Alternatives have started to play a greater part in portfolios as both bonds and equities have lost investors’ money this year.

The failure of the traditionally negatively correlated assets – when one rose the other typically fell and vice versa – has caused investors to look for diversification elsewhere.

This has led them to alternatives such as property, specialist debt, music, private equity and a host of other assets, but this term does not mean the same thing to everyone, and that’s where things start to get complicated, according to David Jane, multi-asset manager at Premier Miton.

“When deciding where to invest, you can have shares in someone else’s company, in their liabilities through bonds or loans, or you can have ‘stuff’, as in property, gold, industrial metals or similar. If somebody could identify something else that exists in the world than those three things, please go ahead,” he said.

Student housing and aircraft leasing, which are often considered alternative investments, are mainstream to Jane, the former being a form of property, which falls under the ‘stuff’ category, and the latter, which he admits owning as “a good asset class”, is lending.

Some people will refer to derivatives in this space, but these too are means to either sell things when you haven't got them, or to own them through a different form, Jane claimed.

He also criticised the definition of hedge funds as alternatives, as their underlying returns still come from those three basic things.

“Hedge funds or specialist property vehicles are nothing other than hedge funds or specialist property vehicles. And the hedge funds invest in the same things the rest of us do.”

Private equity would also count as shares in companies and one shouldn’t believe it is less volatile “just because they price monthly”, said Jane.

“All these examples are not really alternatives, in that they all hold the same things, just cut and pasted in a different way. It's a marketing story, rather than the reality,” he added.

“So when people talk about alternatives, more often than not, they're kidding themselves that there is something other than shares, fixed income and hard assets, which will all end up being correlated in stressed market conditions.”

So are there things out there that one could argue are genuinely different in their description? A few, said Jane, if you are prepared to go deep into niche, obscure territory.

Think catastrophe reinsurance businesses or legal settlements companies. These, for example, earn returns through financing legal cases, generally in the commercial sector, and get a percentage of the return, should it be successful.

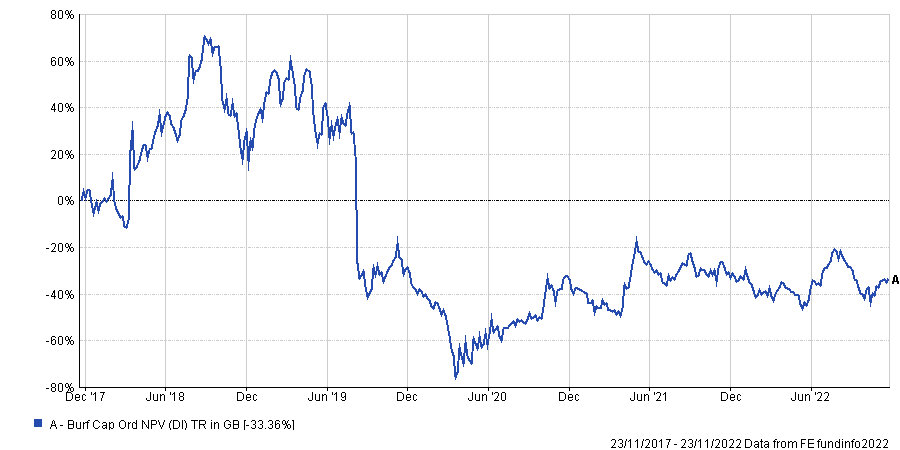

“There's a company called Burford Capital that does that, which clearly tends to have a pattern of returns that's completely different to everything else, so I can argue that it's probably an alternative,” said Jane.

Performance of stock over 5 years

Source: FE Analytics

Fred Ingham, head of international hedge funds and managing director at Neuberger Berman, specialises in uncorrelated assets and also thinks there is a mismatch between how people think of and use some hedge funds as alternatives, and how these vehicles behave.

Pointing to the 0.8 correlation figure of the HFRI Equity Hedge index (a benchmark of equity long/short managers) to the MSCI World, and other indices, he noted how many products in the hedge fund industry have a significant correlation to bonds and equities.

“I am consistently surprised, when I look at multilateral hedge fund portfolios, by the fact that they claim to be diversified, but have a massive allocation to strategies that are just 0.7 to 0.8 correlated to equities, and then people are surprised when their strategies underperform when shares drop 20%,” he said.

“But the reason people are heavily allocated to that section of the hedge fund industry is that equities have caught up so much over the past 20 years, particularly in the US.”

Performance of indices over 20 years

Source: FE Analytics

“If you're looking to diversify, you must be careful about what is in each fund and how those assets are going to behave when compared to what you are trying to diversify away from. And a big chunk of the alternative universe probably isn't the answer.”

Correlation, he pointed out, also depends on the time horizon, but the biggest challenge comes with trying to get away from the binary macro momentum risk that dominates everything.

“This year has been quite monothematic in that everything has basically traded on the next inflation print, and to some extent, it doesn’t matter whether you're going to trade currency, fixed income or a single stock – everything is going to be driven and impacted by that,” said Ingham.

“These kinds of environments where you've got to try to find ways to not just be making yet one more bet on the macro direction are the real challenge.”