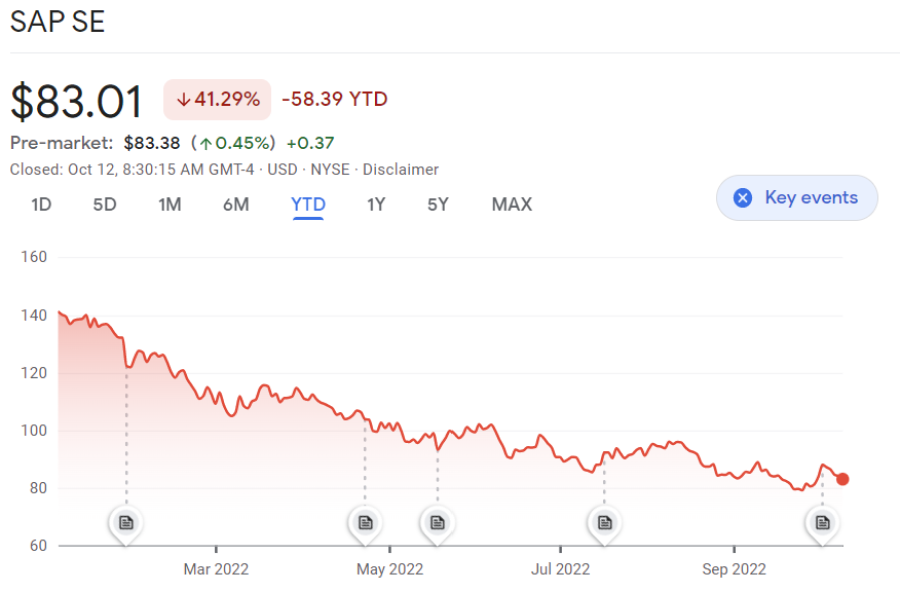

In this space, Mitchell highlighted SAP, a near pure-play in back-office software applications, and the largest global ERP provider with a market share of almost 30%.

“SAP is expected to gain share as its customers migrate to the cloud, because it benefits from approximately a 2-3x revenue uplift as on-premises maintenance and support revenue transitions to cloud subscription revenue,” he noted.

“Its €11.4bn of on-premises maintenance and support revenue in 2021 can transition to €22.8-34.2bn of cloud revenue. As more customers adopt the cloud, SAP should also benefit from economies of scale in cloud costs and margin.”

According to Mitchell, investors dismiss SAP too quicky as a legacy on-premises solution ripe for disruption by new cloud-native start-ups.

“The reality is that ERP is a research and development intensive sector, and there have been very few entrants into this space, particularly targeting the large enterprise segment. Outside of the top ERP vendors, smaller competitors have limited competitive cloud offerings,” he said.

“A quality defensive business, SAP is trading on a 25.9x forward P/E [price to earnings ratio]. This is cheaper than other defensive parts of the market, such as consumer staples. SAP is also expected to grow at a faster rate than the consumer staples sector, without facing the same inflationary pressures.”

Performance of stock year to date

Source: Google Finance

Healthcare technology

Ken Wotton, manager of the Strategic Equity Capital investment trust, selected healthcare technology company Medica Group.

The company uses digital communications, and increasingly artificial intelligence (AI) software, to support healthcare professionals processing radiology results into diagnoses.

Technology is becoming increasingly important in areas such as brain scans where imaging and diagnoses are particularly complex, explained Wotton, whose interest in this sector derived both from observations on demand and supply and on valuation.

“The healthcare sector was under immense pressure from structural demand drivers even before the pandemic, which has then added an additional backlog which will drive earnings higher up in the short term. But demand will be even higher in the long term due to fiscal budget pressures and a greying population, to which Medica will be in a great position to supply.”

Growing use of outsourcing and AI technology is a clear solution to the above problems as it will expand the available services to clients, yet Medica trades at a 50% discount to private equity transactions for similar businesses.

“In this context, Medica’s discount is attractive and could give it a chance to outperform big tech on valuation grounds over the long term as markets recognise and correct this,” Wotton said.

Performance of stock year to date

Source: Google Finance

Hyperscalers

Lastly, Evenlode Investment portfolio manager James Knoedler and fund manager Chris Elliott said hyperscale computing is “an attractive space to be”.

Hyperscaling, or the ability to provide and add computer, memory, networking, and storage resources to a digital environment, is necessary in order to build robust and scalable cloud, big data or distributed storage systems.

“We're still really in the early innings of the cloud migration, as only 30% of businesses have successfully moved to the cloud today, and we expect that number to go up to around 70% or 80%.”

Not only will this shift require large volumes of computing power, but the amount of data created will create an increased need for processing and storage.

“All of that just leads straight through to the bottom line for hyperscalers,” said Elliott.

Amazon, Google and Microsoft, all have remained very competitive in this space, even if cloud computing is not necessarily a dominant narrative for these stocks.

All three cloud providers are well positioned to take advantage of this trend, having all taken up different roles in the market.

“Microsoft remains fantastic for business packages, while Amazon Web Services is absolutely perfect for cloud native software packages or app development, and AI processing is Google’s niche,” he added.