Markets have just gone through something of a rollercoaster ride and this caused investors to look at funds outside of the favourites that were previously at the top of the performance tables, the changes in factsheet views on Trustnet suggests.

The funds that received the most pageviews last year are a familiar bunch: Fundsmith Equity, the Vanguard LifeStrategy range, Baillie Gifford American, Rathbone Global Opportunities, Royal London Sustainable Leaders, Artemis Income, Jupiter European and Liontrust Special Situations are all among the 20 most-viewed funds on Trustnet in 2022.

However, looking at which funds benefitted from a boost – or a fall – in popularity can offer more insight in the trends at play across the year. To do this, we focus on the change in the share of pageviews that each fund’s factsheet captured between 2022 and the year before.

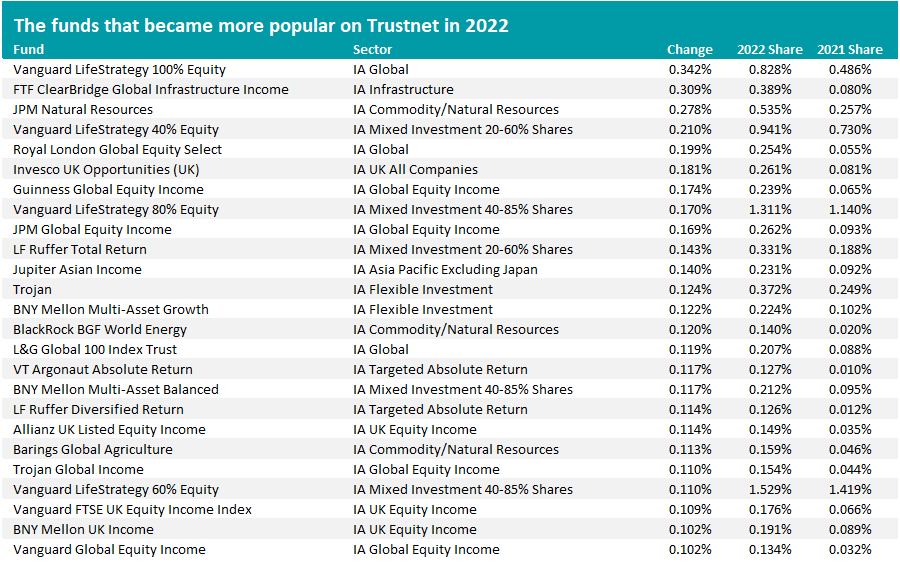

As the table below shows, the fund that had the biggest jump in interest from Trustnet users was Vanguard LifeStrategy 100% Equity. Its share of pageviews went from 0.486% to 0.828% between 2021 and 2022.

Source: Trustnet

While these might seem like low numbers, it’s important to remember that there are more than 5,000 funds in the Investment Association universe so each one has a small share of the total. But in ranking terms, these results mean the fund went from being the 31st most-viewed on Trustnet in 2021 to the eighth most-viewed last year.

The Vanguard LifeStrategy range has been a persistent favourite with both private and professional investors since their launch in 2011 and its five funds are usually among the most-viewed factsheets on Trustnet. The increase in relative popularity of Vanguard LifeStrategy 100% Equity in 2022 likely reflects the fact that it has no exposure to government bonds, which had a terrible year as central banks around the world hiked interest rates to tackle surging inflation.

Vanguard LifeStrategy 100% Equity was the best performing member of the range last year, with a fall of 6.3% (compared with the 15.8% loss of bond-heavy Vanguard LifeStrategy 20% Equity). It was also in the second quartile of the IA Global sector, where the average fund was down 11.1%.

Two overarching trends are clear from the list of funds that investors have been paying more attention, the first of which is higher inflation. Inflation has reached multi-decade highs in some parts of the world, led by rising commodity prices caused by post-pandemic supply bottlenecks and the war in Ukraine.

The list of funds getting more research shows this through the presence of several commodity funds: JPM Natural Resources, BlackRock BGF World Energy and Barings Global Agriculture.

Meanwhile, the jump in research in FTF ClearBridge Global Infrastructure Income suggests investors were looking at other ways to protect from rising prices, as infrastructure is a classic inflation hedge.

The likes of VT Gravis Clean Energy Income, L&G Global Infrastructure Index and M&G Global Listed Infrastructure are others that were getting researched more last year, although they fall outside of the top 25.

Greater interest in equity income funds such as Guinness Global Equity Income, JPM Global Equity Income, Allianz UK Listed Equity Income, Trojan Global Income and Vanguard FTSE UK Equity Income Index is also an indication of investors looking for ways to make their money worked harder to beat inflation.

The second theme at play in the list of funds winning more research on Trustnet is capital preservation in volatile markets. Last year there were brutal falls in both stocks and bonds so it comes as little surprise to see an uptick in research into funds that prioritise protecting their investors.

Funds that fit into this theme include LF Ruffer Total Return, Trojan and LF Ruffer Diversified Return. VT Argonaut Absolute Return was also researched more; while it tends to be more volatile than the typical absolute return strategy, it did make more than 11% in 2022’s challenging markets.

Source: Trustnet

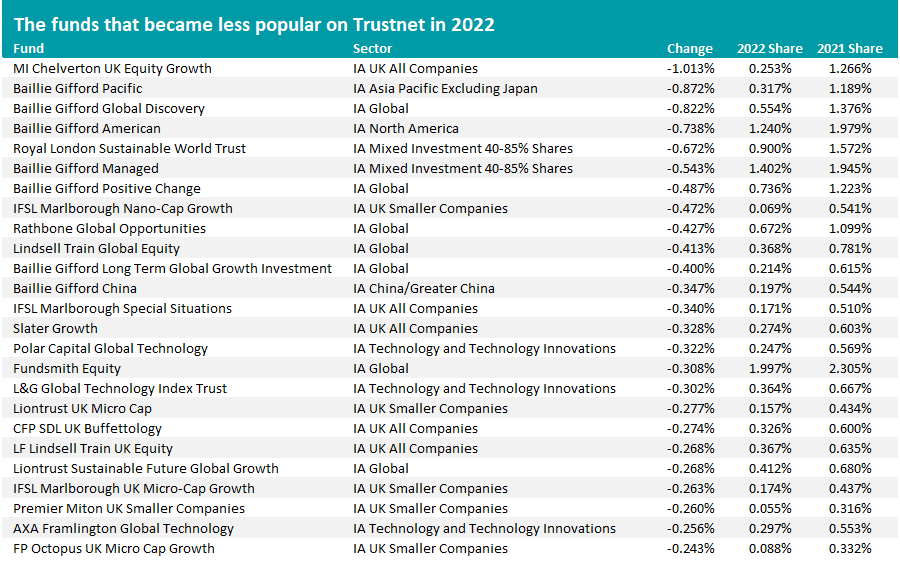

Of course, some funds will have lost research share as others gained it and, again, there are some clear trends at play.

One is a fall in research in smaller companies strategies, which are seen as more risky than portfolios with a focus on large-caps. Smaller companies struggled in 2022 as investors fled risk assets and started to worry about a central bank-induced recession.

MI Chelverton UK Equity Growth, IFSL Marlborough Nano-Cap Growth, IFSL Marlborough Special Situations and Liontrust UK Micro Cap are some examples of funds caught up in this.

The rotation away from growth stocks – which underperform when interest rates are rising as it makes their future earnings less attractive to companies paying out today – is also apparent in the above table.

Baillie Gifford is a well-known growth investor: its funds made stellar returns when growth was leading the market but has struggled as investors moved away from this style.

Seven of the funds on the above list are managed by the firm, including well-known names such as Baillie Gifford American, Baillie Gifford Positive Change and Baillie Gifford Managed.

However, they aren’t the only examples of growth funds that investors were researching less in 2022 (although some remain among the most popular overall despite this dip in relative interest): Rathbone Global Opportunities, Lindsell Train Global Equity, Fundsmith Equity, CFP SDL UK Buffettology and LF Lindsell Train UK Equity are some of the others.

Within this theme of a rotation away from growth is tech stocks. These were the best performing areas of the market when rates were low but sold off aggressively when central banks started to tighten policy.

Polar Capital Global Technology, L&G Global Technology Index Trust and AXA Framlington Global Technology are some of the funds that investors were researching less as a result.