The rise of environmental, social and governance (ESG) has been seemingly unstoppable in recent years and a good example of this is the Janus Henderson Global Sustainable Equity fund.

It has been a top-quartile performer in the IA Global sector over the past three, five and 10 years, racking up a total return of 288.2% over the decade.

The £1.8bn portfolio flew 115.8 percentage points ahead of its peer group over the long term by investing in companies creating a positive impact.

Here, FE fundinfo Alpha manager Hamish Chamberlayne explains why he has never seen Meta as a sustainable company in the nine years he has run the fund and why he is excited that the ESG bubble has been burst this year.

Total return of fund vs sector over the past decade

Source: FE Analytics

What is your investment process?

Our mission has always been to deliver better performance than a classical global equity fund, and I think people now understand that there's an alignment between big sustainability issues and generating good investment returns, but that wasn't always the case when we started.

We felt that there was a bit of an ESG bubble forming last year and the market volatility of the past 12 months has burst that bubble. I'm feeling a lot more excited about the strategy again today because a lot of the froth has come out of the market.

Our evaluation of ideas comes down to two questions – is the world a better place because of this company and is it going to grow wealth? Our investment process is designed to answer those.

What sets you apart from your peers?

We've been doing this for a very long time, so the consistency of our performance track record is definitely worth highlighting. We’ve also had a lot of positive feedback from our reporting – we produce a quarterly report that gives full transparency into our portfolio so investors can see every single holding with an explanation of its thematic alignment within the strategy.

What has been your best position this year?

Some of the contributors to performance this year, the fact that we have never owned companies like Meta, Alphabet or Amazon. These were headwinds to our performance in the past but this year they've been positive for us.

Meta has never qualified for our criteria, and we've always been extremely negative on the prospect.

We've said for a very long time that Facebook was an accident waiting to happen, so it's very pleasing to see the company underperform this year. We feel a bit vindicated by that.

Should Meta have a place in sustainable funds?

Under the way that we approach sustainable investment, we felt there was never any place for that companies in our portfolio.

Its mission doesn't align with its business model – the whole mission around connecting the world and bringing people together, doesn’t connect with the business model, which is selling data to advertisers, so there's a conflict there.

One big red flag was the fact that Mark Zuckerberg has complete control of the company. There are no minority shareholder rights at Facebook so there's no oversight on Zuckerberg. I think he’s a deeply problematic character.

In terms of the companies you do hold, what was your best performing stock over the past year?

Several of our insurance holdings have been strong contributors this year. We have two property and casualty companies called Intact Financial and Progressive, which are both best in class, they have consistent underwriting margin profitability and very good risk management.

Progressive and Intact, followed by two others, Webtec and Humana, contributed about 70 basis points. Insurance is a very stable business in many ways because they’ve got very defensive characteristics. You have to renew your insurance every year, so it's a consumer staple in many ways.

Share price of Progressive and Intact over the past year

Source: Google Finance

What was the worst performer?

It’s been our software names – our biggest detractor this year has been a company called Atlassian.

The whole sector overall has hit a very big derating this year so a lot of our biggest underperformers have been there, but we still really like the long-term prospects. Atlassian detracted about 100 basis points of performance, so around about 1%.

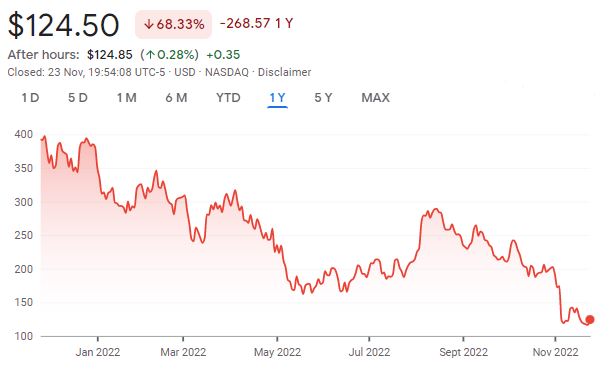

Share price of Atlassian over the past year

Source: Google Finance

Are there many ESG opportunities in the UK?

I'm not particularly positive on the UK economy, but it’s not that important for a global equity strategy. We've got less than 5% of our portfolio in UK stocks.

We don’t typically find the types of businesses that we're looking for in the UK market. There isn't a huge amount of activity in the UK around clean technology industries.

I think Britain does very well, especially in wind, offshore wind, but we're not a global leader in other clean technology industries. We're finding those investment opportunities in other regions.

What are your interests outside of stock picking?

When I’m not taxi driving my kids around I love swimming. I'm still swimming in the sea at the moment without a wetsuit, so I'm seeing if I can make it to December.