Just under 60% of funds in the Investment Association universe have made a double-digit loss over 2022 so far, research by Trustnet has found, with far fewer achieving double-digit positive returns.

Markets are still in a rocky state as the headwinds that have plagued 2022 – such as surging inflation, rising interest rates, fears of a looming recession, Russia’s invasion of Ukraine, China’s zero-Covid policy and UK political uncertainty – show no signs of going away.

With stocks, bonds and many alternatives falling into the red this year, funds have had few places to hide and FE fundinfo data shows that only 10.6% of the 5,029 funds in the Investment Association universe made a positive return over 2022’s first 10 months.

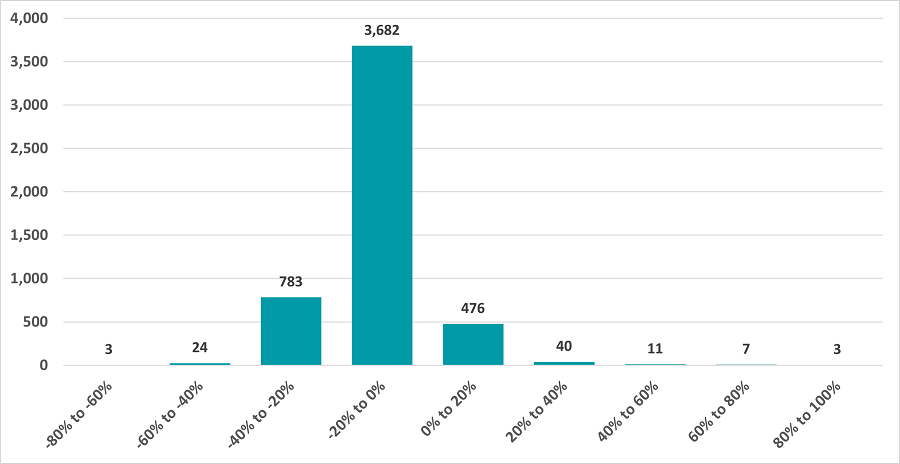

The below chart breaks 2022’s total returns down by various bands and most funds find themselves in the cohort that is down between 0% and 20%. There’s a fairly sizeable group of funds that are down between 20% and 40% while 27 have lost between 40% and 80%.

Source: FE Analytics

When we dug a bit deeper into the numbers we found that 2,982 of the 5,029 funds – or 59.3% – have made a double-digit loss this year. This compares with just 148 funds (or 2.9%) that are up by 10% or more over the same period – so 20 times more funds are down by double-digits.

Some sectors have fared better than others, of course.

There are four where every single fund is sitting on a double-digit loss: IA China/Greater China, IA European Smaller Companies, IA UK Index Linked Gilts and IA UK Smaller Companies. Meanwhile, no funds in the IA India/Indian Subcontinent, IA Latin America, IA Short Term Money Market and IA Standard Money Market have fallen to this extent.

The IA Global and IA UK All Companies sectors – the two largest peer groups – sit in the middle of these two extremes with around half of their members down by 10% or more in 2022.

Turning to that handful of funds to make double-digit gains this year, every member of the IA Latin America sector has achieved this. But this is the only sector that can make this boast: IA Commodity/Natural Resources comes in second place but only 55.6% of its members are up by 10% or more while the stat stands at just 29.4% for third-placed IA USD Government Bond.

There’s a far more extensive list of sectors where not one member has made double-digit returns – 33 in total, including IA UK All Companies, IA UK Equity Income, IA UK Smaller Companies, IA Sterling Strategic Bond, IA Sterling Corporate Bond, IA Japan, IA Europe Excluding UK and IA Asia Pacific Excluding Japan.

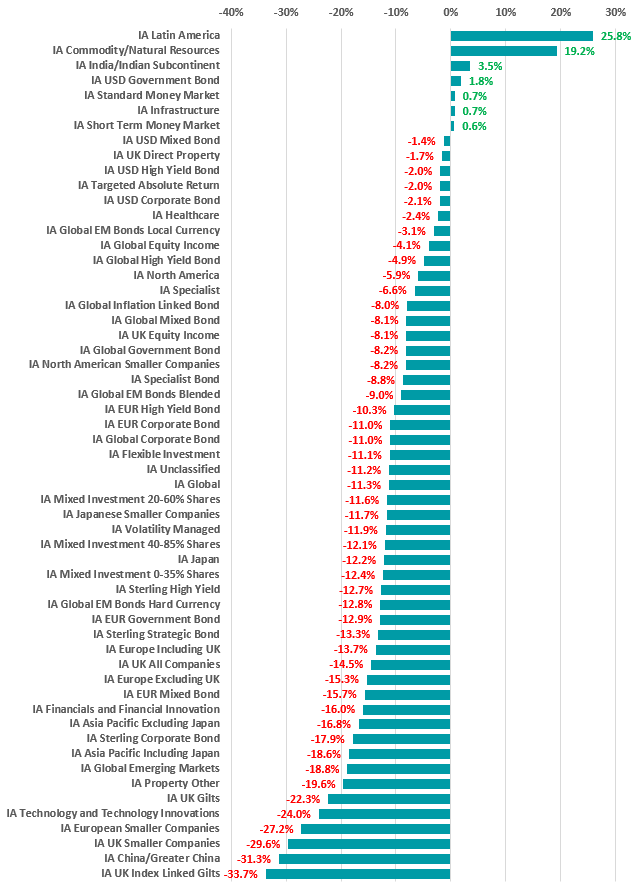

Given the dire statistics presented above, it should come as little surprise to see that most of the 57 Investment Association sectors are showing average losses for 2022 so far.

Source: FE Analytics

Only seven sectors are in positive territory and two of these are for money market funds. The average IA Latin America fund is up 25.8% while the typical IA Commodity/Natural Resources fund has made 19.2%; both of these can be attributed to the surge in commodity prices that came with the end of the Covid lockdowns and the war in Ukraine.

The chart above shows some pretty hefty losses, with the average IA UK Index Linked Gilts fund losing one-third of its value over the course of the year as surging interest rates and sterling weakness created strong headwinds.

IA China/Greater China is down by a similar extent, with the country’s zero-Covid policy acting as a continued headwind on growth, the property market spluttering and regulatory crackdowns on sectors such as technology and education hampering investor sentiment.

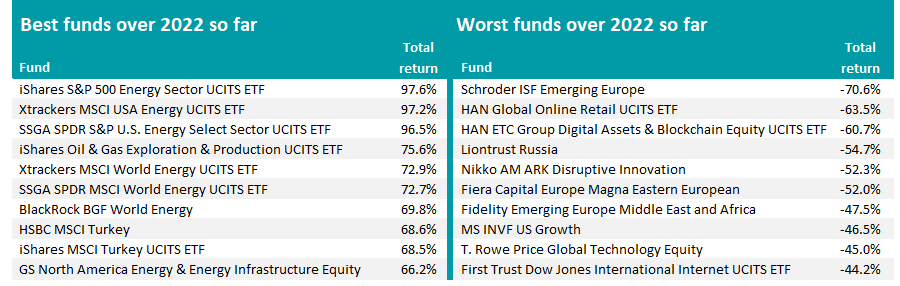

These themes are reflected in the best individual funds. As the table below makes clear, the strongest returns tend to have come from funds that focus on energy stocks, which have been buoyed by rising oil & gas prices.

The worst performers, on the other hand, are more of a mixed bag but tend to fit into two camps: eastern European funds, where losses stem from Russia’s invasion of Ukraine; and funds that invest in growth or tech stocks, which have sold off as higher interest rates make investors less willing to pay up for their future earnings.

Source: FE Analytics