Traditional investment approaches are under pressure and savers need a new rulebook to deal with the current era of higher interest rates, rampant inflation and geopolitical unrest, according to the latest Goldman Sachs Asset Management investment update in New York.

The firm said investors should focus on the ‘5Ds’: decarbonisation, deglobalisation, demographics, destabilisation and digitisation.

Ashish Shah, chief investment officer of public investments at Goldman Sachs Asset Management , said there had been a “perfect monetary and fiscal storm” over the past decade that is unlikely to repeat.

During the pandemic, consumer balance sheets improved, but in more recent times the Federal Reserve, which had been slow to react to inflation, has embarked on “one of history’s most aggressive periods of tightening”.

Interest rates of 5% are being priced in for next year and with conditions tightening, a recession could be on the cards although it has yet to be “fully baked in yet”.

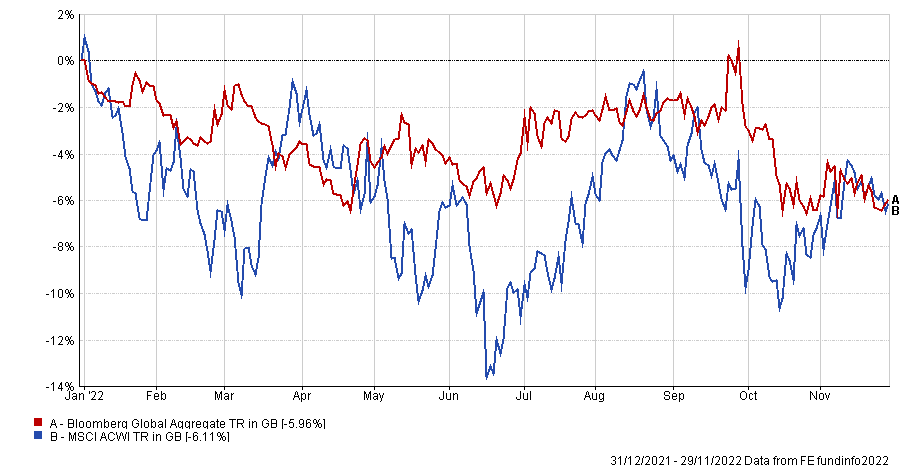

Maria Vassalou, co-chief investment officer of multi-asset solutions at Goldman Sachs Asset Management, said there are opportunities as index returns mask the volatility of individual assets, suggesting there has been a huge divergence between the winners and losers this year.

Total return of MSCI All Countries World index vs Bloomberg Global Aggregate index YTD

Source: FE Analytics

This means there is “ample room” for investors to make money from picking winners and even from shorting losers, although she warned that the current environment is “very complicated”.

What is clear, she continued, is that a 60/40 allocation split between equities and bonds respectively “does not work”.

“We were a little spoiled, going through a long period since the early 2000s of rising equity valuations and relatively low volatility only interrupted by the financial crisis. But even then, risks to the economy increased and central banks stepped in to ease financial conditions. That helped 60/40 performance because bonds became flight to safety instruments and cushioned equities sell-offs,” she said.

“Now, correlations are positive between equities and bonds. That is always the case when going through an environment of rising interest rates, high inflation and falling growth.”

Shah added that no one complained when markets are rising, but now that this has turned, the allocation has “caused a lot of pain”. Yet it remains one of the most common strategies among retail investors, he said.

Although it will work again in the future, investors should not expect the quantitative easing regime of the past decade to start up again, meaning other strategies may work better.

As such, investors may wish to rethink their portfolio construction now. In particular, the team said that people should look at their allocations to passives.

Vassalou said: “Being passive does not work anymore. We must be more dynamic because the world is not in equilibrium. During highly volatile markets, there are lots of dislocations, which create opportunities for stock and security selection.

“That helps on the active side, but security selection has to be done when volatility subsides. At peak volatility, as experienced at various points this year, it is much harder to pick stocks. Even when we identify appropriate securities, it is unlikely they will pay off immediately.”

As well as stocks, an active approach will be critical when investing in bonds, somewhere investors will start to allocate more money to as interest rates rise, she added.

Diversification will be key in the future, however, as it is the only “free lunch” in the market. Uncorrelated assets will be sought after by investors and therefore alternatives may become more mainstream.

Co-president of direct alternatives Greg Olafson said there are opportunities in the alternatives space. Two areas of interest include private credit, where investors can make good returns from lenders, and infrastructure, where both the digital landscape and the energy sector are ripe for shake up.

“Today’s climate plays to the strengths of alternatives by calling upon the advantages of control and influence central to direct investing, contrasted with the indirect approach inherent to public markets. Taking a more hands-on approach allows for proactive value creation and risk management, along with transaction terms negotiation,” said Olafson.