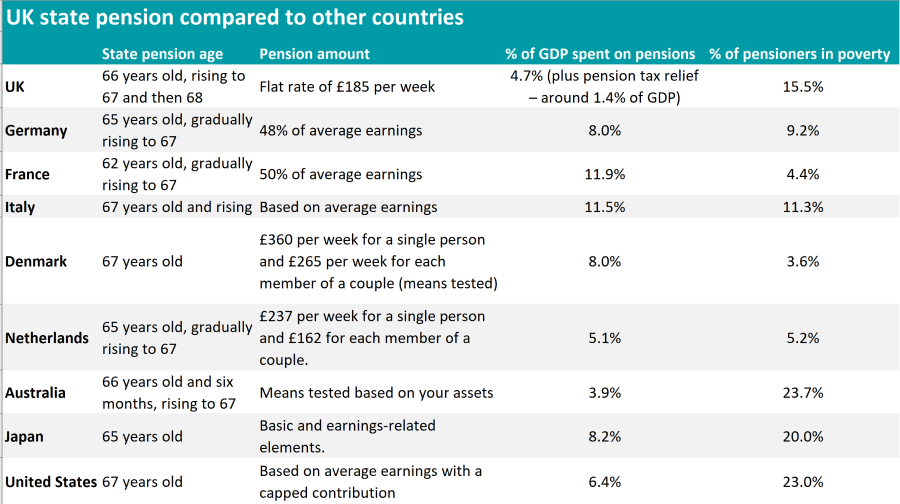

The UK spends very little on state pensions compared to other European countries and has the highest percentage of pensioners in poverty, despite tax reliefs on workplace and private pensions, according to data from interactive investor, which compared state pensions across Europe, Australia, Japan and the US.

The UK government only spends 4.7% of GDP on state pensions, much less than many other countries in Europe, as shown in the table below.

This, combined with increasing fiscal pressure on the older generation, makes it harder for investors to save for a comfortable retirement, said Alice Guy, personal finance expert at interactive investor.

Source: interactive investors

The UK state pension is a two-tier system, with a safety-net flat-rate pension designed to keep pensioners out of poverty and then the private pension system, which is supported by tax reliefs.

However, even if the £43bn spent on pension tax relief is added in, which amounts to an additional 1.4% of GDP, government spending on pensions is still lagging behind most countries in Europe.

Pensioner poverty at 15.5% suggests that many pensioners are struggling to supplement the flat-rate UK state pension, according to Guy.

“Given the UK pension system’s reliance on private pensions, it’s essential the government safeguards pension tax relief [in next week’s Budget]. If tax relief is reduced, it would damage the whole UK pension system and make it much harder to save for retirement.”

But growing fiscal pressure is complicating the situation even further. The lifetime allowance, for instance, or the total amount you can build up in all your pension savings without incurring a tax charge, has not been increased since it was introduced in 2006.

At today’s inflation rate, this means it effectively shrank by £1,249,483 in real terms.

"The shrinking lifetime allowance makes it harder for investors to save for the future. The current £1,073,100 may seem generous, but it amounts to an annual income of just over £32,000, (assuming withdrawals of 3% per year), around the UK average wage,” said Guy.

"There’s a danger that fiscal drag makes it harder for investors to save for a comfortable retirement.”

The same goes for the inheritance tax, which is also impacted by fiscal drag as the £325,000 nil rate band has stayed the same since 2009.

“There’s a danger that reducing annual allowances or the lifetime allowance discourages pension saving and drags more ordinary workers into paying punitive tax charges,” said Guy.

“As far as the future is concerned, the one silver lining is that since new auto-enrolment pension rules, more Brits than ever before are now saving into their workplace pension. It’s only with a combination of the state pension and workplace or private pension saving that we can ensure we have enough for a comfortable retirement.”