Inflation is now embedded in the US economy, having spread into sectors with no exposure to its original drivers, according to Fahad Kamal, chief investment officer at Kleinwort Hambros.

However, it is not all bad news, with Kamal’s colleague Thomas Ghelen, a senior market strategist at Kleinwort Hambros, saying there are signs that the Federal Reserve’s tightening cycle is already starting to work.

US headline CPI inflation now stands at 8.2%, having steadily fallen from its cyclical peak of 9.1% in June, yet there has been no positive reaction from markets to this downward trend. Kamal pointed out this is because the overall decline lags well behind the fall in energy prices, meaning that inflation is no longer being driven by external shocks.

“Energy has fallen from more than 30% of the CPI basket to less than 20% in the past few months, and that’s what has driven headline inflation to fall,” said Kamal.

“But the big problem is it has spread into areas far beyond commodities or supply chain-related issues.

“You'd imagine physician services are relatively immune from the vagaries of the global commodities market.

“But this has gone from less than 1% of the basket to 1.8% over the last few months. Why? One reason is a very, very tight labour market. People are demanding higher wages. That is what's scaring the Fed more than anything.”

Kamal said this means investors who are pinning their hopes on a near-term pivot – when the Federal Reserve switches from hiking to cutting interest rates – are likely to be disappointed.

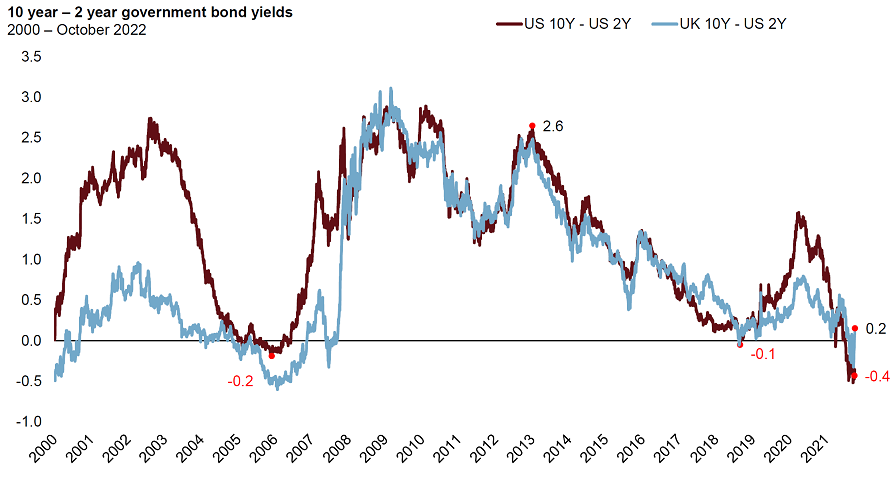

Yet he admitted that, to a certain extent, this contrasts with what the bond market is predicting, with yields on 10-year treasuries at their lowest point this century relative to their two-year counterparts.

UK and US yield curves

Source: Kleinwort Hambros

“The two-year yield is more reflective of where the Fed policy rate is going to be, while the 10-year yield is much more reflective of future inflation expectations,” Kamal explained.

“Basically, the bond market is telling you that while the Fed may raise rates a little bit more now, eventually it’s going to have to turn around and pivot quite aggressively because we're going to be in a recession.”

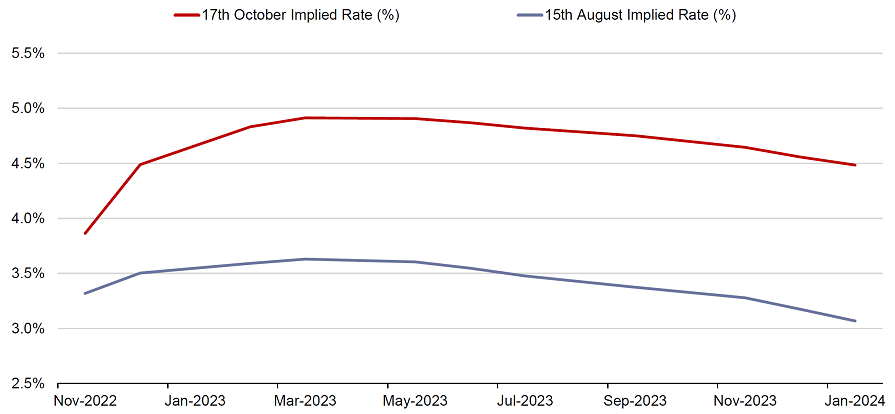

Pessimism remains the dominant emotion in markets, but Kamal said it is important to consider how quickly this can change. For example, he highlighted the spike in interest rate expectations which followed the release of August’s inflation figures and the subsequent sell-off in equities.

Fed funds rate projections

Source: Kleinwort Hambros

Yet with markets positioned for further shocks, he said there is now more room for a surprise to the upside.

“For what it's worth, when US rental inflation starts to go backwards, that’s when you will see a big expectation of the Fed pivoting. It may come out of the blue and surprise everybody. Nobody knows what the future holds and expectations can change on a single number.”

Thomas Ghelen, senior market strategist at Kleinwort Hambros, said there are already signs that the Federal Reserve’s tightening cycle is having an impact, whether that is in fewer building permits being granted, business forecasts being lowered or falling interest rate spreads.

As a result, Kamal bucked the market consensus by praising the central bank, which has been accused of falling behind the curve in bringing inflation under control.

He justified this by pointing out it is not the job of the Federal Reserve to worry about current inflation, as this is impossible to control.

“Current inflation can rise for all sorts of reasons,” he explained. “Think about orange juice being an important contributor to the inflation basket in Florida.

“If you have a frost and all the orange crop is gone, suddenly inflation has risen a lot. And that's not the fault of central bank policy. Exogenous shocks happen. The Fed’s real mandate is to make sure that long-term inflation expectations don't become unanchored, and it’s done a pretty good job.

“With the benefit of hindsight, it clearly lost that narrative earlier in the year. But it has reclaimed it now, and inflation expectations have come down quite aggressively and are roughly in line with its 2% mandate.”

He added: “While the Fed has been pilloried, it deserves a lot of credit.”