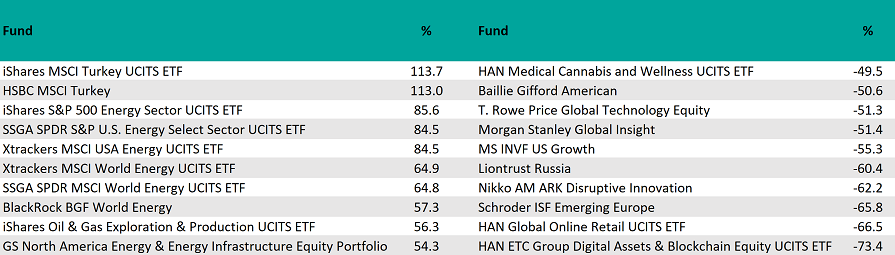

The iShares MSCI Turkey UCITS ETF was the best-performing fund of 2022, with gains of 113.7%. It was followed by another Turkey fund, the HSBC MSCI Turkey ETF, which finished in second place with gains of 113%, as Turkish citizens swarmed into the stock market last year to escape rampant inflation.

These gains are even more spectacular considering the Turkish lira fell by about 20% against the pound over this time.

Inflation in Turkey rose from 48.7% in January 2022 to a peak of 85.5% in October, after interest rates were cut from 14% to 9%. While central banks usually raise interest rates to cut inflation, President Recep Tayyip Erdoğan urged policymakers to move the other way.

At the end of September, he said: “My biggest battle is against interest. My biggest enemy is interest. We lowered the interest rate to 12%. This needs to come down further.”

A lack of alternative options has caused Turkish savers to flock to the stock market, but foreign investors have fled. Analysts at Schroders explained why: “The combination of unorthodox economic policy and rising uncertainty ahead of next year’s general elections mean that the market’s current trajectory seems unsustainable. We have become outright negative in our outlook.”

Another driver of Turkish inflation last year was the high price of oil & gas – the country is a net importer of both natural resources – and this was also the main driver for the performance of the other eight names on the top-10 funds list for 2022, all of which had an energy focus.

iShares S&P 500 Energy Sector UCITS ETF delivered the best performance of these funds, with gains of 85.6%.

Best- and worst-performing funds of 2022

Source: FE Analytics

Energy was also responsible for eight of the best-performing funds in 2021, with India strategies accounting for the other two positions.

It is worth noting that just two of the 10 best performers of 2022 were actively managed: BlackRock BGF World Energy in eighth place, with gains of 57.3%, and GS North America Energy & Energy Infrastructure Equity Portfolio in 10th place, with gains of 54.3%.

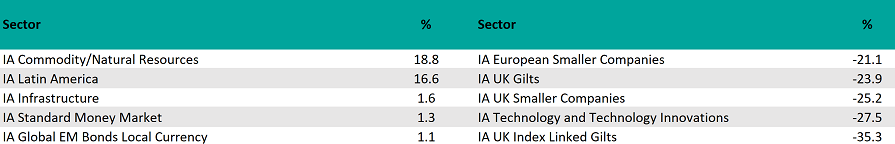

In terms of sectors, IA Commodity/Natural Resources finished top with gains of 18.8%, aided by the high price of energy and other commodities, which spiked after Russia invaded Ukraine.

The resource-heavy IA Latin America sector also benefited from this trend, finishing in second place with gains of 16.6%.

These were the only sectors to make double-digit gains in 2022, and just three more managed to eke out a positive return: IA Infrastructure, IA Standard Money Market, IA Global EM Bonds Local Currency.

At the other end of the table, IA UK Index Linked Gilts was the worst performer, with losses of 35.3%. This may have come as a shock to investors who had bought index-linked gilts to protect against rising inflation.

Andrew Eve, investment specialist at M&G, said that while the principle and coupons of these assets are linked to inflation, they also have a higher duration, or sensitivity to interest rates.

“In inflationary environments, in which central banks tend to hike rates, rising interest rates are bad news for bonds with a lot of duration,” he explained.

“One way to mitigate this effect is to invest in much shorter-dated linkers.”

IA Technology and Technology Innovations was the second-worst performer, with losses of 27.5%. This sector is full of growth companies, the valuations of which rely heavily on future earnings. These are worth less when interest rates rise, as they have done this year.

Best- and worst-performing sectors of 2022

Source: FE Analytics

This trend also affected the IA UK Smaller Companies sector, which finished third from bottom of the performance table with losses of 25.2%. Small caps also tend to be more economically sensitive, and valuations were hit by fears of a recession last year.

The list of worst-performing funds was dominated by those with exposure to technology or Russia. The HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF picked up the wooden spoon, with losses of 73.4%. Although it doesn’t have direct exposure to cryptocurrencies, it holds exchanges such as Robinhood and Coinbase, which have been hit by the collapse of the asset class.

In ninth place was the tech-heavy £2.6bn Baillie Gifford American fund, with losses of 50.6%.

The original list of worst-performing funds included the LF Equity Income fund and stated it had lost 50.2% last year. However, the fund is in the process of being wound up, and this data may not accurately reflect the true value of its assets. The list has been amended accordingly.